Recently, a person impersonated me at 3 financial institution branches and drained pipes hundreds of bucks from my bank account.

Opportunities are greater since something comparable will certainly take place to you.

This type of antique in-person identification burglary gets on the increase after defrauders expanded a lot more advanced throughout the pandemic, boosting their illegal supply chain that makes it simpler to manage these criminal activities.

The rise is aggravating financial institutions and the federal government as they attempt to satisfy the reanimated dangers.

” Yours is not a one-off,” Mary Ann Miller, fraudulence and cybercrime exec consultant at electronic identification option company Prove Identification, stated concerning my current encounter with ID burglary, which I discussed previously this year.

” A star strolling right into branches and doing what they performed with your account, taking out cash, is a pattern,” she stated. “It’s taking place now.”

‘ The large cash grab’

ID burglary swelled throughout the pandemic when the federal government provided $5 trillion in alleviation to companies and houses with stimulation checks, boosted welfare and food help, and excusable finances.

” It was what I call the large cash grab,” Miller stated, and wrongdoers desired an item of it. They “competent up” at producing phony identifications and swiping existing ones, Miller stated, so they can fraudulently apply for these pandemic advantages.

And it functioned. They took $300 billion in pandemic alleviation, according to one FBI official’s account, standing for the most significant fraudulence in background. That success inspired defrauders to maintain going.

” They have actually taken those discoverings,” Miller stated, “and they have actually remained to improve and much better at what they do.”

‘ Really advanced suppliers’

To manage the traditional break-in of my savings account, the offender that impersonated me required my savings account number and a phony type of ID.

These are ripe for the tackling Telegram Internet, a cloud-based encrypted immediate messaging system that is a preferred discussion forum to offer swiped papers. Miller calls it “the brand-new dark internet that’s not so dark.”

David Maimon, an associate teacher of criminal justice and criminology at Georgia State College, provided me a trip of Telegram throughout our meeting. On that particular day, a person had actually uploaded swiped checks dated simply a couple of days in the past.

These swiped checks can originate from home or automobile break-ins. One more productive ground for these criminal activities is the United States postal system.

Some mail providers just swipe them from the mail they are expected to provide. In various other situations, burglars burglarize the providers themselves or the renowned blue mail boxes discovered on public pathways. It obtained so negative that the US Postal Service last year increased down on initiatives to suppress these criminal activities.

I might have been among these sufferers. A check went missing out on after I mailed it years back, and my household later on figured out that the mail box outside our apartment had actually consistently been struck by burglaries.

A swiped check can just inform you a lot, though. It does not supply a day of birth or Social Safety number– important individual information required to develop a phony motorist’s permit or key.

So, the wrongdoers transform to unfaithful employees of banks and credit report bureaus to search for that missing out on details “for an affordable rate of one hundred dollars,” Maimon, that is likewise the head of fraudulence understandings at SentiLink, stated.

They can likewise transform to Telegram and acquisition phony types of recognition.

” Phony IDs are the most popular product you can think of on Telegram,” Miller stated. “There are really advanced suppliers.”

Fake keys have actually come to be an enhancing issue, the federal government warned banks earlier this year, because, as “a much less acquainted type of government-issued recognition,” they are more probable to escape discovery.

Yet phony motorist’s licenses supplied on Telegram are likewise “actually excellent quality,” Maimon stated.

So excellent quality that in my situation, where the criminal took out $11,300 from my savings account, “the inadequate financial institution cashier possibly could not discriminate in between the legit, actual motorist’s permit and the phony one,” he stated.

‘ You can not neglect to do the fundamentals’

The financial institution cashiers in my situation missed out on various other fraudulence flags as well.

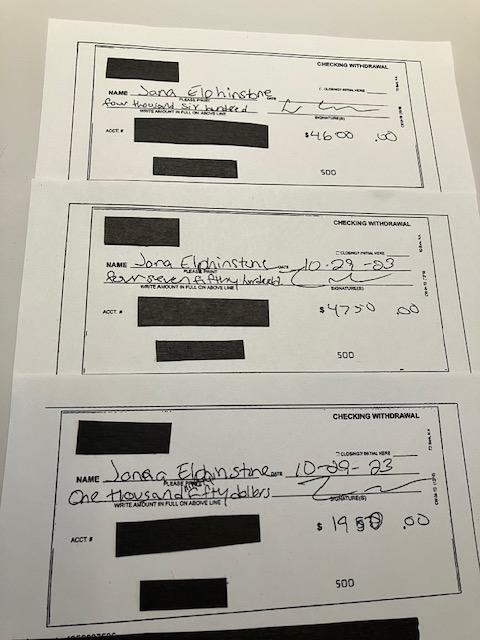

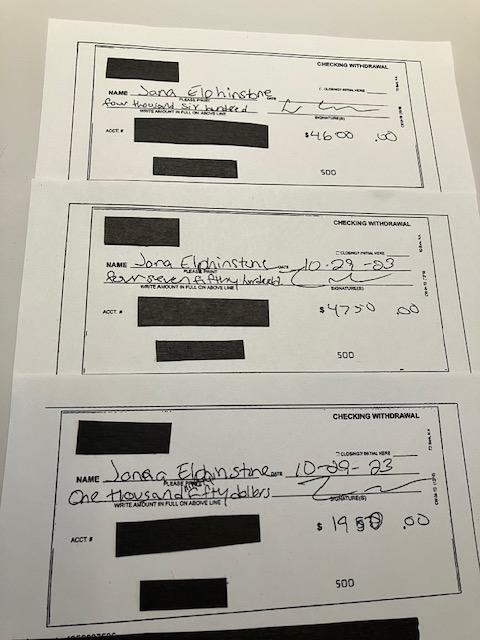

One was my name. The criminal utilized my first name on the financial institution withdrawal slide to make the purchase. The issue is that this name hasn’t shown up on my accounts given that it was altered in 2010.

The charlatan likewise misspelled my given name on 2 slides– Jana versus Janna. The 3rd revealed what seemed an effort to fix the messed up punctuation of both my very first and first names.

There’s likewise no other way to recognize what type of phony ID existed to the bank employees, due to the fact that none taped the ID type and number on the back of the withdrawal slides, a violation of treatment, a financial institution branch supervisor later on informed me.

” Wow, this had not been an extremely advanced fraudulence strike,” stated Ian Mitchell, creator of the Knoble, a not-for-profit network of banks, police, and various other nonprofits dealing with fraudulence.

” It seems like complying with the treatments that the financial institution had in area possibly would have resolved this.”

That’s what the defrauders try to find: the weak spot. So, if one financial institution has solid cybersecurity yet inadequate in-person safety, they send out in charlatans. If it’s the opposite, they might hack the banks. And to make issues worse, they share this intel amongst each various other.

The issue is that a financial institution will certainly purchase anti-fraud actions and neglect it for 5 years, Mitchell stated. Because time, the defrauders have actually advanced past those actions, discovering brand-new technicalities. Or they manipulate old ones that nobody attended to.

” You can not neglect to do the fundamentals actually well. We are frequently versus wrongdoers that are searching for brand-new and old methods to beat our defenses,” Mitchell stated.

” It’s a continuously fight.”

—

Janna Herron is an Elderly Writer at Yahoo Financing. Follow her on Twitter @JannaHerron.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.