Brand-new pure nicotine items have actually taken the USA by tornado in the last years. These consist of e-vapor tools (vapes) and pure nicotine bags. Standard cigarette business have actually spent and obtained startups in the room with blended success. Recently, the vaping field has actually been interrupted by non reusable tools, generally from international nations. Although these items are not accepted by the united state federal government and are practically prohibited, they have actually been taking a lots of market share, offering a headwind for proprietors of various other vaping brand names.

Currently, the united state federal government and police declare they will lastly punish shops marketing these prohibited non reusable vapes. What does that mean for the pure nicotine titan British American Cigarette ( NYSE: BTI) and its ultra-high returns producing near 10%? Allow’s take a more detailed look and learn.

Suppression on prohibited vaping tools

On Monday, June 10, the Federal Medication Management (FDA) and Division of Justice stated that they would certainly be dealing with several police in the USA to obtain prohibited vaping tools off retail racks. There have actually been statements from the federal government informing corner store to quit marketing these tools, yet offered just how lucrative they are, there has actually been marginal adjustment thus far. Currently, with possible enforcement activities ready to occur, you’ll likely see shops begin taking these tools off the racks.

This ought to profit British American Cigarette, which is among the only proprietors of accepted vaping tools in the USA with the Vuse brand name. Regardless of these headwinds, British American Cigarette’s vapor section expanded income by 27% in 2023 (it likewise markets these items worldwide). Include the reality that its largest rival to pure nicotine bags– Zyn– is encountering item lacks today, and British American Cigarette’s brand-new pure nicotine brand names are established to do well this year.

In 2014, these brand-new classifications incorporated to create $4.22 billion in income, utilizing today’s conversion from British extra pounds to united state bucks. Pure nicotine bag income expanded 39% in 2015, which demonstrates how encouraging this item classification is. Given that 2019, the whole brand-new pure nicotine items section has actually expanded income at a 28% yearly clip for the firm.

Currently, the section is lastly creating an earnings. In 2014, the section struck around break-even as its procedures scaled around the world. In the coming years, if income maintains expanding and revenue margins remain to broaden, the section can be doing near $10 billion in yearly income and several billions in running incomes. These are incomes that are not in British American Cigarette’s tracking operating incomes and price-to-earnings proportion (P/E).

The supply is economical, yet is the returns lasting?

Plainly, the suppression on prohibited vapes and present Zyn scarcity can aid British American Cigarette in 2024. Yet what concerning its tradition cigarette procedures?

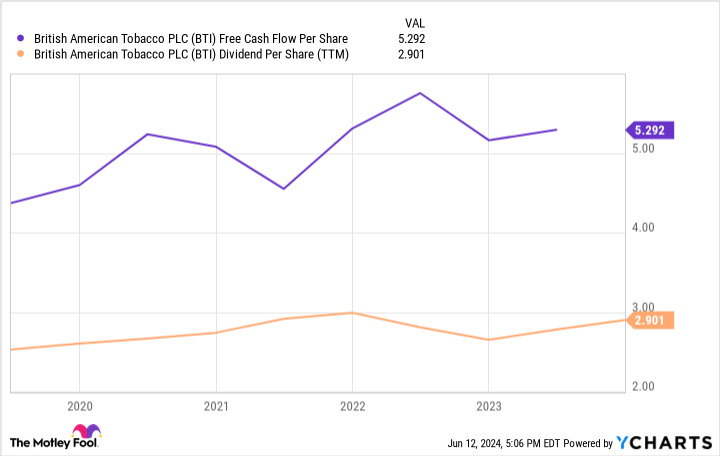

Quantities are decreasing rapidly, yet that is obtaining offseted with cost boosts on its cigarette brand names like Newport and Camel. Complimentary capital per share is in fact up 20% over the last 5 years, despite having no revenue payments from brand-new pure nicotine classifications. Over the last year, British American Cigarette has actually produced $5.30 in complimentary capital per share. This is considerably over its returns per share of $2.90, reducing any kind of problems that its 9.5% returns return will certainly obtain reduced anytime quickly.

Over the following 5 to one decade, complimentary capital per share ought to expand also if the cigarette organization has a hard time as the brand-new pure nicotine classifications lastly begin adding to complimentary capital. As a matter of fact, I assume it is most likely that British American Cigarette will certainly expand its returns per share considerably over the following one decade. Because of that, the supply resembles a fantastic purchase for income-focused capitalists at these rates.

Should you spend $1,000 in British American Cigarette today?

Prior to you acquire supply in British American Cigarette, consider this:

The Supply Expert expert group simply recognized what they think are the 10 best stocks for capitalists to acquire currently … and British American Cigarette had not been among them. The 10 supplies that made it can create beast returns in the coming years.

Think About when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $808,105! *

Supply Expert gives capitalists with an easy-to-follow plan for success, consisting of advice on developing a profile, routine updates from experts, and 2 brand-new supply choices every month. The Supply Expert solution has greater than quadrupled the return of S&P 500 given that 2002 *.

* Supply Expert returns since June 10, 2024

Brett Schafer has no placement in any one of the supplies stated. The suggests British American Cigarette P.l.c. and suggests the complying with choices: lengthy January 2026 $40 contact British American Cigarette and brief January 2026 $40 places on British American Cigarette. The has a disclosure policy.

Is This Huge News for This Ultra-High-Dividend Income Stock? was initially released by The

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.