This is The Takeaway from today’s Early morning Short, which you can join to obtain in your inbox every early morning together with:

Wall surface Road planners remain to chase after the S&P 500 greater.

The most recent? Julian Emanuel at Evercore ISI, that currently sees the index climbing to 6,000 by the end of this year in the middle of an AI transformation still in its “very early innings.”

Emanuel sees profits going back to development this year and following, along with stock exchange background that recommends appraisals can continue to be raised longer than financiers anticipate, driving the index one more 11% greater this year.

However the cost targets and the marketplace’s course to them– in Evercore’s bull situation, the S&P 500 could get to 7,000 by the end of following year; in a bear situation, we’re pull back to 4,750– are much less considerable than the push this item of study offers to all customers: You have to have a response when inquired about your AI technique.

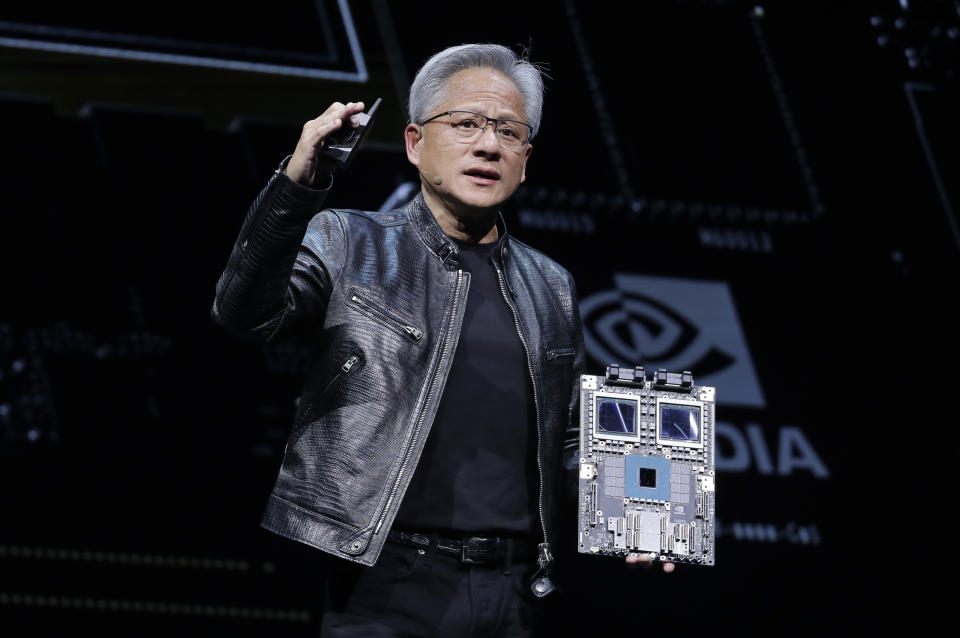

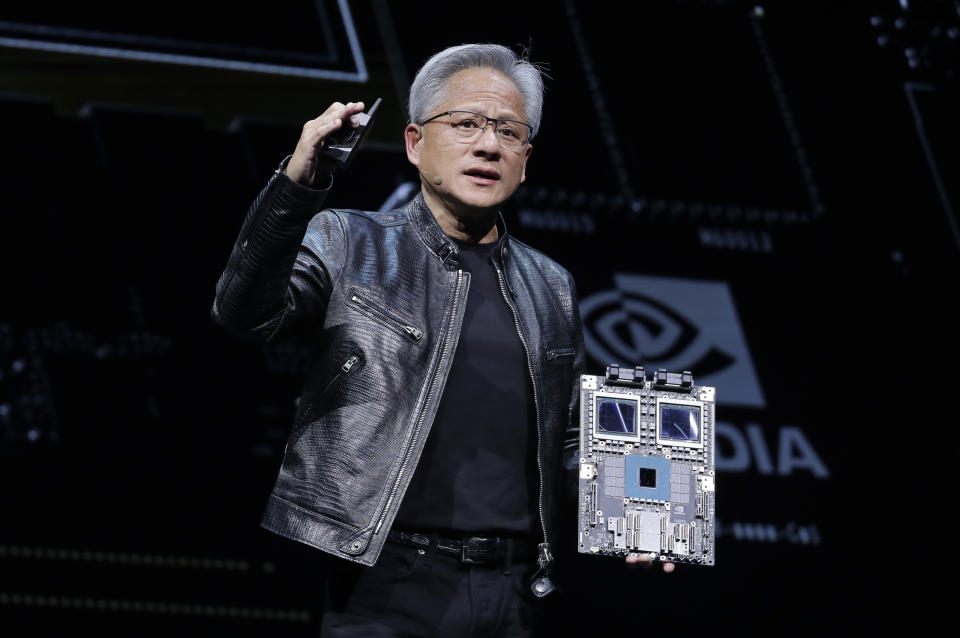

For the in 2014, AI has actually been pointed out nearby as one of the most essential stimulant pressing markets greater. This came as the Federal Book postponed price cuts, rising cost of living has actually been slow-moving to go back to 2%, and the United States economic situation outmatched assumptions.

And as this booming market proceeds, Emanuel anticipates volatility to boost as AI comes to be an also bigger thematic vehicle driver for supplies.

” Convexity is a ‘have to have’ in a Technology driven Booming market that is going to obtain even more unpredictable,” Emanuel composed. Therefore, his group advises a “suffocate” choices placement on the Nasdaq, getting phone calls and places at rates greater and less than existing rates, specifically.

Yet the information of this profession are lesser than the drive of Emanuel’s suggestion to customers.

Which is that you have to have an AI profession.

The profession can be as straightforward as an alternatives placement that supplies some upside benefit and drawback defense. Somewhere else, Emanuel’s group states “AI Revolutionaries” and “Tiny Cap Standouts” as various other feasible profile turns for the existing setting.

As constantly, profile supervisors will certainly function within their required to make the very best choices for customers. What any kind of one planner thinks of the S&P 500’s instructions in the following 6 months is simply component of that estimation, currently or at any kind of various other time.

What isn’t sensible, nevertheless, is to see on your own out of the AI conversation– to inform your stakeholders we’re not interested, or otherwise prepared, or otherwise prepared to locate a method to bring AI right into our procedure. For financiers and everybody else.

When 2023 started, financiers were supporting for economic downturn and Wall surface Road was much less than thrilled regarding the stock exchange’s potential customers. The shocking agreement that hardened amongst the capitalist course in late 2022 was that supplies would certainly maintain decreasing in very early ’23 as the economic situation got. In the 2nd fifty percent of the year, financiers anticipated the marketplace to rebound as the economic situation went back to development.

Rather, the marketplace tore greater right from the start. AI took control of the Road, while profits, the lifeline of long-lasting stock exchange returns, were level.

Financiers captured flat-footed in a rally sustained by the unforeseen mania for chatbots, cloud storage space, and huge quantities of calculating power had some freedom to clarify to customers why they had not predicted the Nasdaq obtaining 40%.

In June 2024, those justifications have actually frayed.

Go Here for the most up to date stock exchange information and thorough evaluation, consisting of occasions that relocate supplies

Check out the most up to date monetary and company information from Yahoo Money

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.