On-chain information reveals that the Bitcoin taker buy/sell proportion has actually experienced a considerable rise on a specific crypto exchange. Right here’s just how it can influence the cost of the premier cryptocurrency.

Bitcoin Financiers Acquiring The Dip On This Exchange

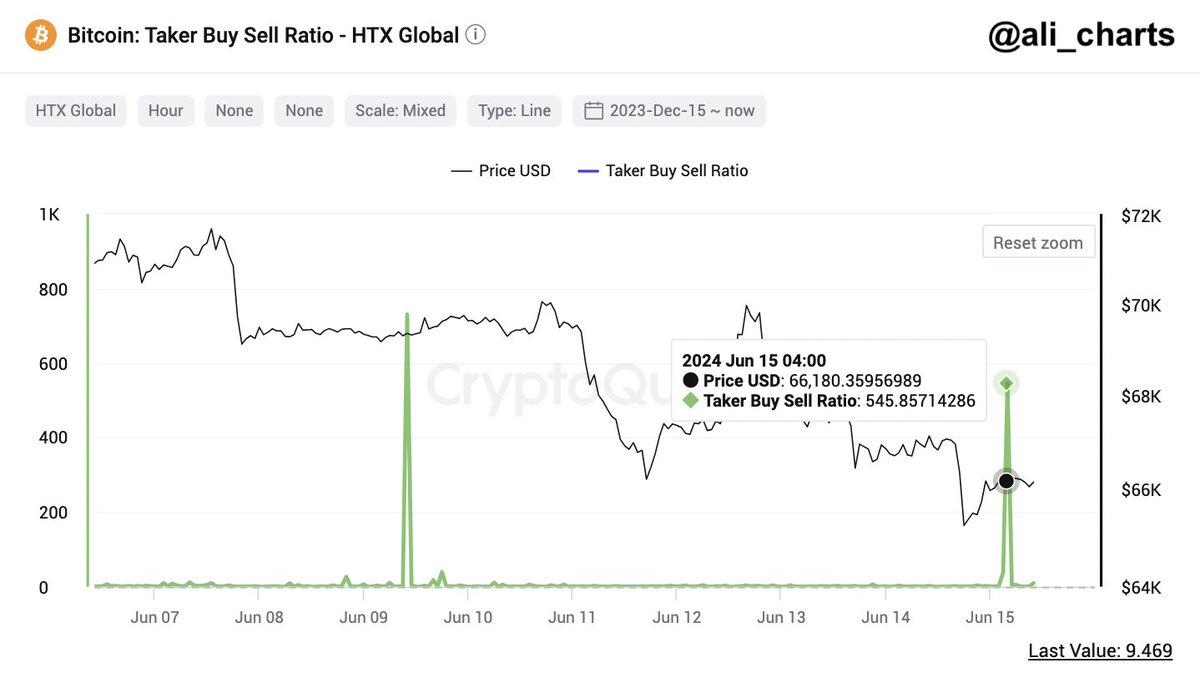

Noticeable crypto expert Ali Martinez required to the X system to reveal that capitalists on a specific exchange have actually been benefiting from the current loss in Bitcoin cost. The appropriate indication below is the taker buy/sell proportion, which gauges the proportion in between the taker get quantities and the taker sell quantities.

Usually, when the worth of this statistics is higher than 1, it suggests that the taker get quantity is greater than the taker sell quantity on the exchange concerned. In this situation, even more investors agree to get coins at a greater cost on the trading system.

Alternatively, when the taker buy/sell proportion is listed below 1, it indicates that even more vendors agree to market coins at a reduced cost, suggesting that the sell quantity is higher than the buy quantity.

Bitcoin taker buy/sell proportion|Resource: Ali_charts/X

According to information from CryptoQuant, the Bitcoin taker buy/sell proportion on the HTX Exchange (previously called Huobi) just recently increased to over 545 on Saturday. This recommends a considerable boost in getting stress and a change in capitalist belief.

Martinez kept in mind in his message on X that this spike in favorable stress can be a signal of approaching higher cost motion for Bitcoin. These high buy quantities on the HTX exchange begun the rear of BTC’s current be up to $65,000.

Nonetheless, it deserves keeping in mind that the standard Bitcoin taker buy/sell ratio throughout all exchanges is still listed below 1. At the time of creating, the worth of this statistics loaf 0.8.

BTC’s Ordinary Mining Price Rises Over $86,500

The current information programs Bitcoin’s typical mining price has actually skyrocketed to $86,668. This number shows the collective expenditures related to generating one BTC, consisting of electrical power, equipment, and functional expenses.

As highlighted by Ali Martinez in a post on X, every considerable boost in BTC’s typical mining price is typically complied with by an equivalent boost in the coin’s market price. With this historic context, the most up to date boost in the typical mining price recommends that a rate boost can be coming up for Bitcoin.

#Bitcoin‘s typical mining price is presently at $86,668.

And think what? Historically, $BTC constantly rises over its typical mining price! pic.twitter.com/S3UkwgvS3N

— Ali (@ali_charts) June 15, 2024

Since this writing, the cost of Bitcoin remains to float around the $66,000 mark, without any considerable modification in the previous day. According to CoinGecko information, the premier cryptocurrency is down by almost 5% in the previous week.

The cost of BTC on the everyday duration|Resource: BTCUSDT graph on TradingView

Included photo from Barron’s, graph from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.