You might currently have a financial connection with Chase and question if it’s an excellent location to obtain a home mortgage.

The Yahoo sight: Whether you’re an existing client or otherwise, Chase is absolutely worth taking into your mix of prospective home mortgage lending institutions to think about.

With an adequate array of financing choices, consisting of home customer gives and home loans for the new customer or big-house seeker, Chase is a leading lending institution with a whole lot to supply. Nonetheless, Chase does not presently supply home equity finances or credit lines.

Stars: 3.99

Secret advantages

-

Chase Buyer Grants enable $2,500, $5,000, or approximately $7,500 on low-down-payment financing programs that can be put on the deposit or costs, with specific constraints. These aid choices make it among the most effective home loan loan providers for new home customers.

-

Plainly offers 4 low-down-payment home loan choices and the basic certifications on its “Discovering the appropriate financing begins below” web page.

-

Supplies a $5,000 closing warranty as rapidly as in 3 weeks, under specific standards.

-

VA finances might be qualified for a $2,000 credit rating that can be put on shutting prices.

Required to understand

-

Released traditional financing rate of interest are sweetened with 20% deposits, one price cut factor and consumers with “outstanding” credit rating.

-

The Chase internet site includes an “instructional” building financing short article yet keeps in mind that it does not supply building finances.

-

Does not presently supply home equity finances or HELOCs, just cash-out refinances.

-

A typical ranking for client fulfillment, according to the current J.D. Power Home loan Source Complete Satisfaction Research.

-

JPMorgan Chase hasn’t had any kind of mortgage-related governing activities given that 2017.

Dig deeper: Is it a great time to acquire a home?

Finance kinds used

Chase home loans for new home customers

Chase has lots of financing choices for the new customer. It uses gives that enable $2,500, $5,000, or approximately $7,500 on low-down-payment financing programs. FHA and VA finances remain in bet professional customers, along with traditional finances with 3% deposits.

An Education And Learning Facility and “utmost overview” for first-timers are valuable in damaging down the lingo and describing the detailed procedure for just how to acquire a home.

Chase home equity financing

In the meantime, Chase is not offering home equity finances or credit lines. The financial institution uses cash-out refinancing as an equity-tapping option.

That’s not a fantastic option if you currently have a home mortgage with a reduced rates of interest than what is presently offered. You would certainly need to obtain a brand-new financing to take money from your home’s worth.

Find Out More: Home equity financing vs. HELOC: What’s the distinction?

Chase home loan prices

On a cellphone, it took a minute to locate the present Chase home loan prices, once there, the procedure was very easy sufficient.

Without offering comprehensive info, released prices are constantly an “in the ball park” quote. Some loan providers make you leap via a great deal of hoops to provide you what might be a somewhat much more precise– yet still a “do not hold us to it” rates of interest. Chase just wishes to know your postal code. Keeping that, you’re revealed 30- and 15-year set prices, FHA dealt with prices, and 3 flexible prices of different terms.

On the day of our query, the traditional set prices were based upon a 20% deposit, with one price cut factor and outstanding credit rating.

Dig deeper: Exactly how to obtain the most affordable home loan prices

Making an application for a home mortgage with Chase

Chase has home loan financing advisors in all yet a loads states, so an in-person check out is a feasible choice.

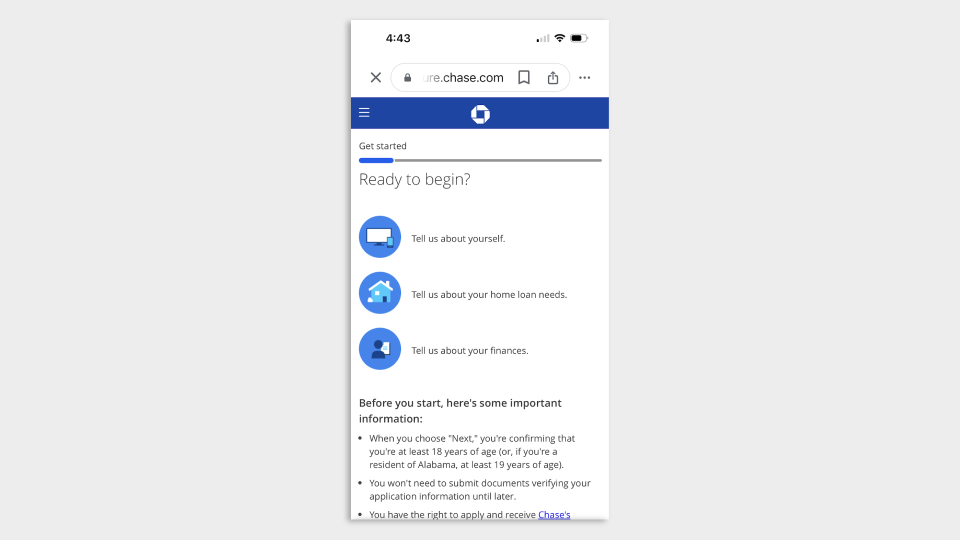

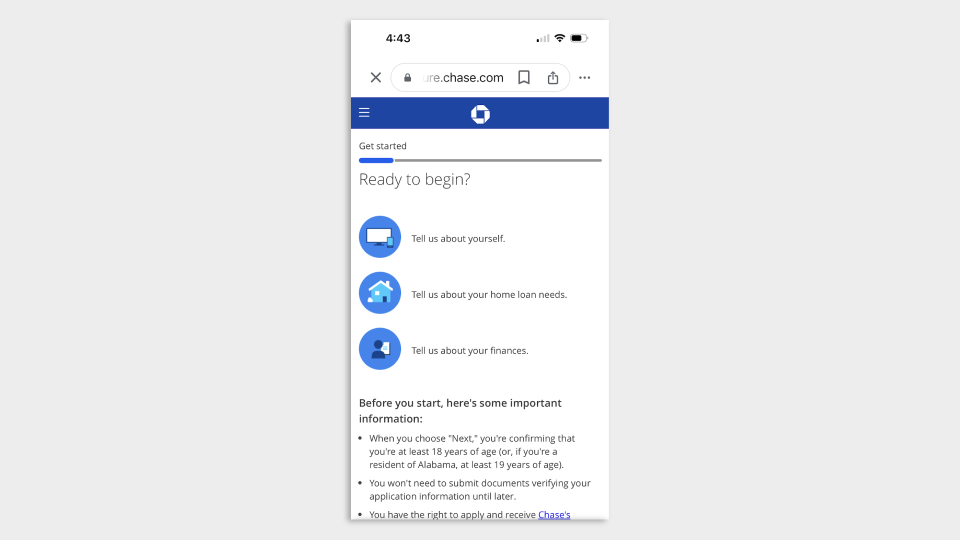

If you intend to leap online right into a car loan application or a preapproval, you’ll touch on a “begin online” or comparable activity switch, which will certainly take you to a “all set to start” web page that offers some info you’ll need to know prior to continuing.

Click the web link “Chase’s financing analysis standards” to see a boilerplate one-pager that information what lies in advance: entry of your credit rating and work background, revenue, offered money, and all the remainder. It coincides procedure all home loan loan providers utilize to think about finances, yet it acts as a tip that when you click that switch, there will certainly be numerous actions to finish.

You’ll intend to have every one of your individual info handy– and have a glass of persistence close by. You’re denying something on Amazon with a one-click check out. This is a home mortgage. It’s a large bargain.

Discover More: Review our complete Financial institution of America home loan evaluation

The Chase internet site is thick with info. The instructional sources exist, yet it takes a little excavating to locate– and it’s all quite completely dry.

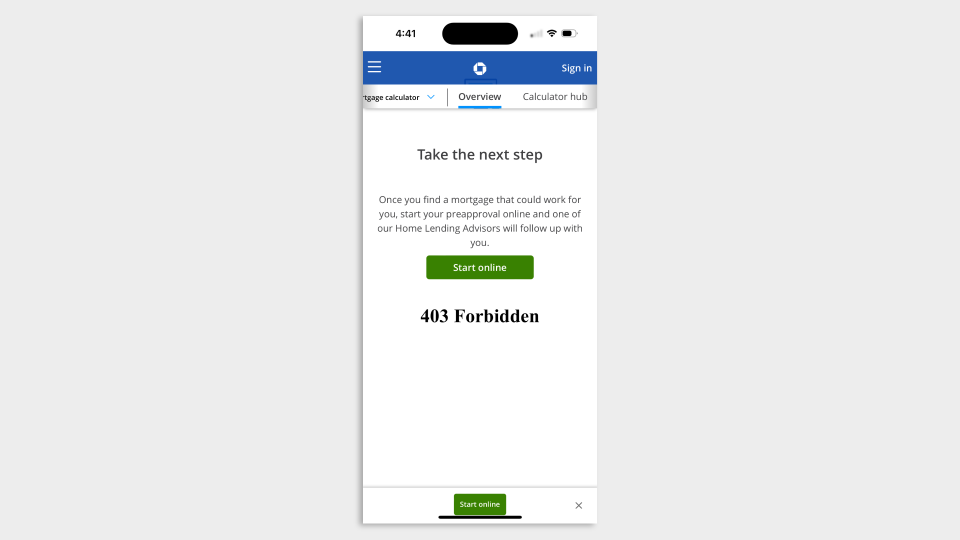

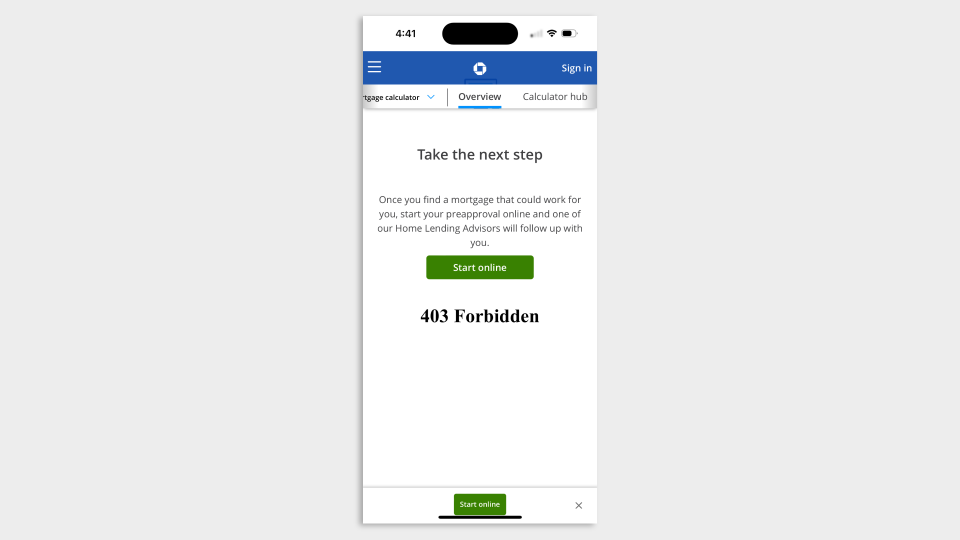

A home loan calculator watched on mobile was inaccessible on the day of our check out, tossing a “403 Forbidden” mistake. Not really motivating. Nonetheless, it did appear on a desktop computer sight.

As soon as obtainable, the calculator requested for a credit report variety, the postal code where the building lay, the acquisition cost, and the deposit. It easily returned 4 financing choices: 30-year set traditional, FHA and VA finances, and a 15-year dealt with. Not a negative location to begin.

Clicking the information for a car loan revealed the approximated month-to-month settlement with a malfunction of principal and passion, real estate tax, insurance coverage and personal home loan insurance coverage. Thus far, so great. Yet the rates of interest and APR were described together with the source prices– that included price cut factors that can not be readjusted and a relatively tight “handling charge.”

A minimum of you’ll understand what you intend to think about and/or bargain: factors and costs.

Find Out More: Review our complete Rocket Home loan evaluation

This ingrained material is not offered in your area.

Method:

Yahoo Money determined the most effective home loan loan providers for new home customers by rating prominent nationwide loan providers on a luxury range from ratings assembled from and balanced from public testimonials. Requirements consisted of rates of interest, costs and financing prices, convenience of application, price openness, financing item schedule and choices, client experience, minimum deposit, minimal FICO ratings, on the internet attributes, time to authorization, reliability. Added evaluation of the current J.D. Power united state Home Mortgage Source Fulfillment Research study supplied a 5% perk for loan providers placing over the study standard for client experience. Marketers or sponsorships do not affect scores.

Content disclosure for Home loans:

The info in this short article has actually not been assessed or authorized by any kind of marketer. The information on economic items, consisting of rate of interest and costs, are precise since the release day. All product and services exist without service warranty. Inspect the lending institution’s internet site for the most present info. This website does not consist of all presently offered deals.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.