In a world clouded by excessive valuations and tiny shareholder yields, Verizon Communications (NYSE:VZ) shines by way of with its 6.7% dividend yield. The corporate’s wi-fi tools income may quickly surge if customers determine to improve their iPhones. With capital expenditures anticipated to break down in 2024 and past, the inventory may proceed to rebound. Subsequently, I’m bullish on Verizon.

It looks like no person on Wall Avenue likes telecom shares. However if you’re bullish on AI, massive language fashions, the Metaverse, and cloud computing, why not be bullish on America’s reliance on connectivity and Verizon’s pricing energy?

Verizon’s Resilient Aggressive Place

Verizon’s aggressive place underpins its revenues. So, how does Verizon stack up towards the competitors? Let’s dive in.

To know the place Verizon’s going, let’s first take a look at the place it’s been. Going right into a world of 5G, Verizon had one of the best community in the US. With its main 4G protection, the corporate gained the J.D. Energy award for community high quality 31 occasions in a row. Verizon’s popularity for high quality meant it had the profitability to speculate closely in 5G, and it locked in very low rates of interest in 2021 to take action.

If we quick ahead to at present, Verizon has merely outspent opponents on its 5G community. It gained the J.D. Energy award once more for the thirty second time (with the least community issues throughout all areas), and it was awarded probably the most dependable 5G community by RootMetrics. Whereas T-Cell (NASDAQ:TMUS) has tried to promote customers on its main 5G protection (at 53.79%), that is usually low-band 5G in rural areas. Shoppers could barely discover the distinction between low band 5G and Verizon’s main 4G community (overlaying 70% of the US).

So, is having the main place in 4G protection and one of the best 5G reliability sufficient? Possibly not, however Verizon additionally has a aggressive benefit with its Extremely Wideband 5G and glued wi-fi entry. Verizon has deployed Extremely Wideband in main cities, and it’s apparently able to delivering 5G speeds which are 10 occasions sooner than different networks.

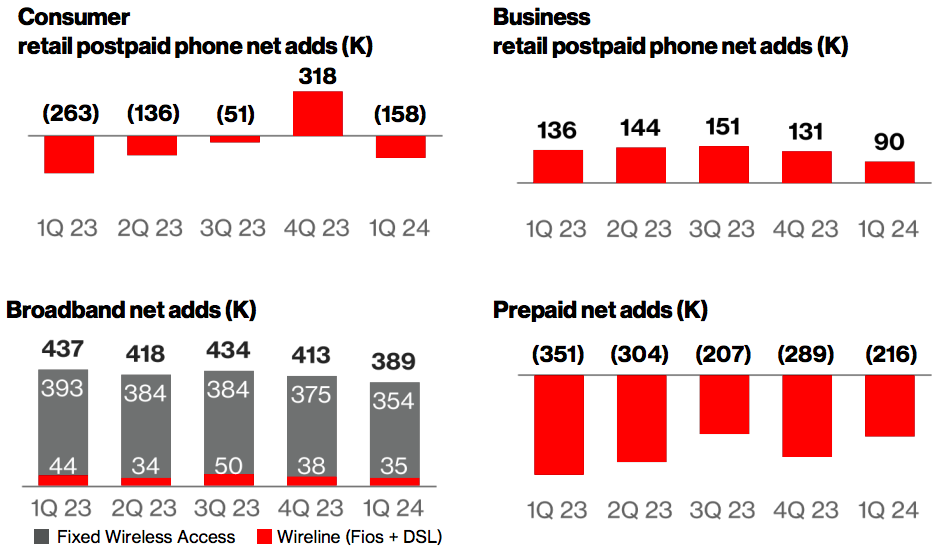

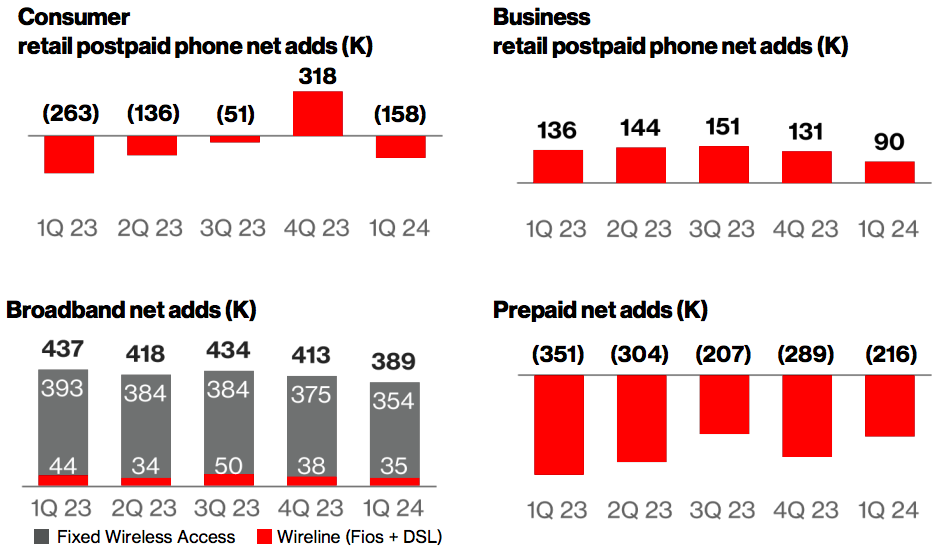

Lastly, in my view, the corporate has had the preeminent place in fastened wi-fi web, which is rising quickly. Simply take a look at Verizon’s fastened wi-fi entry provides beneath (in gray).

Additionally, discover that Verizon’s losses in pay as you go and postpaid cellphone internet provides are shrinking year-over-year. It appears to be like like Verizon has been growing its costs, leading to a few of its lower-margin, or to poke some enjoyable, “cheapskate” prospects, leaving. Nonetheless, what issues on the finish of the day is income, which results in profitability.

Income May Surge

I imagine Verizon’s income is about to move increased. In Q1 2024, Verizon’s whole wi-fi service income grew 3.2% year-over-year, supported by a powerful aggressive place. If we start to see a rebound in Verizon’s wi-fi tools revenues (the sale of smartphones, tablets, and different gadgets, which had been down final yr), Verizon could quickly return to respectable income development. I see Apple’s unveiling of exciting new AI features as a optimistic on this entrance. A rebound in gadget gross sales may drive Verizon’s backside line.

The Valuation

At a ahead P/E ratio of 8.9x, I imagine Verizon is just too low-cost. This provides VZ a ahead earnings yield of 11.2%, which greater than covers its ahead dividend yield of 6.7%.

I feel Verizon is enticing in comparison with the S&P 500 (SPX), which has a P/E ratio of 28x and extra cyclical earnings. Additionally, the S&P 500’s dividend yield is simply 1.31%.

Why Verizon Is Recession-Resistant

Verizon’s profitability might be affected by different components, however recessions usually haven’t been one among these components. Why is that this? Properly, web connection and wi-fi cellphone plans are important to most customers and companies. They’re one of many final issues individuals cease spending cash on when occasions get robust. Right here’s the proof: Verizon’s working money stream and working earnings grew through the Nice Monetary Disaster of 2008-09 and the COVID-19 meltdown of 2020.

Collapsing Capital Expenditures

I feel the funding case for Verizon is pretty easy. The corporate had to spend so much on its 5G community, which harm its steadiness sheet (to a manageable extent). This, together with rising rates of interest, despatched Verizon’s inventory tumbling. However that spending is now dwindling throughout the {industry}, and Verizon is starting to concentrate on its profitability. At such a low valuation, this could result in sturdy shareholder returns. The inventory’s P/E a number of may additionally re-rate increased as debt is paid down and/or rates of interest fall.

As capital expenditures collapse in 2024 and past, I imagine Verizon will report robust free money flows. Verizon stated, “We anticipate money necessities for our 2024 capital program to be between $17.0 billion and $17.5 billion.” That is down from $23.1 billion of CapEx in 2022 and $18.8 billion in 2023. Plus, I feel the dividend needs to be properly coated, leaving room for debt discount, which ought to increase e-book worth per share and earnings per share.

The Dangers

Competitors is Verizon’s main threat. Will the {industry} proceed to compete intensely for patrons? Will opponents attempt to outspend one another for market share beneficial properties (throwing profitability out the window)? I feel these are robust inquiries to reply. However to this point, so good. CTIA, American Tower (NYSE:AMT), and Wells Fargo (NYSE:WFC) mixed anticipate decrease {industry} CapEx in 2024 and 2025.

Traders also needs to keep watch over Verizon’s curiosity protection ratio (working earnings divided by internet curiosity expense), which is at the moment fairly robust, above 5x. Benjamin Graham, the famed investor who taught Warren Buffett, advisable an curiosity protection ratio of 4x or larger for secure firms.

Is VZ Inventory a Purchase, In response to Analysts?

At the moment, six out of 13 analysts overlaying VZ give it a Purchase score, seven fee it a Maintain, and 0 fee it a Promote, leading to a Average Purchase consensus score. The average VZ stock price target is $44.62, implying upside potential of 12.2%. Analyst worth targets vary from a low of $39 per share to a excessive of $52 per share.

The Takeaway

I’m bullish on Verizon and imagine it’s one of many prime worth shares within the S&P 500. Verizon’s industry-leading 5G reliability, 4G protection, Extremely Wideband speeds, and glued wi-fi web make it a best-in-class operator. The corporate’s tools revenues may quickly rebound alongside its wi-fi service income. I see rising revenues and collapsing capital expenditures as a bullish setup for Verizon at a ahead P/E of 8.9x.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.