On-chain information reveals the Bitcoin Exchange Whale Proportion has actually gotten on the up lately, an indication that might confirm to be bearish for the property’s rate.

60-Day MA Bitcoin Exchange Whale Proportion Has Actually Been Quickly Climbing Up Just Recently

As explained by an expert in a CryptoQuant Quicktake post, the Exchange Whale Proportion has actually seen sharp development lately. The “Exchange Whale Proportion” is a sign that tracks the proportion in between the amount of the leading 10 transfers mosting likely to exchanges and the overall exchange inflow.

The 10 biggest exchange inflows can be thought to be originating from the whales, that are entities that lug the biggest holdings on the network and therefore, additionally one of the most affect on the market.

The Exchange Whale Proportion generally informs us regarding just how the exchange inflow task of these enormous capitalists contrasts versus that of the whole Bitcoin market.

When the worth of this statistics is high, it indicates the leading 10 exchange inflows are offseting a considerable component of the marketplace down payments. Typically, capitalists make down payments whenever they wish to utilize among the solutions that these systems offer, which can consist of marketing.

Therefore, the sign having a high worth might indicate these huge owners are adding a high quantity of offering stress today. Normally, this sort of fad can be bearish for the property.

On the various other hand, the proportion being reduced recommends the whales are offseting a reasonably healthy and balanced component of the overall exchange inflows, which can have a favorable result on the rate.

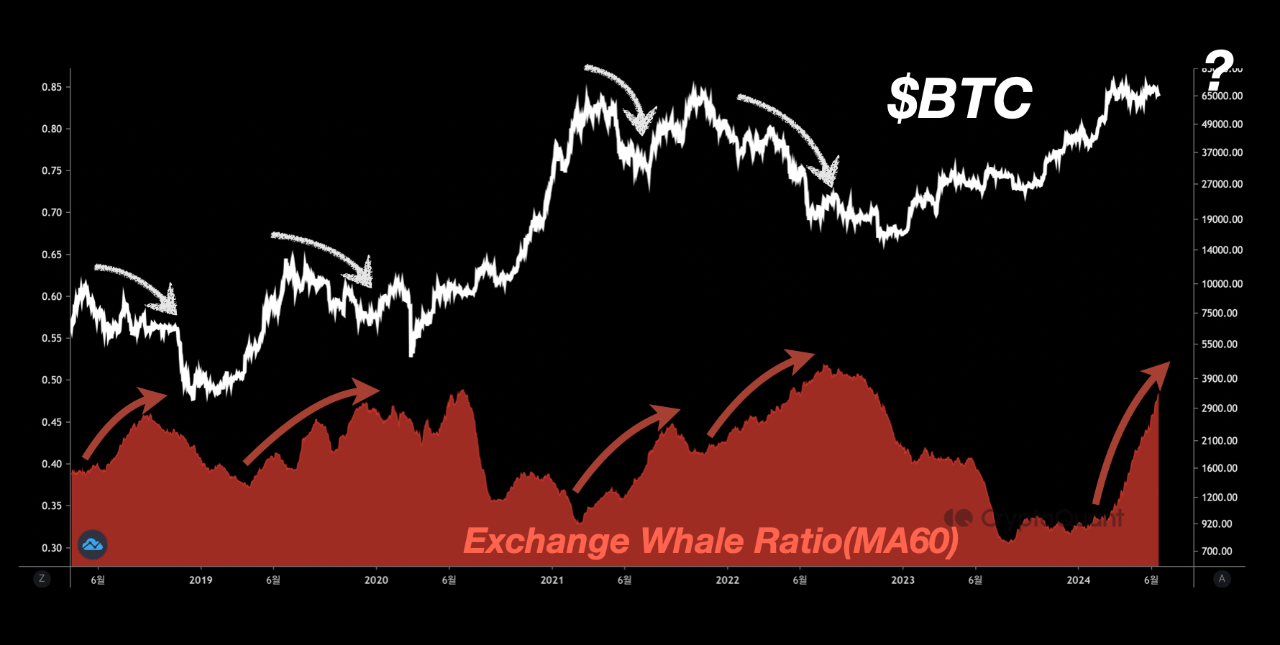

Currently, below is a graph that reveals the fad in the 60-day relocating standard (MA) of the Bitcoin Exchange Whale Proportion over the previous couple of years:

Appears Like the 60-day MA worth of the statistics has actually been trending up over the last couple of months|Resource: CryptoQuant

As shows up in the above chart, the 60-day MA Bitcoin Exchange Whale Proportion has actually been climbing up on a high upwards trajectory throughout the previous couple of months. This would certainly recommend that the whales have actually been raising their share of the exchange inflows lately.

The surge in the sign has actually come as the rate of the cryptocurrency has actually delighted in development and has actually established a brand-new all-time high (ATH). In the graph, the quant has actually highlighted what occurred throughout the last couple of times when the statistics experienced a comparable rally.

It would certainly show up that the rate of the cryptocurrency has actually typically seen a high drawdown whenever the Exchange Whale Proportion has actually expanded to high worths. Up until now, BTC has yet to see a comparable decrease, although its rate has actually shed its favorable energy and has actually been relocating sidewards lately.

” My hunch is that this hasn’t occurred as a result of the substantial need for place ETFs,” keeps in mind the expert. It currently stays to be seen how much time the need will certainly have the ability to absorb this raising marketing stress from the whales and if the rate would certainly surrender in a comparable style as in the past when acquiring does run out.

BTC Rate

At the time of creating, Bitcoin is drifting about $65,600, down greater than 5% over the last 7 days.

The rate of the coin has actually remained to be embeded its combination variety lately|Resource: BTCUSD on TradingView

Included picture from Dall-E, CryptoQuant.com, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.