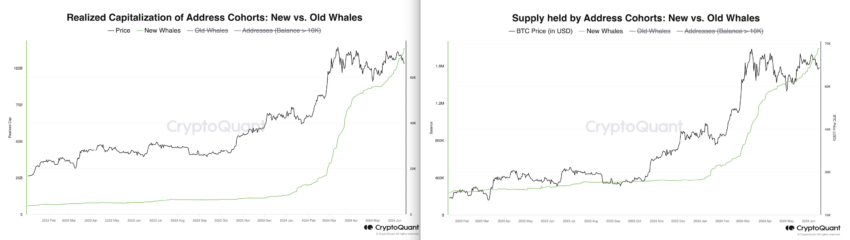

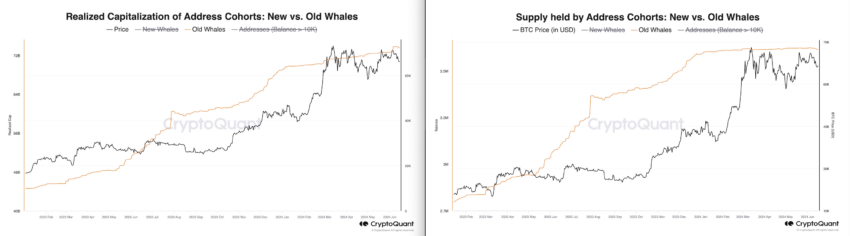

New whales strongly build up Bitcoin, while old whales somewhat minimize their holdings.

This habits recommends a mix of favorable belief amongst brand-new market participants and calculated repositioning amongst lasting owners. Big owners additionally reveal solid build-up, sustaining Bitcoin’s mid-term potential customers.

New Whales Accumulating BTC

The supply held by brand-new whales, specified as addresses holding greater than 1,000 BTC and with an ordinary apprehension time of much less than 6 months, has actually seen a significant rise.

The complete supply for this associate increased from roughly 1,577,544 BTC to 1,784,327 BTC, a boost of 206,783 BTC.

Additionally, the understood capitalization for brand-new whales revealed a constant higher pattern, enhancing from roughly $98.44 billion to $113.12 billion, showing a surge of $14.68 billion.

Learn More: Bitcoin Halving Background: Every Little Thing You Required To Know

Bitcoin’s Recognized Cap offers a photo of its real worth by thinking about the rate at which each Bitcoin was last negotiated. Unlike standard market capitalization, which just considers the present market value, Recognized Cap goes much deeper, mirroring the historic purchase costs on the blockchain.

The hostile build-up of brand-new whales frequently indicates self-confidence in Bitcoin’s near-term capacity. For that reason, their enhancing visibility and greater understood capitalization recommend that current participants to the marketplace are hopeful concerning future rate gratitude and want to get BTC at greater costs.

Old Whales Minimizing Holdings

On the other hand, the supply held by old whales– addresses with greater than 1,000 BTC and an ordinary apprehension time surpassing 6 months– reduced somewhat. Their holdings went down from concerning 3,621,388 BTC to 3,614,122 BTC, leading to a decrease of 7,266 BTC.

At the same time, the understood capitalization for old whales continued to be reasonably steady, enhancing somewhat from around $72.62 billion to $73.56 billion. Noting a small surge of $940 million.

The small decrease in holdings by old whales may suggest a critical adjustment, perhaps making the most of current rate gains or planning for market volatility.

The steady understood capitalization recommends that these lasting owners keep their placements with very little web marketing or acquiring task, showing a solid sentence out there.

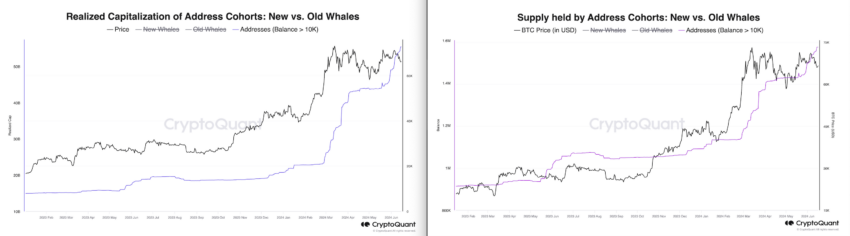

Big Owners Are Building Up Bitcoin

Solid Assistance from Big Owners: Attends to with an equilibrium surpassing 10,000 BTC experienced a remarkable rise in supply. The complete holdings in this associate increased from 1,494,362 BTC to 1,568,702 BTC, mirroring a boost of 74,340 BTC.

The understood capitalization for these big owners additionally considerably boosted, increasing from $49.06 billion to $55.43 billion, showing a boost of $6.37 billion.

Learn More: Bitcoin (BTC) Cost Forecast 2024/2025/2030

The rise in supply and understood capitalization amongst addresses holding greater than 10,000 BTC shows solid self-confidence amongst the greatest market individuals. This build-up stage emphasizes a substantial favorable belief, giving a strong assistance degree for Bitcoin and mitigating disadvantage threats.

Offered the build-up patterns observed amongst brand-new whales and big owners, Bitcoin is most likely to target the $80,000 mark in the close to term.

The favorable belief amongst brand-new participants and the solid assistance from big owners recommend a favorable expectation for Bitcoin’s rate activity. The enhancing understood cap shows expanding self-confidence and the entrance of brand-new funding, sustaining a prospective surge to 80,000 in the midterm.

If temporary whales quit acquiring or lasting whales begin offering considerably, it might suggest a prospective rate turnaround. Temporary whales have actually been driving the current favorable energy. If these whales quit acquiring, it indicates a loss of self-confidence or a change in market belief. This decrease popular can deteriorate rate assistance, enhancing the opportunities of down rate stress.

On the various other hand, lasting whales normally give market security. If these whales start substantial marketing, it might recommend a critical leave or a response to awaited market recessions. For that reason, their marketing stress can flooding the marketplace with BTC, enhancing supply and possibly driving costs to listed below $60,000.

Please Note

According to the Count on Task standards, this rate evaluation post is for educational objectives just and ought to not be thought about monetary or financial investment suggestions. BeInCrypto is dedicated to exact, honest coverage, yet market problems undergo alter without notification. Constantly perform your very own research study and seek advice from an expert prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.