Donald Trump painted considerably completely different footage to completely different audiences Thursday of how he would minimize taxes if he wins in November.

Earlier than a closed-door gathering of CEOs, he talked up an thought to cut back the company tax price to twenty% from its present 21% degree. The previous president’s remarks have been first reported by the New York Occasions and confirmed to Yahoo Finance.

However earlier that morning earlier than an viewers of Home Republicans, according to attendees, Trump floated one other thought: scrapping your entire US revenue tax system in favor of upper tariffs.

Maybe not surprisingly, Trump would not seem to have repeated his “all tariff” thought to the enterprise executives. The reception if he had would undoubtedly have been cooler, with tariffs representing a tax that companies pay after they import items.

The 2 news-making concepts that Trump provided Thursday aren’t irreconcilable — he may pursue each if he’s elected — however the sequence was emblematic of his general method to campaigning on fiscal points.

He typically tosses out seemingly spontaneous concepts favored by the viewers in entrance of him. The place Trump is constant is in having a eager deal with decrease particular person and company tax charges however a distinct method to commerce duties.

One attendee Thursday added that Trump provided assist for various company tax price ranges in his remarks to CEOs. The previous president targeted on a 20% price but in addition talked about 15%, a quantity he has pushed for beforehand.

Trump favored the 20% degree, in keeping with the CEO, partially as a result of it was a “spherical quantity.”

President Biden was additionally invited to deal with the CEOs this week however was touring in Europe. In his stead he despatched White Home chief of employees Jeff Zients, who informed the viewers Biden had wished to be there.

Taxes additionally got here up in that dialog, in keeping with an individual aware of the assembly, with Zients acknowledging a White Home plan to doubtlessly increase company taxes above 21% however stressing the necessity to preserve the US aggressive whereas doing so.

Zients is a former enterprise govt himself and sometimes a Biden emissary to company America.

He made an general case to the assembled enterprise CEOs that Biden’s insurance policies, from authorities assist for infrastructure and particular sectors to a respect for worldwide norms and world alliances, are extra essential to the financial system’s well-being than a tax minimize.

Assist for company backside traces

Trump’s company tax concepts drew reward from some conservative advocates, with some making an attempt to forged a minimize for America’s companies as one that may assist on a regular basis residents.

Grover Norquist, the president of People for Tax Reform, said in a statement that “staff, retirees, and households pay the company tax” and such a transfer “reduces the tax burden on the center class and creates jobs and progress.”

It is also a transfer that — if it involves move — would even have an financial affect.

Garrett Watson, a senior analyst and modeling supervisor on the D.C.-based Tax Basis, informed Yahoo Finance Friday that an adjustment to the company tax price to twenty% would enhance GDP by about 0.1% — however may additionally additional elevate the nationwide debt if it is not offset by spending cuts.

Such a transfer would price about $114 billion over the approaching decade, Watson stated, however would assist US world competitiveness by way of attracting company exercise.

He added in a notice that “company taxes are a few of the more harmful types of revenue raisers for financial progress, so relying much less on company taxes may be useful to encourage higher long-run progress.”

However decrease company taxes are one thing Trump has known as for for years and he’s unlikely to cease anytime quickly.

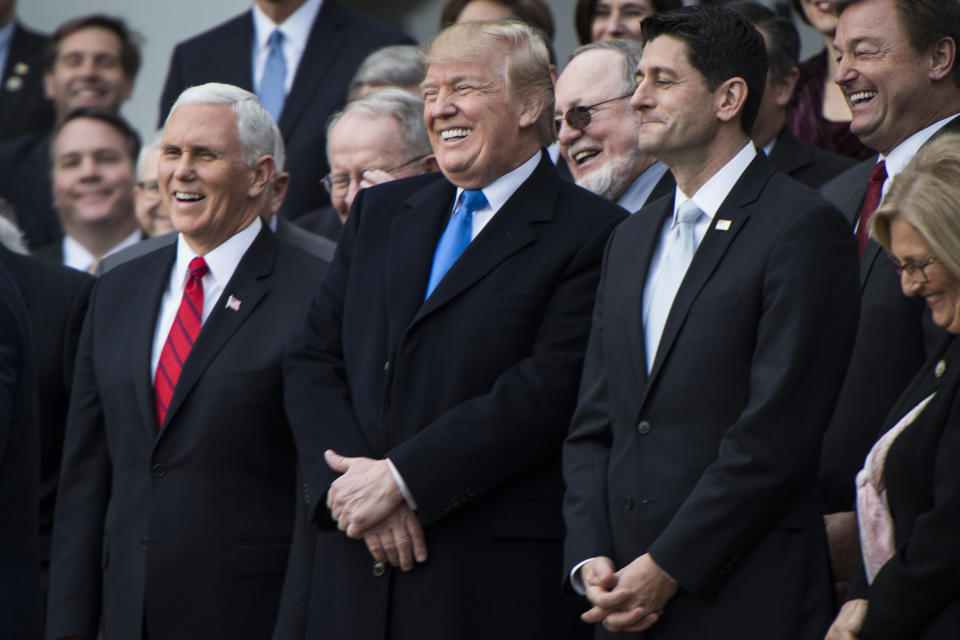

Again in 2017, the Trump-era tax cuts lowered the company tax charges from 35% to 21%. However throughout these negotiations Trump was a voice pushing for it to be lowered further, to 15%.

And he has known as for low charges within the years since.

In a 2023 NBC interview, Trump stated of company charges “I might prefer to decrease them somewhat bit if we may,” however declined to name for a 15% price then, saying, “It relies on the place we’re on the time.”

Trump has typically touted his tax cuts typically when reaching out to rich potential donors.

One leaked video — which Democrats and the Biden campaign have often surfaced in the months since — seems to indicate Trump at a fundraiser at Mar-a-Lago final December speaking to a well-heeled viewers.

“You are wealthy as hell,” he stated within the clip, after which added, “We’ll provide you with tax cuts.”

How the enterprise world compartmentalizes Trump’s guarantees

Trump’s go to to Washington this week additionally put a highlight on a company method to the Republican that always focuses on highlighting the business-friendly components of his agenda whereas downplaying others.

Trump appeared earlier than the Enterprise Roundtable, a gaggle that represents CEOs in Washington and has made tax reform and decrease charges a high precedence for the yr forward.

In a gathering with reporters earlier within the week, Enterprise Roundtable CEO Joshua Bolten downplayed Trump’s much less business-friendly concepts, corresponding to his willpower to impose a ten% tariff on US buying and selling companions.

“We’re not taking a look at it as a package deal deal,” Bolten stated. “We expect that taxes must be low, and we predict unjustified tariffs ought not be put into place.”

In a current interview, a Northwestern College political scientist named Jason Seawright who co-authored a book on billionaires and politics provided a motive why enterprise leaders may make this distinction.

He notes that final time Trump was in workplace, what truly occurred was a wave of tax cuts in addition to increased tariffs.

However these commerce tensions finally did not throw the financial system too far off target.

“They suppose that they managed issues very properly final time and so they suppose they will do it once more,” Seawright stated.

Ben Werschkul is Washington correspondent for Yahoo Finance.

Click on right here for politics information associated to enterprise and cash

Learn the most recent monetary and enterprise information from Yahoo Finance

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.