NextEra Power ( NYSE: NEE) has a reward return of around 2.7% today. Earnings capitalists and those with a worth prejudice most likely will not wish to get its shares, yet if you like returns development supplies, the 10% annualized payment development NextEra Power has actually accomplished over the previous years will most likely obtain your juices streaming.

And if monitoring is right, the future looks equally as great as the past for returns development.

Why some individuals will not such as NextEra Power

NextEra Power has one significant trouble: Wall surface Road recognizes that this is a really well-run energy. That’s why the return is 2.7%, which is listed below the 3% standard for the utility sector, utilizing the Lead Utilities Index ETF ( NYSEMKT: VPU) as a proxy.

Sure, NextEra generates greater than the 1.3% you would certainly obtain from an S&P 500 Index fund, yet it simply isn’t a high return supply. Returns capitalists and those with a worth prejudice– keeping in mind that the return goes to ideal center of the roadway over the previous years– will most likely wish to consider energies with greater returns.

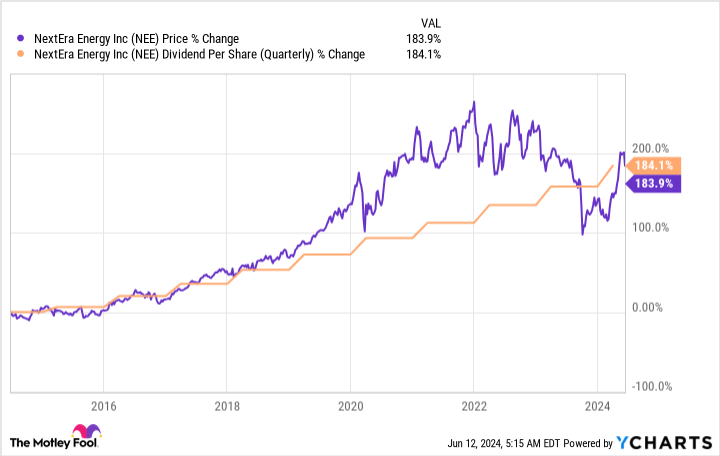

That stated, the present returns return isn’t the factor to get NextEra Power. Returns development is the actual tale, with the returns enhancing by greater than 180% over the previous one decade.

The supply has actually climbed by virtually the specific very same quantity over that period, also, resulting in a rather remarkable overall return of greater than 260%, with returns reinvestment. That’s far better than the S&P 500 index, which had a complete return of around 225% over the very same period. Go back momentarily: NextEra, an energy firm, defeated the S&P 500!

However there’s one more number that you may locate fascinating: return on acquisition rate. If you acquired NextEra Power in 2013 at its most pricey factor, you would certainly have paid $22.4375 per share, readjusted for a 4-for-1 supply split in 2020. The annualized returns in the 4th quarter of 2013 was $0.66 per share, for a return on acquisition of about 2.9%.

At the end of the 2nd quarter of 2024, the annualized returns was $2.06 per share, which would certainly indicate your return based upon acquisition rate increased to a significant 9.2% or two in a little over a years. If you like returns development, you’ll enjoy NextEra Power.

The future looks intense for NextEra Power

NextEra Power has actually accomplished this returns development by developing a big sustainable power organization atop its controlled energy procedures in Florida. Plainly business design has actually functioned well based upon the returns development.

And NextEra assumes the following couple of years will certainly be equally as great as the last years. Today, the firm is requiring profits development of in between 6% and 8% a year via a minimum of 2027. That will certainly cause returns development of 10% a year via a minimum of 2026.

What’s support that expectation? Monitoring anticipates electrical energy need in the USA, driven by need for sustainable power, to raise materially in the years in advance.

Some numbers will certainly assist: In between 2000 and 2020, electrical energy need broadened simply 9%, yet in between 2020 and 2040, NextEra thinks need will certainly raise by 38%. That’s a radical modification in what has actually traditionally been taken into consideration a rather drowsy industry.

However the actually fundamental part of the tale below is that NextEra Power’s tidy power competence, developed over years, placements it well to gain from the promote sustainable power that it anticipates. And if you get NextEra today, you can profit together with the firm.

NextEra Power is constantly pricey

If you acquired the supply in 2013 when it had a 2.9% returns return, you would most likely be a rather delighted dividend-growth financier today. However that return is quite near the 2.7% return today, which recommends that NextEra Power has actually been a pricey supply to have for a long time. Nonetheless, if returns development is what you desire, this energy has actually shown that compensating for high quality can exercise extremely well over the long-term.

Should you spend $1,000 in NextEra Power now?

Prior to you get supply in NextEra Power, consider this:

The Supply Consultant expert group simply determined what they think are the 10 best stocks for capitalists to get currently … and NextEra Power had not been among them. The 10 supplies that made it can generate beast returns in the coming years.

Take Into Consideration when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $808,105! *

Supply Consultant supplies capitalists with an easy-to-follow plan for success, consisting of support on developing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Supply Consultant solution has greater than quadrupled the return of S&P 500 given that 2002 *.

* Supply Consultant returns since June 10, 2024

Reuben Gregg Brewer has no setting in any one of the supplies discussed. The has placements in and suggests NextEra Power. The has a disclosure policy.

Is NextEra Energy Stock a Buy? was initially released by The

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.