The Australian Stocks Exchange (ASX), the biggest stock market in Australia, has actually lately authorized the listing of its very first place Bitcoin exchange-traded fund (ETF).

The VanEck Bitcoin ETF (VBTC), which will certainly start trading on June 20, will certainly be provided by possession monitoring company VanEck. This authorization complies with VanEck’s effective launch of the VanEck Bitcoin Trust Fund (HODL), in the USA previously this year.

Australia’s Bitcoin ETF Market Warms Up

VanEck’s chief executive officer for the Asia-Pacific area, Arian Neiron, highlighted the boosting need for Bitcoin direct exposure in Australia, especially with managed and clear financial investment lorries.

Acknowledging Bitcoin as an arising possession course, Neiron highlighted that VBTC would certainly streamline consultants’ and capitalists’ accessibility to Bitcoin by handling the intricacies connected with getting, saving, and protecting electronic possessions.

According to Bloomberg, apart from VanEck, various other gamers in the Australian market are preparing to present their spot-Bitcoin and Ethereum ( ETH) funds. Sydney-based BetaShares Holdings Pty and DigitalX Ltd. are apparently functioning in the direction of detailing their offerings on the primary Australian board.

Particularly, BetaShares means to release place Ethereum and Bitcoin ETF funds quickly to satisfy “the expanding need” for varied electronic possession financial investments

While VBTC stands for the very first place for Bitcoin ETF to get authorization from the ASX, it is not the very first to release in Australia. 2 various other Bitcoin ETFs have actually been presented in the nation in the previous 2 years.

The Worldwide X 21 Shares Bitcoin ETF (EBTC) debuted in April 2022, adhered to by the Grayscale Bitcoin ETF (IBTC), which started trading on the Cboe Australia exchange on June 4.

Change From BTC To Altcoins

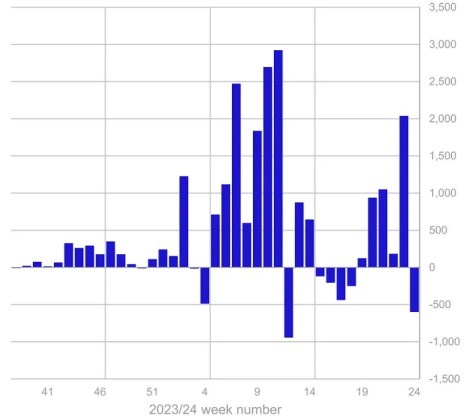

In the more comprehensive context of electronic possession financial investment items, current data from possession supervisor CoinShares exposes substantial discharges of around US$ 600 million.

These discharges, the biggest because March 22, accompanied a much more hawkish than anticipated Federal Free market Board (FOMC) conference, leading capitalists to lower their direct exposure to fixed-income possessions Because of this, overall possessions under monitoring (AuM) dropped from over $100 billion to $94 billion.

The discharges observed were mainly on Bitcoin, with around US$ 621 million taken out. Nonetheless, numerous altcoins knowledgeable inflows throughout this duration.

Ethereum, Lido (LDO), and XRP were amongst the altcoins that obtained noteworthy inflows of US$ 13 million, US$ 2 million, and US$ 1 million, specifically. This recommends that capitalists looked for diversity past Bitcoin among the current market volatility.

Since this writing, the biggest cryptocurrency on the marketplace is trading at $65,400, down 2% in the 24-hour amount of time and virtually 6% in the previous 7 days, coming close to the essential $65,000 assistance degree.

Included photo from DALL-E, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.