The launch of Bitcoin exchange-traded funds (ETFs) in January noted a substantial landmark. Nevertheless, economic consultants are coming close to these brand-new financial investment cars with care.

BlackRock’s Principal Financial investment Police officer of ETF and Index Investments, Samara Cohen, supplied understandings throughout the Coinbase State of Crypto Summit in New York City City.

Why Financial Advisors Avoid Bitcoin ETFs

Cohen explained that regarding 80% of Bitcoin ETF acquisitions are presently made by self-directed capitalists making use of on the internet brokerage firm accounts. According to last quarter’s 13-F filings, hedge funds and broker agents have actually likewise been energetic purchasers. Nevertheless, signed up financial investment consultants stay reluctant.

Cohen mentioned, “I would certainly call them cautious … That’s their work.” She highlighted the fiduciary duty that consultants need to their customers, keeping in mind that Bitcoin’s historic rate volatility, which has actually gotten to 90% sometimes, demands comprehensive danger evaluation and due persistance.

Monetary consultants thoroughly assess information and take the chance of analytics to establish Bitcoin’s suitable duty in financial investment profiles, taking into consideration elements such as danger resistance and liquidity requirements.

” This is a minute, in regards to truly advancing crucial information, danger analytics [and determining] the duty Bitcoin can play in a profile, what type of allotment is suitable provided a capitalist’s danger resistance, their liquidity requires. That’s what a consultant is intended to do, so I believe this trip that we get on is precisely the appropriate one and they’re doing their work,” Cohen included.

Learn More: Just How To Profession a Bitcoin ETF: A Step-by-Step Strategy

While economic consultants stay mindful, some experts hold a favorable expectation on Bitcoin’s future.

Bernstein, a significant property supervisor with $725 billion in properties, anticipates that Bitcoin’s rate might get to $1 million by 2033. The brand-new projection recommends a cycle-high of $200,000 by 2025. This forecast is driven by unmatched need from place ETFs and Bitcoin’s restricted supply.

Bernstein’s previous price quote was $150,000 for 2025, showing their expanding positive outlook regarding Bitcoin’s possibility.

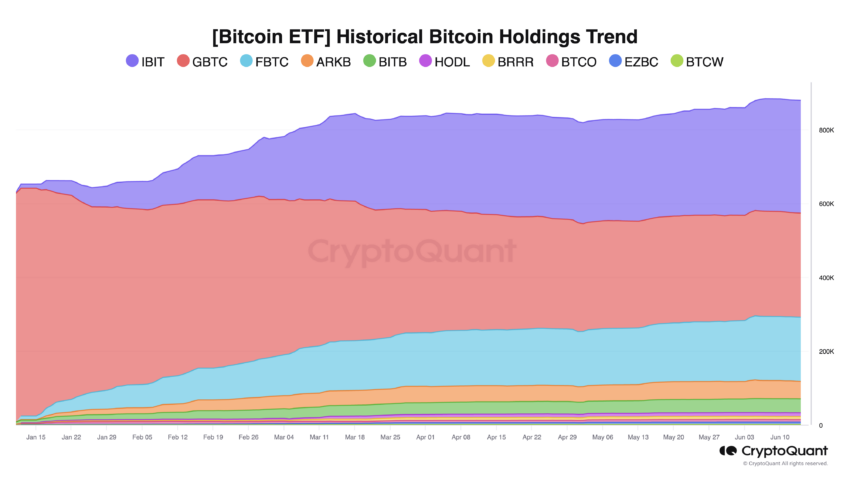

” Around $15 billion of internet brand-new circulations have actually been generated by the ETFs integrated. We anticipate Bitcoin ETFs to be equal to roughly 7% of Bitcoin in flow by 2025 and virtually 15% of Bitcoin supply by 2033,” Bernstein experts created.

Learn More: Bitcoin (BTC) Cost Forecast 2024/ 2025/ 2030

WAX founder William Quigley likewise commented on the spreading of ETFs for various other cryptocurrencies like Solana. “Wall surface Road is money grubbing,” Quigley stated, recommending that the success of Bitcoin ETFs will certainly stimulate comparable items.

Nevertheless, he warned that if the energy slows down, ETF companies may change emphasis or closed down underperforming ETFs because of an absence of need.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to offer precise, prompt details. Nevertheless, viewers are suggested to confirm truths separately and speak with an expert prior to making any kind of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.