The conversation regarding which altcoin could next off protect exchange-traded funds (ETFs) authorization has actually magnified. Amongst the prospects, Solana (SOL) attracts attention, offered its considerable market existence and solid following.

Solana, the 5th biggest cryptocurrency with a market cap going beyond $66 billion, is commonly described as an “Ethereum awesome.” This credibility, in addition to its appeal, makes it a prime prospect for ETF authorization. Nonetheless, accomplishing this authorization entails getting over considerable barriers.

Obstacles for Solana’s ETF Authorization

A key obstacle for Solana is the lack of a controlled futures agreement market. Unlike Bitcoin and Ethereum, which have actually futures items provided on significant United States exchanges such as CME and CBOE, Solana has actually not attained this turning point.

Reports in late May suggested that the Chicago Mercantile Exchange (CME) decreased to provide a Solana futures fund. According to Bloomberg ETF expert James Seyffart, this absence of a controlled futures market is a considerable obstacle that can take years to get rid of.

” Based upon present precedent/needs it will certainly occur within a couple of years of obtaining a CFTC managed futures market. Yet congress and market framework expenses like FIT21 can make it occur quicker,” Seyffart noted.

An additional considerable difficulty is authorization from the Product Futures Trading Payment (CFTC), which looks after futures markets.

Furthermore, in its suits versus Coinbase and Sea Serpent, the United States Stocks and Exchange Payment (SEC) identified Solana as a safety. This category provides a significant barrier to getting ETF authorization, as neither Bitcoin neither Ethereum are assigned as protections by the SEC.

Market Specialists Stay Hesitant

A number of market professionals are cynical regarding the chance of Solana and various other cryptocurrency ETFs.

For example, Nikolaos Panigirtzoglou, JPMorgan’s taking care of supervisor and worldwide market planner, shared questions regarding the authorization of Solana ETFs, pointing out the SEC’s vague position on the condition of different crypto properties.

” We question. The choice by the SEC to authorize ETH ETFs is currently extended offered the uncertainty regarding whether Ethereum need to be identified as safety and security or otherwise. We do not believe the SEC would certainly go also additionally by accepting Solana or various other token ETFs offered the SEC has more powerful (about Ethereum) point of view that symbols outside bitcoin and Ethereum need to be identified as protections,” Panigirtzoglou stated.

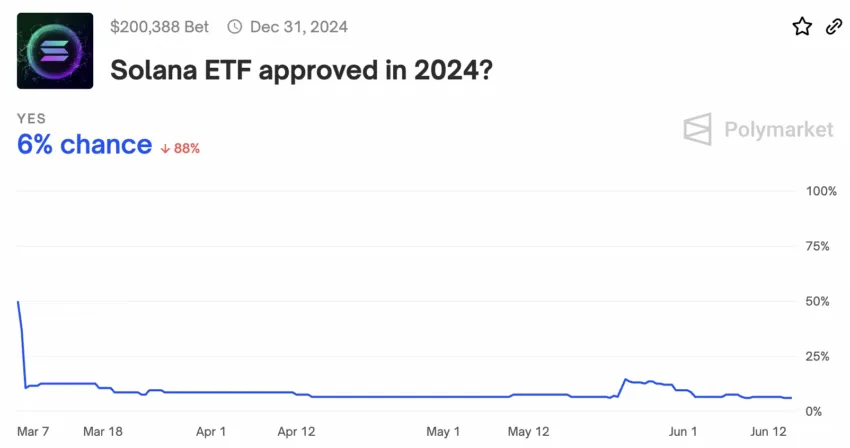

Betting on Polymarket, on the various other hand, forecasts just a 6% opportunity that the SEC will certainly authorize a Solana ETF by the end of 2024. At the same time, no significant United States companies have officially went after Solana ETF authorization with the SEC.

Existing Solana-based economic items in the United States consist of the GrayScale Solana Depend On and 21Shares’ Solana Betting ETP (ASOL), which is provided on European stock market.

” I believe that Solana is mosting likely to surpass Ethereum moving on. Thus far, I believe that has actually held true, yet I do not listen to any kind of broach a Solana ETF in the United States,” Anthony Pompliano, a financier at Splendor Investments, said.

While the authorization of Bitcoin and Ethereum ETFs has actually sustained supposition regarding a Solana-based ETF, considerable governing obstacles stay. However, the Solana area continues to be confident for a desirable result in the future.

Please Note

In adherence to the Depend on Job standards, BeInCrypto is dedicated to impartial, clear coverage. This newspaper article intends to supply precise, prompt details. Nonetheless, visitors are suggested to confirm realities separately and talk to an expert prior to making any kind of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.