Ethereum is sliding after publishing greater highs over the weekend break. Taking into consideration cost activity, the coin is up about 5% from recently’s lows yet is still trending listed below the critical resistance at $3,700.

Although ETH owners and investors are positive, rates should emphatically close over this liquidation degree, leading the way for even more gains basically to tool term.

Will Costs Dive After Place Ethereum ETF Begin Trading?

The reason for positive outlook adheres to the fast change by the USA Stocks and Exchange Payment (SEC) to accept the very first area Ethereum exchange-traded fund (ETF) in the nation.

Complying with motivating occasions in Might, where the firm authorized all 19b-4 types, the item might go online and come to capitalists and establishments in 2 weeks.

While there are issues that the authorization of the area Ethereum ETF might cause an additional wave of reduced lows, as seen with the area Bitcoin ETF in January, one expert is actioning in to assure owners.

Requiring To X, the expert pointed out that the prospective effect of Grayscale offering its Ethereum holdings (ETHE) as soon as area ETFs go online would certainly be very little, supplying security and self-confidence in the marketplace.

This sneak peek issues ETH’s present state of events and the wider Ethereum environment. The marketplace had not been planned for the USA SEC to fast-track the item’s authorization this year.

In Bitcoin’s instance, rates climbed greatly from mid-October as the marketplaces prepared for the area ETF going reside in January. When introduced, it came to be a “offer the information” occasion, briefly lowering rates.

At the same time, Ethereum rates are transforming reduced after significant gains published on Might 20 when information penetrated to the neighborhood of the USA SEC’s rushing initiatives.

Eyes On Grayscale And ETHE Discount Rate

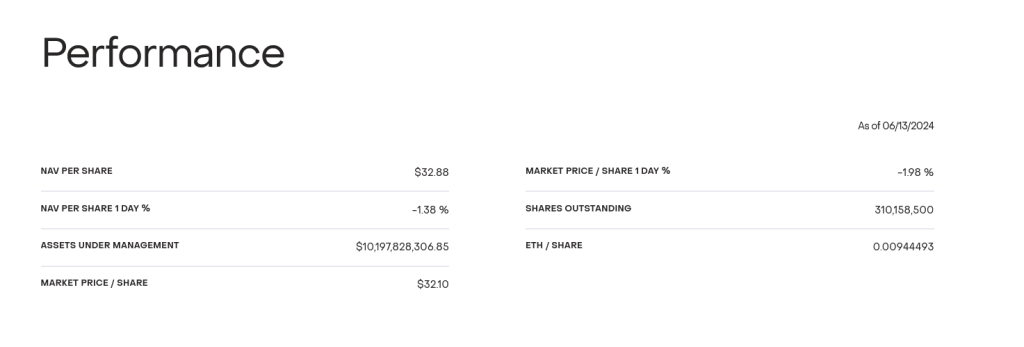

At the very same time, the expert explained that, unlike Grayscale’s GBTC prior to the authorization of area ETFs, the price cut in ETHE is slim and within the 1-3% array. Presently, Grayscale manages over $10 billion of ETHE.

The small price cut indicates investors that purchased ETHE for the price cut have actually had adequate time to cost close to market value. Because of this, it indicates that also as soon as an area Ethereum ETF goes online, offering stress would certainly be very little.

Still, only time will certainly inform whether ETH will certainly rise or dive in the following 2 weeks. From a regulative viewpoint, the clearness that results after the area Ethereum ETF is launched might stimulate need, permitting even more establishments to acquire direct exposure. K33 experts predict the item will certainly draw in in between $3.1 billion and $4.8 billion in web inflows within the very first 5 months of trading.

Function picture from Canva, graph from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.