In a proposal outlined in the Wall Surface Road Journal, previous Audio speaker of your home Paul Ryan has actually promoted for an unique monetary approach that incorporates cryptocurrency, particularly dollar-backed stablecoins, right into the United States financial structure to neutralize the impending risk of a public debt situation. Ryan, a popular number that led your home of Reps till 2019, emphasizes the seriousness of taking on stablecoins to avoid a disastrous failing in the following financial debt public auction, which he thinks might threaten the international reputation of the USA and speed up a significant economic recession.

Below’s Just how Crypto Can Conserve The United States

Presently offering on the Plan Council for Standard, an equity capital company concentrated on crypto advancements, Ryan brings an one-of-a-kind point of view that links typical economic devices with arising electronic remedies. In his viewpoint item, he verbalizes an extensive vision for leveraging stablecoins to boost the liquidity and allure people national debt on a worldwide range.

Ryan suggests that stablecoins, which are cryptocurrencies made to preserve a steady worth by being secured to fiat money like the United States buck, might dramatically reinforce need for United States public financial debt. He recommends that these electronic properties might outmatch typical international capitalists in Treasury protections, such as Hong Kong and Saudi Arabia, by giving an extra secure and trusted device for acquiring United States financial debt.

” Dollar-backed stablecoins not just supply a method for preserving the United States buck’s prominence as the worldwide book money however additionally work as a vital tool for funding the United States shortage without jeopardizing long-lasting financial security,” Ryan describes. His proposition highlights the twin advantages of crypto stablecoins: helping with efficient financial debt administration and strengthening the buck’s worldwide standing.

Ryan’s ask for a “durable and foreseeable governing structure for stablecoins” is focused on promoting a setting where these electronic properties can flourish safely and naturally. He slams the present absence of thorough guidelines, which he deems a substantial obstacle to the fostering and development of stablecoins in mainstream economic procedures.

He specifies on the possible financial effects of incorporating crypto stablecoins right into the United States economic system, consisting of the reduction of threats connected with monetary inequalities and the decrease of dependence on international financial debt owners. By doing so, Ryan assumes that stablecoins might act as a barrier versus financial shocks, such as those experienced throughout market tightenings and self-confidence situations in the buck.

In the wider geopolitical sector, Ryan recognizes the tactical value of preserving the buck’s preeminence despite increasing difficulties from international rivals like China. He mentions that China has actually been strongly seeking improvements to its worldwide financial stature, placing itself as an awesome opponent in the international economic system.

” By incorporating stablecoins right into our economic toolbox, we not just safeguard our economic freedom however additionally neutralize initiatives by various other countries to deteriorate the buck’s international impact,” Ryan insists. He worries that aggressive economic advancement, such as the fostering of stablecoins, is essential to maintaining the United States’s financial prominence and protecting against possible political and financial agitation.

Significantly, Tether, the company of USDT, is currently among the biggest United States treasury owners. Since March 31, its economic documents revealed holdings of $91 billion in United States Treasury expenses, both straight and indirect, together with $5.4 billion in Bitcoin. These holdings rated Tether as the 19th biggest international owner people Treasuries, positioned in between South Korea and Germany.

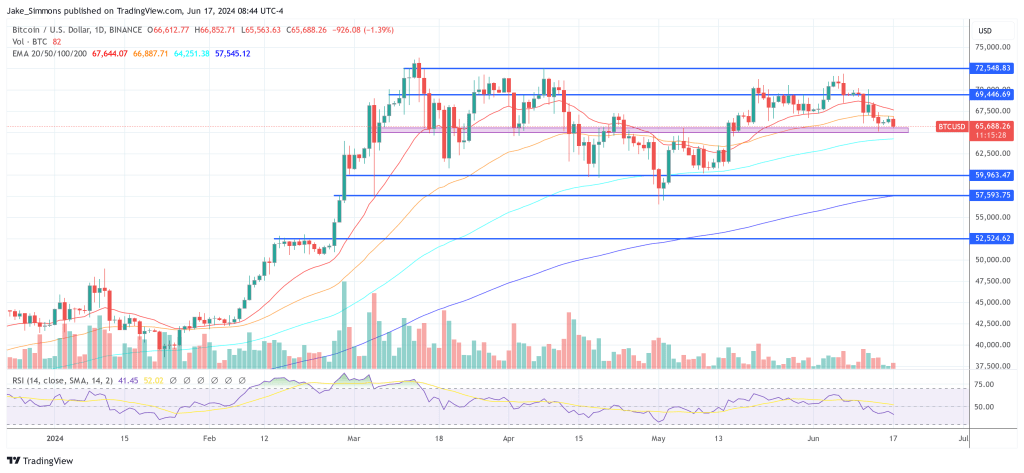

At press time, BTC traded at $65,688.

Included photo from Capital, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.