Like numerous various other altcoins, Fantom’s (FTM) rate has a hard time to recoup from its quarter-long decrease. On-chain information highlights certain variables maintaining the token from getting to a greater worth.

FTM’s greatest rate this quarter was $1.03 on April 10. While there were efforts to trade greater, the token dealt with denial on a number of events.

Fantom Locates It Challenging to Burst Out

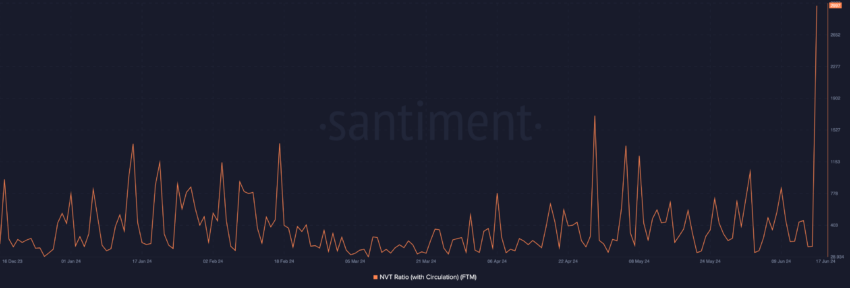

There has actually been conjecture that FTM has actually gone into a chance area for market individuals to build up. Yet, according to the Network Worth to Deals (NVT) Proportion, bearish pressures remain to confiscate control of the token’s instructions.

- NVT Proportion: The NVT Proportion determines whether a blockchain’s network is miscalculated or otherwise. To obtain this understanding. If this worth is expensive, it implies that the marketplace cap has actually exceeded the deal quantity. Alternatively, a reduced analysis recommends that the deal quantity is expanding much faster than the marketplace cap. In this circumstances, the network is thought about underestimated.

According to information from Santiment, the NVT Proportion on the Fantom network instantly leapt to 2,997 on June 17. This extraordinary spike suggests that the cryptocurrency is miscalculated contrasted to the flowing symbols on the blockchain.

Worrying the rate, this problem has actually traditionally been related to a regional top. As a result, FTM’s rate, which was $0.61 at press time, might go down additionally.

Find Out More: 9 Finest Fantom (FTM) Purses In 2024

Recently, BeInCrypto reported that need for FTM went down to an annual reduced. The reasoning from that evaluation was that the rate would certainly go down listed below $0.60.

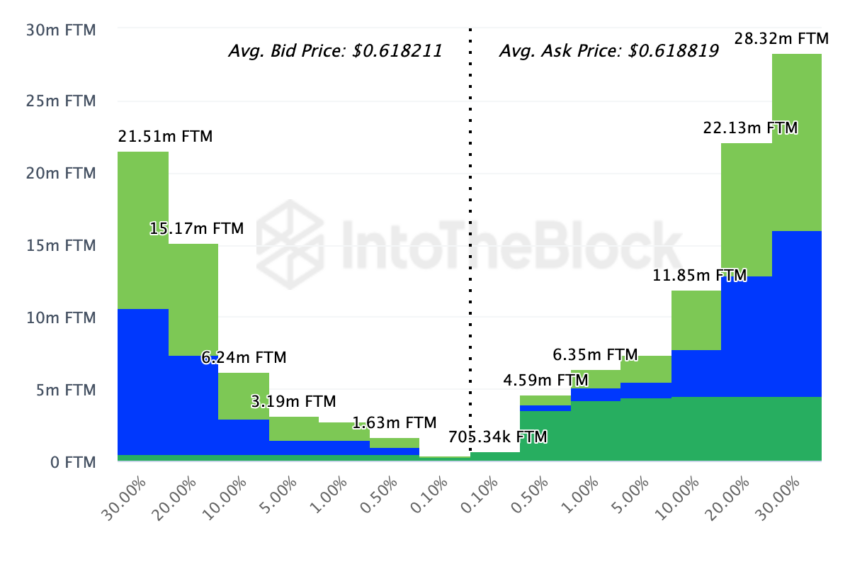

That forecast appears all set to come true. The Exchange-Onchain Market Deepness strengthens this projection.

- Exchange-Onchain Market Deepness: This statistics tracks possible trading orders on exchanges. The column on the left stands for the proposal quantity, which suggests the overall acquiring capacity. On the right is the ask quantity, which suggests the variety of symbols planned for sale.

Information from IntoTheBlock reveals that 50.63 million FTM symbols got on the proposal side. Nonetheless, the ask side has 81.35 million symbols in line to be marketed.

FTM Rate Forecast: Losses Might Be Larger

The variation in the orders exposes that the token looks readied to experience high marketing stress. If this proceeds over the following couple of days, FTM’s rate might go down listed below $0.60, and the worth might transform hands at $0.58.

One more essential statistics for Fantom is growth task. As a wise agreement system, growth task procedures whether designers are delivering brand-new attributes to address obstacles on the network.

According to on-chain information from Santiment, growth task has actually been going down given that June 14. This implies that designers’ dedication to brightening the network has actually been reduced. Furthermore, the 24-hour energetic addresses dropped, recommending a reduction in the variety of special addresses communicating with FTM.

Find Out More: Leading 5 Return Farms on Fantom

Need to these metrics remain to decrease, bulls might be incapable to conserve FTM from an additional recession. Nonetheless, the Sonic upgrade, which is predicted to occur in the 3rd quarter (Q3), might conserve the token from more losses.

Yet Fantom has actually not yet established a day for the Mainnet occasion. If the group does, acquiring stress might enhance, and FTM can go back to $1.

Please Note

According to the Depend on Job standards, this rate evaluation write-up is for informative objectives just and need to not be thought about monetary or financial investment recommendations. BeInCrypto is devoted to exact, honest coverage, yet market problems go through transform without notification. Constantly perform your very own research study and speak with a specialist prior to making any kind of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.