On-chain knowledge exhibits that Bitcoin and Ethereum trade provides have gone reverse methods not too long ago, an indication {that a} rotation could also be on.

Bitcoin’s Trade Provide Has Gone Down Whereas Ethereum’s Has Risen

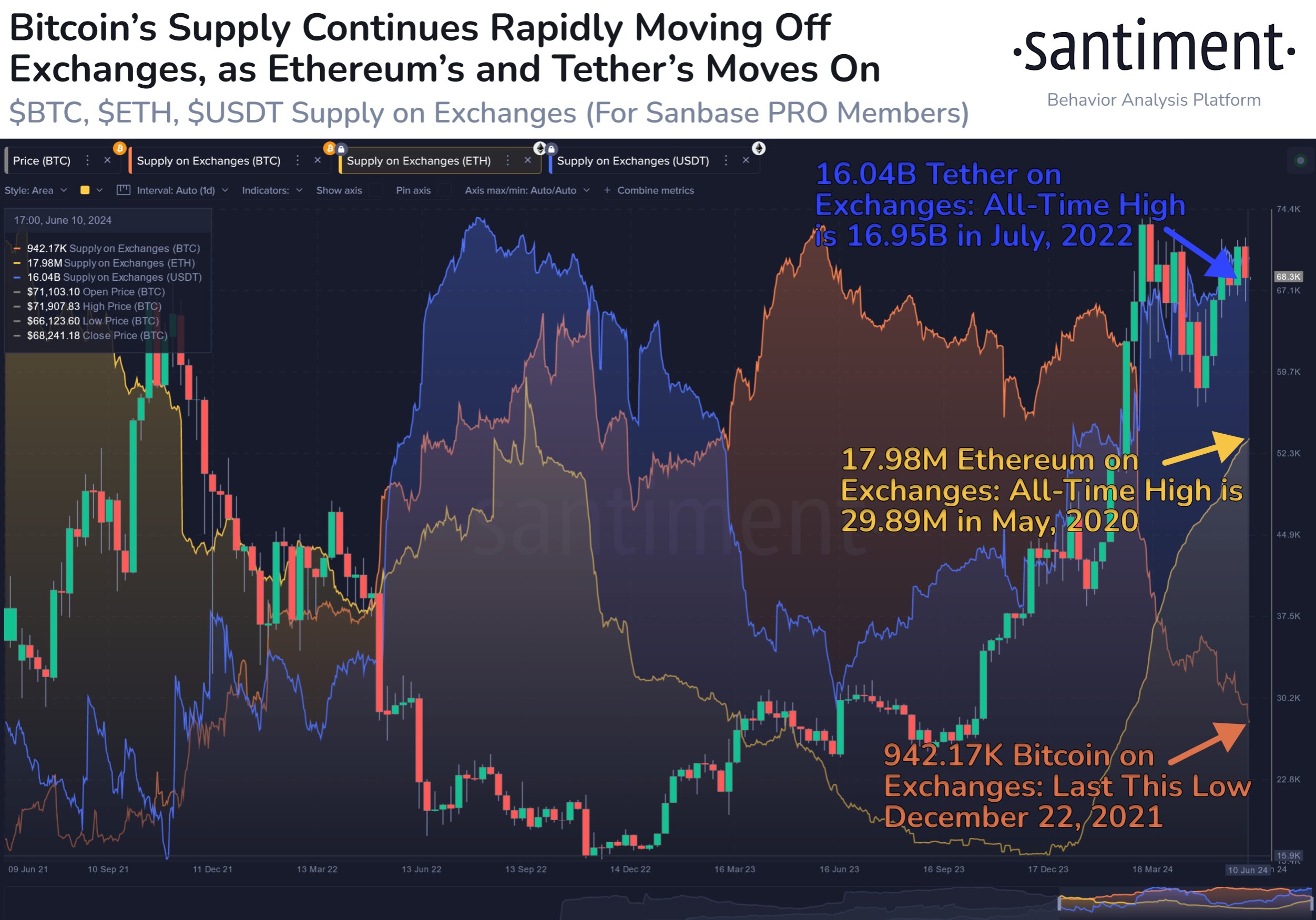

Based on knowledge from the on-chain analytics agency Santiment, the Provide on Exchanges metric has dropped to the bottom stage since December 2021 for Bitcoin not too long ago.

The “Provide on Exchanges” retains observe of the overall quantity of a cryptocurrency’s provide within the wallets related to all centralized exchanges.

When the worth of this metric rises, it means the traders are making deposits of the asset to those platforms proper now. Holders switch their tokens to the exchanges at any time when they need to use one of many companies they supply, which may embody buying and selling.

Then again, a decline within the indicator means that traders are at the moment taking cash off the exchanges and doubtlessly holding onto them for prolonged intervals.

Now, here’s a chart that exhibits the pattern within the Provide on Exchanges for the highest three cash within the sector by market cap: Bitcoin (BTC), Ethereum (ETH), and Tether (USDT).

The worth of the metric seems to have been shifting oppositely for BTC than the opposite two | Supply: Santiment on X

As displayed within the above graph, the availability of Bitcoin exchanges has sharply declined over the previous couple of months. The metric’s worth now stands at 942,170 BTC, the bottom the cryptocurrency has noticed since December 2021.

Concurrently these BTC withdrawals have come, Ethereum and Tether have seen web deposits as a substitute. As talked about, deposits can signify that traders might need to commerce away the asset.

As such, given the other pattern going down in Bitcoin, it will seem potential that traders have been making the ETH and USDT inflows rotate into the unique cryptocurrency.

Following these deposits, the availability on exchanges reached 17.98 million ETH for Ethereum and 16.04 billion USDT for Tether. Naturally, this rotation of capital, if one is actually underway, could be a bearish signal for ETH, because it exhibits traders are wanting on the asset as being too dangerous proper now.

USDT, being a stablecoin with its worth tied to the US greenback, wouldn’t be affected by these trade inflows. As an alternative, USDT trade inflows are typically constructive for the market as a complete, as they recommend some traders who had tied up their capital on this secure asset are able to deploy it elsewhere.

Regardless of this bullish growth Bitcoin has seen not too long ago when it comes to its trade provide, its value has solely been consolidating sideways over the previous few months.

BTC Value

On the time of writing, Bitcoin is floating round $67,900, down nearly 5% over the previous seven days.

Seems like the value of the asset has been shifting sideways not too long ago | Supply: BTCUSD on TradingView

Featured picture from Dall-E, Santiment.web, chart from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.