The largest information of the week wasn’t earnings — it was a lower-than-expected studying of inflation. In accordance with the Bureau of Labor Statistics, shopper costs rose 3.3% from a yr in the past in Could, however that was down from 3.4% in April and was under expectations.

Hypothesis ran rampant the Federal Reserve would minimize rates of interest on account of decrease inflation to stimulate the financial system and stave off what may change into a deflationary surroundings in some elements of the financial system. Price cuts have not occurred but, however these market indicators elevated the percentages they’ll occur this yr.

In accordance with information offered by S&P Global Market Intelligence, shares of Zillow (NASDAQ: ZG) jumped as a lot as 14% on the inflation information, Nextdoor (NYSE: KIND) jumped 17.2%, and Sunnova Vitality (NYSE: NOVA) rose 12.7% at its peak. The shares closed the week up 12%, 14.5%, and eight.6% respectively.

Will housing make a comeback?

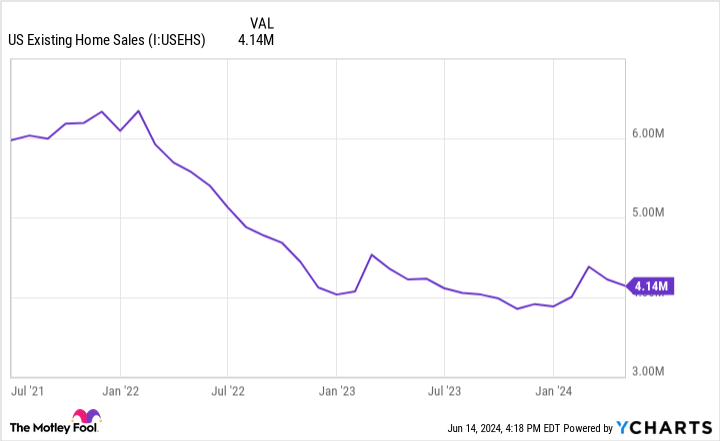

All three shares are in the end depending on the housing market, which has been in a funk for many of the final yr. Greater rates of interest make it tougher to afford houses and finance photo voltaic tasks. The affect on all three corporations is oblique however clear.

Whereas the short-term hypothesis is that charges will come down, we have not seen a giant transfer in that course. The 1-year Treasury yield dropped barely this week, and there are indicators mortgage charges are beginning to come down, however that may take time.

The affect of decrease charges

Charges are vital for homebuyers as a result of decrease ones make month-to-month funds extra reasonably priced. And extra quantity by means of the actual property system is in the end how Zillow makes its cash.

Sunnova is extra immediately impacted as a result of it strains up financing for photo voltaic tasks, and clients can merely select to not set up photo voltaic if the numbers do not make sense. Greater charges led to an enormous decline in photo voltaic installations in 2023, and any reprieve could be welcome.

Nextdoor’s huge transfer

The explanation Nextdoor is up could also be slightly extra puzzling. Shares dropped sharply late final week, and this week its CEO was named CFO of OpenAI.

I additionally assume traders are in search of any purpose to bid up an organization that is been dropping cash like loopy since coming public. Will decrease charges assist? Most likely not, but it surely’s high-risk, money-losing shares that usually react first when charges fall.

Quick-term strikes and long-term affect

I do not assume any of those strikes had been notably significant to the long-term trajectory of those corporations. Decrease rates of interest may ultimately assist revive the housing market and drive extra photo voltaic installations, however one inflation studying is not sufficient to trigger a turnaround.

An actual restoration in these companies will take years, and if that is the type of time-frame you’ve got, this generally is a good shopping for alternative. However the short-term transfer is noise and is not what long-term traders needs to be targeted on. I will await extra earnings progress to be a purchaser, particularly within the solar restoration anticipated in 2024.

Must you make investments $1,000 in Zillow Group proper now?

Before you purchase inventory in Zillow Group, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Zillow Group wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $794,196!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

Travis Hoium has positions in Zillow Group. The Motley Idiot has positions in and recommends Nextdoor and Zillow Group. The Motley Idiot has a disclosure policy.

Falling Interest Rates Sent These 3 Stocks Up Big This Week was initially printed by The Motley Idiot

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.