If 2019 was the Brexit political election, 2024 is the tax obligation political election.

The Tories and Work have actually repetitively clashed over each various other’s tax obligation strategies, with chancellor Jeremy Quest asserting on Sunday that Sir Keir Starmer would certainly transform the UK right into a “taxtopia”.

Work has actually countered by charging the Tories – way behind in the polls – of being “hopeless” and having “large openings” in their very own strategies.

However the Tory concentrate on tax obligation ongoing after Starmer eliminated enforcing resources gains tax obligation on the sale of family members homes. The Traditionalists are currently requiring he eliminates a collection of various other possible tax obligation actions they declare would certainly be required to fill up a “₤ 38.5 bn great void” in Work’s strategies.

However in the middle of all the sniping, just how does a federal government in fact invest each extra pound it draws from us in tax obligation? And what have professionals stated concerning the Tory and Work tax obligation promises laid out in their statement of beliefs today? Right Here, Yahoo Information UK describes.

What are the heading tax obligation promises?

On Tuesday, Rishi Sunak introduced a statement of belief having a ₤ 17.2 bn bundle of tax obligation cuts, consisting of a more 2p cut to nationwide insurance coverage for staff members. This will certainly improve comparable succeeding 2p cuts at the fall declaration and springtime spending plan.

For the freelance, the major price of nationwide insurance coverage would certainly be eliminated by the end of the following parliament.

The policy likewise assures no boosts to revenue tax obligation, nationwide insurance coverage or barrel. And the Tories have actually vowed to ditch resources gains tax obligation for proprietors that offer buildings to their occupants.

On the other hand, financial security was Work’s pitch to citizens in its policy launched on Thursday, with a promise to cap firm tax obligation at its existing price of 25% to offer services long-lasting assurance.

Together With this, Work has actually eliminated increasing the prices of revenue tax obligation, nationwide insurance coverage and barrel. It has actually likewise devoted to billing barrel on independent school charges, eliminating the non-dom tax obligation standing and closing “technicalities” in the windfall tax obligation on oil and gas business.

In overall, Work prepares to increase greater than ₤ 7bn in profits from tax obligation, its costings record stated.

What have professionals stated concerning these promises?

Leading brain trust supervisor Paul Johnson, of the Institute for Fiscal Researches, stated he was skeptical concerning the Tory policy’s costings.

” The Conservatives have actually guaranteed some ₤ 17bn each year of tax obligation cuts and a large walk in support investing,” he stated. “That is apparently moneyed by minimizing the predicted well-being costs by ₤ 12bn; punishing tax obligation evasion and evasion; and conserving billions from reducing public service numbers, minimizing investing on administration professionals and ‘quango performances’.

” Those are precise free gifts spent for by unclear, indefinite and evidently victimless financial savings. Forgive a level of scepticism.”

On the Work policy, Johnson stated the tax obligation overview was just as unclear: “Yes, [economic] development can amaze on the advantage – and if it does, after that the monetary math would certainly be much easier. However if it does not – and it hasn’t often tended to in recent times – after that either we will certainly obtain those cuts, or the monetary targets will certainly be fudged, or tax obligations will certainly increase.”

So just how does the federal government invest our tax obligations?

To Start With, it needs to be explained that the complying with break downs are based upon government figures last upgraded in January: before one of the most current spending plan in March. Nevertheless, they still offer an excellent indicator of where taxpayers’ cash goes.

This initial graph demonstrates how much is invested somewhat on various markets.

So, virtually fifty percent of our tax obligations – 40% – is invested in health and wellness (20%) and well-being (20%) alone. When we think about a few of the numbers and variables behind these vital markets, we can acquire an understanding of why a lot is invested in them.

As an example, under health and wellness investing, the NHS has a gigantic workforce of around 1.7 million people: making it among the largest companies worldwide – and the largest in Europe. Around two-thirds of its spending plan takes place head count.

Financing of the NHS is generally divided right into 2 locations: everyday running prices, which represents the substantial bulk of investing, and facilities. The health and wellness solution sees around 1.3 million patients every day.

And it’s not going to obtain any type of smaller sized – acccording to the NHS Long-term Labor Force Strategy, the predicted need for team by 2036/37 will certainly remain in the area of 2.4 million individuals.

Well-being, at the same time, is specified by the federal government as “social defense”. This consists of investing on many locations such as unemployment insurance, tax obligation debts, public market pension plans … in addition to advantages or assistance covering groups such as seniority, illness and handicap, real estate, kids and family members.

Global credit scores is anticipated to make up 27% of complete well-being investing in 2023-24.

An additional 40% of our tax obligations is invested in public debt passion (12%), state pension plans (10%), education and learning (10%) and service and market (8%).

This 2nd graph, at the same time, reveals the complete quantities invested in the exact same locations as above.

We are paying extra tax obligation than ever before

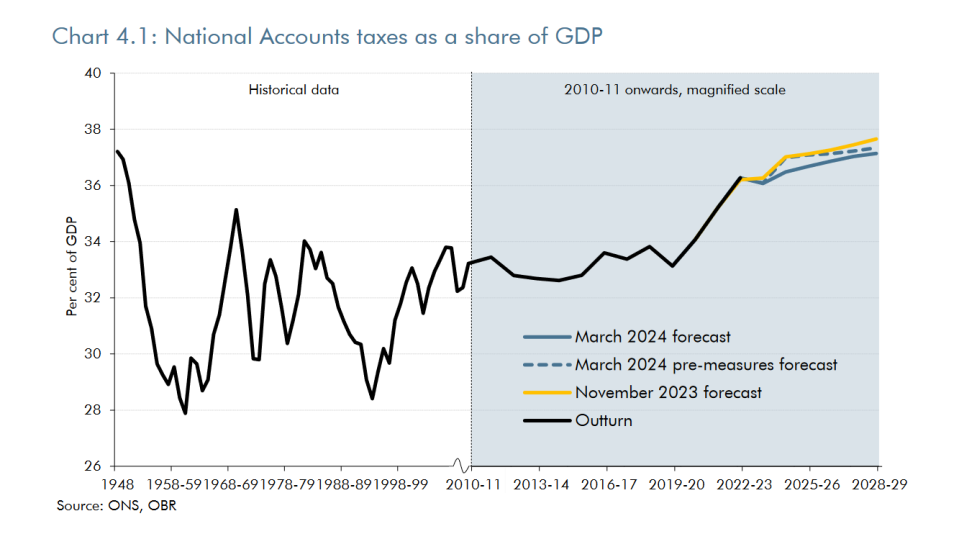

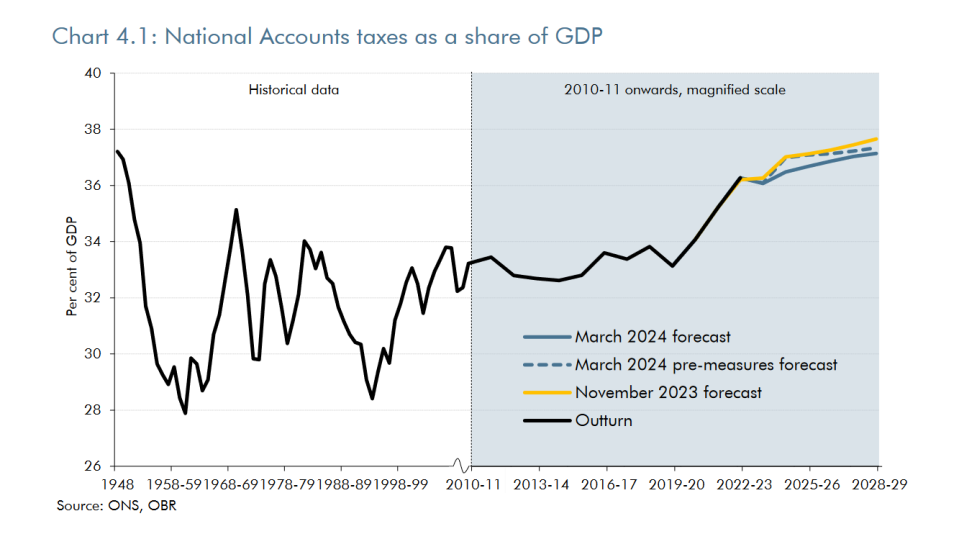

According to an IFS report today, tax obligation profits as a share of nationwide revenue was 36% and increasing previously this month, “the greatest tax obligation worry given that 1948”.

” The parliament that began in 2019 saw the largest increase in the tax obligation take of any type of parliament in contemporary background,” it stated.

The Workplace for Spending plan Duty, at the same time, has actually formerly anticipated ( see graph, over) tax obligation will certainly stand for 37.1% of GDP by 2028– 29. This would certainly be simply listed below the all-time high of 37.2% in 1948.

Nevertheless, the IFS likewise explained the tax obligation worry “is low compared to the majority of western European nations”.

In 2021, one of the most current year for globally equivalent information, UK tax obligation profits was 33.5% of GDP, contrasted to an ordinary 39.9% of GDP amongst the EU14 nations – those in the EU prior to 2004 – consisting of France and Germany.

Your overview to ballot

The statement of beliefs

The leaders

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.