On the BTC Prague convention in the present day, Michael Saylor, government chairman of MicroStrategy, captivated attendees with a keynote handle the place he predicted a meteoric rise within the Bitcoin worth, suggesting it might attain as a lot as $8 million per coin. This assertion was a part of his broader presentation on the “21 Guidelines of HODLing Bitcoin,” which outlines methods for managing and sustaining investments in a extremely unstable atmosphere.

Throughout his speech, Saylor articulated a philosophical and strategic framework for understanding and investing in BTC. He positioned the cryptocurrency not simply as a monetary asset however as a revolutionary device able to reshaping world monetary paradigms, as summarized by Luke Broyles by way of X.

Understanding And Investing In Bitcoin

#1 “Those that perceive purchase Bitcoin, those that don’t criticize Bitcoin,” Saylor declared, setting the tone for his discourse on the dichotomy between skeptics and proponents. He argued that recognizing BTC’s potential is akin to seeing a paradigm shift earlier than it absolutely unfolds.

#2 Reflecting on his preliminary dismissive stance in 2013, Saylor recounted how his view developed as BTC’s resilience and potential turned more and more evident. His private journey from skepticism to advocacy underscores a typical path amongst buyers who usually transition from doubt to robust assist.

#3 You’ll by no means be finished studying about Bitcoin,” Saylor acknowledged, emphasizing the complexity and ever-evolving nature of the cryptocurrency. He recommended that BTC’s intersection with world economics, expertise, and regulatory frameworks makes it a perpetually related topic for research.

#4 Drawing historic parallels, Saylor highlighted moments of serious upheaval, akin to WWII and the rise of communism in Europe, for instance BTC’s worth as a non-geopolitical, secure retailer of wealth. “Purchase BTC as a result of entropy is assured,” he asserted, suggesting that Bitcoin gives a secure haven in instances of dysfunction.

#5 In keeping with Saylor, BTC presents an equitable alternative in distinction to conventional monetary programs, which he views as inherently skewed towards the typical particular person. “Bitcoin is the one sport within the on line casino that we will all win,” he famous, framing it as a uniquely truthful and clear monetary instrument.

#6 He suggested taking a proactive strategy to funding, saying, “Bitcoin gained’t defend you for those who don’t put on the armor.” This analogy was used to encourage substantial, considerate funding in Bitcoin to safeguard one’s monetary future.

#7 Saylor passionately argued that Bitcoin permits a type of possession unmediated by any third get together: “Your cryptographic keys in your head are your wealth.” This, he claimed, is a radical shift from the best way property have been managed and guarded all through historical past.

#8 Reflecting on the volatility and development trajectory, Saylor shared a private anecdote on how he dismissed BTC at $892 to solely deserve shopping for it at $9,500 for the primary time. “Everybody will get Bitcoin on the worth they deserve,” he remarked. “He then stated when Bitcoin is $950,000 folks will attempt to anticipate it to crash to $700,000. Then BTC would go to $8,000,000,” Broyles reiterated.

“All people will get bitcoin on the worth they deserve!” @saylor on the #BTCPrague Principal Stage in certainly one of his 21 Guidelines of #Bitcoin

Subscribe to our YT channel to get the complete keynote quickly! pic.twitter.com/2deKKAvG5Q

— BTC Prague (@BTCPrague) June 14, 2024

#9 Saylor suggested solely investing cash that one can afford to lose, highlighting the conservative strategy to adopting new monetary applied sciences. This rule underscores the stability between visionary funding and monetary prudence.

#10 Describing fiat currencies and conventional financial indicators as “the matrix,” Saylor championed Bitcoin as a method to transcend standard monetary programs. He sees it as not only a expertise however a liberation from the restrictive narratives imposed by conventional financial buildings.

#11 Saylor shared insights from private experiences the place Bitcoin’s influence on his firm’s monetary stability was profound. “With out BTC, MSTR would have failed,” he disclosed, illustrating the direct influence of strategic Bitcoin investments on company finance.

#12 Saylor projected a conservative 24% compound annual development charge (CAGR) over the subsequent decade, setting a possible valuation benchmark and underscoring his confidence in BTC’s sustained development. Notably, this could worth BTC at $600,000 by 2034.

#13 Saylor described the present financial system as flawed, seeing BTC as a treatment for these inherent points. “The treatment to financial sickness is the orange tablet,” he stated, selling it as a revolutionary expertise that provides a radical replace to outdated financial practices.

#14 Quite than attacking the fading fiat system, Saylor urged for a optimistic strategy: “Be for Bitcoin, not towards fiat,” emphasizing the significance of constructing a brand new system relatively than destructively opposing the outdated.

#15 In keeping with Saylor, “Bitcoin is for everyone.” He projected that digital capital like BTC might ultimately characterize half of all worth in a future, yet-to-be-imagined world economic system, which might considerably drive up its worth.

#16 “Study to suppose in Bitcoin,” Saylor suggested, encouraging a shift in perspective to view future applied sciences and paradigms via the lens of BTC, relatively than attempting to suit new improvements into outdated frameworks.

#17 “You don’t change Bitcoin, it modifications you.” Saylor highlighted how BTC challenges people to rethink their strategy to cash, worth, and funding on a worldwide scale.

#18 “Laser eyes defend you from limitless lies.” Saylor underscored the significance of sustaining deal with the long-term potential, particularly when its market worth reaches landmarks like $100,000 or $1 million. He envisioned a future the place BTC’s market cap might escalate to between $100 trillion and $500 trillion.

#19 He cautioned, “Respect Bitcoin or it would make a clown of you.” This rule was a warning towards underestimating BTC’s influence and the foolishness of mocking an rising monetary expertise that has substantial backing and confirmed resilience.

#20 “You don’t promote your Bitcoin.” Saylor likened promoting BTC to self-sabotage, suggesting that it’s a foundational asset for long-term monetary safety, very similar to a life raft in an ocean or a hearth in winter.

#21 Lastly, Saylor concluded with, “Unfold Bitcoin with love.” He harassed the significance of persistence and kindness in selling BTC, particularly in the direction of those that are initially important or dismissive of its advantages.

By way of these 21 guidelines, Saylor supplied a blueprint for not solely understanding and investing in BTC but in addition for collaborating in a broader motion that would redefine the worldwide financial order.

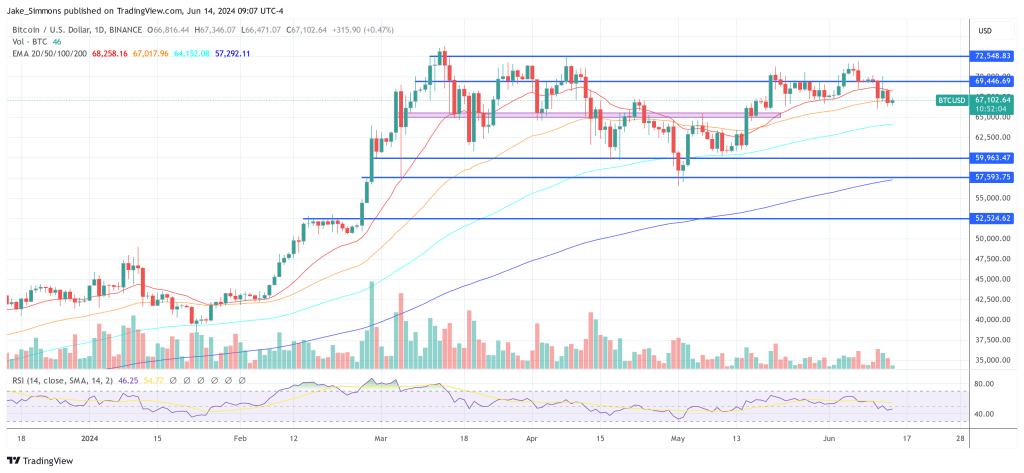

At press time, BTC traded at $67,102.

Featured picture from Forbes, chart from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.