It’s quite tough to say Virgin Galactic ( NYSE: SPCE) is anything however a story stock today. And you either think that tale or you do not. However there are some quite engaging aspects in the story, along with some truly large issues.

Are you a glass-half-full capitalist or a glass-half-empty capitalist? Right here’s what you require to think of as you make the buy, sell, or hold choice on Virgin Stellar supply.

The debate for marketing Virgin Stellar supply

The factor to offer Virgin Galactic (or never ever purchase it to begin with) is extremely uncomplicated. This room tourist firm finished the very first quarter of 2024 with money and valuable protections of approximately $800 million on itsbalance sheet That’s below concerning $910 million at the end of 2023. The $110 million in money that went away approached Virgin Galactic’s capital expense program. The firm sheds cash, and it anticipates to proceed doing so for the near future, so it’s not renewing the money it is investing in its procedures anytime quickly.

The present money equilibrium needs to obtain Virgin Galactic to the factor where it has actually developed and is flying its Delta-class spacecraft. That will not occur till 2026 at the earliest. If the firm’s money equilibrium does not become adequate cash, or something fails and hold-ups the launch of the very first Delta ships, Virgin Galactic can be in large economic problem. To make issues worse, it has a $425 million exchangeable protection note that comes due in 2027. So not just would it need even more money if there are growth hold-ups with the Delta ship, however there’s a considerable financial debt high cliff simply past the predicted 2026 Delta launch day that may be tough to manage if points do not go as intended.

In several methods, it seems like Virgin Room is strolling an economic tightrope. It’s the sort of risky financial investment that conventional capitalists will possibly wish to prevent.

The debate for acquiring or holding Virgin Stellar supply

That stated, if you can tolerate some threat, there are some positives below. Firstly, the firm has actually verified that it can run a room tourist company. Although its Unity spacecraft has actually finished its last scheduled trip, it managed a month-to-month trip tempo in the very early days. That was reduced to quarterly in an initiative to lower the money shed, however the actual takeaway is that Virgin Galactic can do what it declares.

On the other hand, the firm thinks that the Delta spacecraft will certainly have the ability to cover its trip prices from the sale of a solitary seat of the 6 seats that will certainly be readily available per trip. So it thinks that each trip will certainly generate a massive quantity of earnings. Monitoring assumes that running simply 2 Delta spacecraft will certainly enable the firm to be cash-flow-positive. If that holds true, Virgin Galactic’s money equilibrium will not be diving any longer. And also, it will certainly have an extra lasting company to back additional capital-raising initiatives so it can construct a lot more Delta-class ships.

An additional crucial element below is that the room professional has around 725 individuals aligned to take a trip. These clients have actually currently placed cash down on what is presently a $600,000 ticket (very early customers really did not pay almost that much), so they are extremely thinking about hopping on a Virgin Galactic spaceflight. Despite having 2 spacecraft addressing one-time (which would certainly be 12 paying travelers), it would certainly take 58 trips to shed via that consumer stockpile (which thinks no one else ever before purchases a ticket). Tickets aren’t presently offer for sale, however sales will certainly open once again when the Delta ship is even more along.

When it comes to the addressable market, well, monitoring thinks that there are around 300,000 prospective clients worldwide. However that thinks that only individuals trying to find “journey traveling” chances are mosting likely to be interested. That’s plainly the instance today, however as an increasing number of effective trips are finished, it promises that need will certainly boost as issues around threat diminish. (A trip calamity would undoubtedly be a significant obstacle.)

All informed, Virgin Galactic can be an extremely lucrative company eventually in the future. You simply need to think that every little thing goes as intended if you action in and purchase the supply.

Virgin Stellar supply is certainly except every person

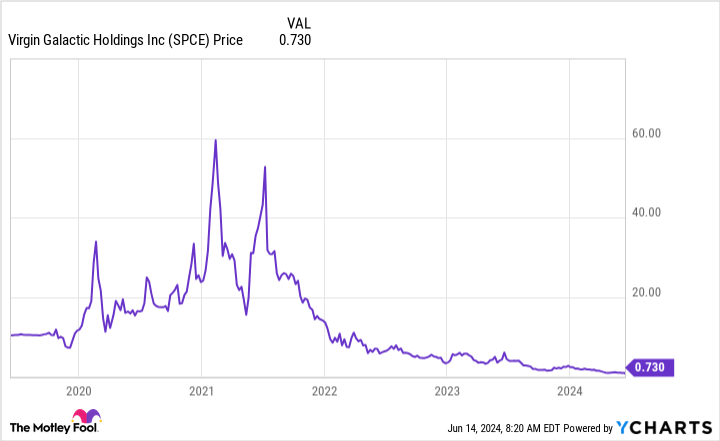

After seeing very early enjoyment on Wall surface Road, Virgin Galactic’s supply has actually trended progressively reduced. Now, it has actually established a 1-for-20 reverse supply split to return in conformity with exchange listing criteria. That’s typically not a great indicator and is an indicator of just how bearish capitalists are right currently on the firm’s potential customers. Traditional capitalists must possibly share that sight till the Delta-class ship gets to a minimum of a couple of even more growth landmarks. Nevertheless, for hostile capitalists going to turn for the fencings every now and then, the high decrease in the supply can be a chance to participate the first stage. If (and it’s a large if) Virgin Galactic can perform well, it can have an eye-catching future in advance of it.

Should you spend $1,000 in Virgin Galactic today?

Prior to you purchase supply in Virgin Galactic, consider this:

The Supply Consultant expert group simply determined what they think are the 10 best stocks for capitalists to purchase currently … and Virgin Galactic had not been among them. The 10 supplies that made it can generate beast returns in the coming years.

Think About when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $808,105! *

Supply Consultant supplies capitalists with an easy-to-follow plan for success, consisting of support on constructing a profile, routine updates from experts, and 2 brand-new supply choices every month. The Supply Consultant solution has greater than quadrupled the return of S&P 500 because 2002 *.

* Supply Consultant returns since June 10, 2024

Reuben Gregg Brewer has no placement in any one of the supplies pointed out. The has no placement in any one of the supplies pointed out. The has a disclosure policy.

Virgin Galactic Stock: Buy, Sell, or Hold? was initially released by The

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.