BlackRock chief executive officer Larry Fink just recently dealt with the Team of 7 (G7) leaders. He highlighted a substantial change in the international economic system.

Fink stressed the expanding duty of resources markets as the main resource of private-sector funding. This adjustment signifies a pushing requirement for brand-new approaches to open economic possibility.

Larry Fink: The “Development Issue”

In a keynote address, Fink highlighted a pushing “development issue” influencing arising economic climates and well-known financial powers.

” The International Monetary Fund and the Globe Financial institution were produced 80 years earlier when financial institutions, not markets, funded most points. Today, the economic globe is turned. The resources markets are the greatest resource of economic sector funding,” Fink kept in mind.

Current reforms have actually currently generated considerable outcomes, with billions of bucks channelled right into facilities in creating nations. Nevertheless, he stressed the requirement for a brand-new strategy to unlocking resources, which varies from typical financial institution annual report versions.

Because of this, Fink introduced the development of the Capitalist Union, consisting of BlackRock, GIP, and KKR, which will certainly dedicate $25 billion to Asia’s arising economic climates. This campaign mirrors initiatives in Africa, intending to promote financial development via facilities financial investments.

Fink worried that the requirement for development expands past arising economic climates.

” Excellent financial powers, consisting of the G7, remain in reality on the checklist. Certainly, development moving forward. Everybody are gazing down a development issue, whether we fix it or otherwise. It’s a substantial financial fork in the roadway for our nations,” he mentioned.

With G7 nations balancing a debt-to-GDP proportion of 129%, typical approaches of taxes and costs cuts want. Fink said that authentic development is important to conquering this financial difficulty, though attaining it is progressively tough as a result of group changes and decreasing working-age populaces.

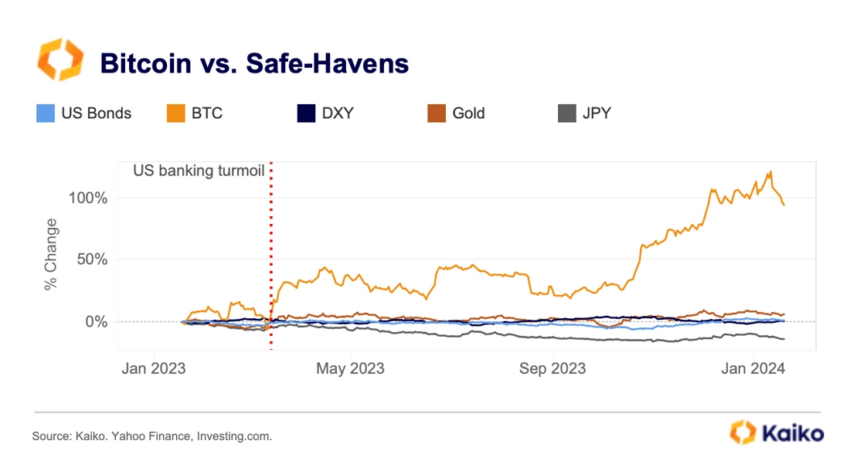

Amidst these financial worries, Bitcoin has actually amassed interest as a prospective safe house. Experts at blockchain analytics strong Kaiko have observed big institutional gamers, such as Franklin Templeton, Integrity, and also BlackRock, admiring Bitcoin’s safe-haven features.

Unlike typical safe houses, Bitcoin uses greater returns and a reduced connection with equities, especially throughout market chaos.

Kaiko’s evaluation discloses that Bitcoin’s 60-day connection with the Nasdaq 100 has actually considerably reduced over the previous year, balancing near to no because June 2023. This reduced connection boosts its allure as a safe house, particularly throughout economic dilemmas, such as in 2014’s United States financial dilemma, where Bitcoin outshined typical properties like gold and United States bonds.

The intro of area Bitcoin exchange-traded funds (ETFs) in the United States has actually likewise seen solid need, with greater than $15 billion in web inflow because its launch in January 2024. These ETFs gain from Bitcoin’s crooked returns and its credibility as a trustworthy property throughout financial instability.

Learn More: Just How To Profession a Bitcoin ETF: A Step-by-Step Method

As the international economic situation deals with extraordinary obstacles, Bitcoin’s duty as a safe house ends up being progressively considerable. With institutional recommendations, Bitcoin attracts attention as a practical choice for capitalists looking for security in the middle of financial unpredictability.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to give exact, prompt details. Nevertheless, viewers are suggested to confirm truths separately and seek advice from an expert prior to making any kind of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.