The crypto market braces for volatility as roughly $2.06 billion in Bitcoin (BTC) and Ethereum (ETH) choices will expire at this time.

How will the expiring choices influence the market dynamics, with notable knowledge factors highlighting the numerous stakes concerned?

Key Insights on Immediately’s Bitcoin and Ethereum Choices Expiration

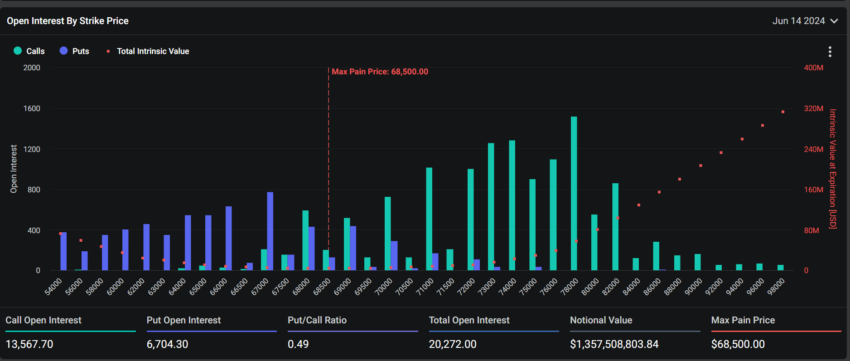

Roughly 20,276 Bitcoin choices contracts are set to run out at this time. These contracts have a notional worth of $1.35 billion, with a put-to-call ratio of 0.49. Within the context of crypto choices buying and selling, this ratio suggests a prevalence of buy choices (calls) over gross sales choices (places).

Learn extra: An Introduction to Crypto Choices Buying and selling

These expiring Bitcoin choices have a most ache level of $68,500. This represents the worth degree the place the best monetary losses will likely be skilled by possibility holders, marking important thresholds for market individuals.

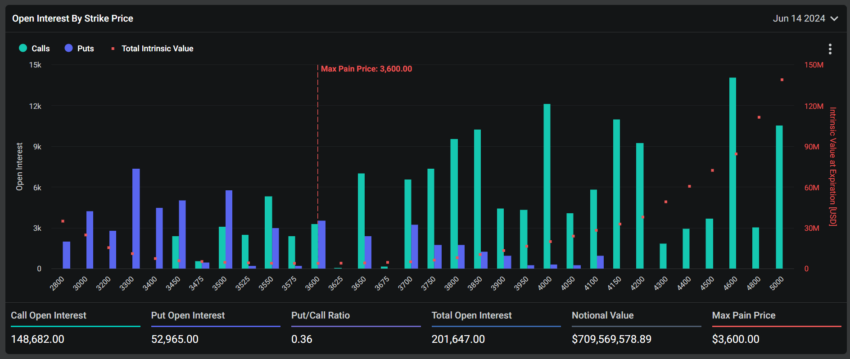

Moreover, 201,647 Ethereum contracts will expire on the similar time. In line with Deribit’s knowledge, the notional worth of those contracts is $709.76 million, with a most ache level of $3,600. The info additional exhibits that the put-to-call ratio for these choices is 0.36.

Adam, a macro researcher at choices buying and selling device Greeks.Reside, shared insights on at this time’s expiring Bitcoin and Ethereum contracts. He emphasised the week’s macroeconomic significance.

“This week is a giant week for macroeconomics. Financial knowledge is comparatively favorable to the enterprise capital market. The US inventory market has risen considerably, however the crypto market has carried out poorly. Mainstream cash have fallen total, and altcoins have fallen much more. There are fewer sizzling spots available in the market not too long ago, and the market is comparatively quiet,” he famous.

He additional defined the volatility and the potential strategic strikes for merchants.

“Presently, the foremost medium- and short-term implied volatilities of BTC are all under 50%, and the foremost medium- and short-term [implied volatilities] IVs of ETH are all under 60%. Each have fallen to comparatively low ranges, offering patrons with a excessive cost-effectiveness ratio. There must be new information on the approval of [spot] ETH [exchange-traded fund] ETF on the finish of this month, so you’ll be able to plan for subsequent month’s name choices prematurely,” Adam advised.

Bitcoin and Ethereum have confronted value declines main as much as this expiration. Bitcoin, which traded at $71,643 on June 7, briefly dipped to $66,254 on June 11 earlier than recovering to $69,945 on June 12.

Presently, Bitcoin trades at $67,064, reflecting a 6% drop over the previous week. In the meantime, Ethereum is buying and selling at $3,519, marking a 7.8% lower.

Learn extra: 9 Finest Crypto Choices Buying and selling Platforms

Whereas choices expirations may cause non permanent market disruptions, they’re typically adopted by stabilization. Merchants ought to stay vigilant, analyzing technical indicators and market sentiment to navigate the anticipated volatility successfully.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.