This week, the crypto market was turbulent. Occasions resembling Andrew Tate’s controversial meme cash, Ripple’s large-scale asset gross sales, and hedge funds betting in opposition to Bitcoin prompted excessive volatility.

Furthermore, the macroeconomic information, such because the US Federal Reserve conserving the rates of interest unchanged, additionally contributed to the market dynamics.

Andrew Tate’s Meme Coin Sparks Market Frenzy

This week, the controversial social media influencer Andrew Tate has created vital buzz within the crypto market. He has been actively selling numerous tokens throughout the Solana ecosystem, inflicting substantial market actions.

The Actual Nigger Tate (RNT) coin, following his promotion, skyrocketed to a market capitalization of over $18 million. Moreover, Tate acquired a big portion of one other token, TOPG, which he then burned. This motion has led to numerous responses from the crypto neighborhood, starting from admiration to concern about potential market manipulation.

Learn extra: 7 Sizzling Meme Cash and Altcoins which might be Trending in 2024

Amid these developments, Tate additionally backed the DADDY meme coin, vowing to burn $100 million price of crypto throughout a reside stream. His provocative strategy continued as he positioned DADDY in direct opposition to a different meme coin known as MOTHER, promoted by musician Iggy Azalea.

“I heard a couple of coin known as MOTHER, so now I’m supporting a coin known as DADDY to flip it for the patriarchy,” Tate said.

Nevertheless, blockchain analytics from Bubblemaps highlighted suspicious insider actions earlier than Tate’s promotion, revealing that insiders had acquired 30% of DADDY’s provide, doubtlessly artificially inflating the worth.

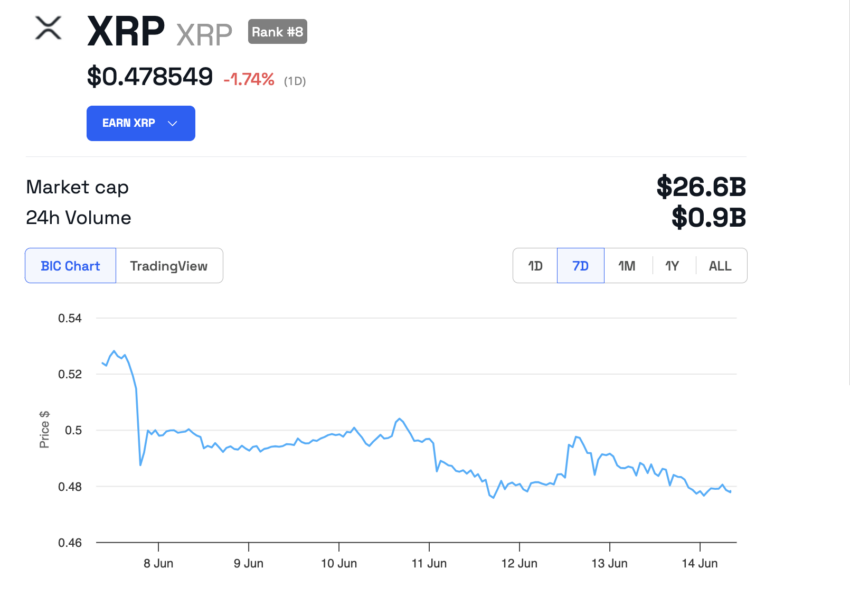

Ripple’s Strategic XRP Gross sales

Ripple lately bought 150 million XRP tokens, valued at $78 million. These gross sales are half of a bigger technique that features setting apart 400 million XRP for future gross sales.

The magnitude of those gross sales highlights Ripple’s vital affect on the XRP market and raises questions concerning future value tendencies. Furthermore, final week, Ripple transferred practically $1.5 billion in XRP tokens from its escrow pockets.

The transactions have drawn consideration as a result of their potential impression on the XRP market value, which has declined by 8% over the previous week. Nevertheless, prior to now 24 hours, the worth has displayed comparatively lesser volatility, down by simply 1.74%.

Learn extra: Ripple (XRP) Value Prediction 2024/2025/2030

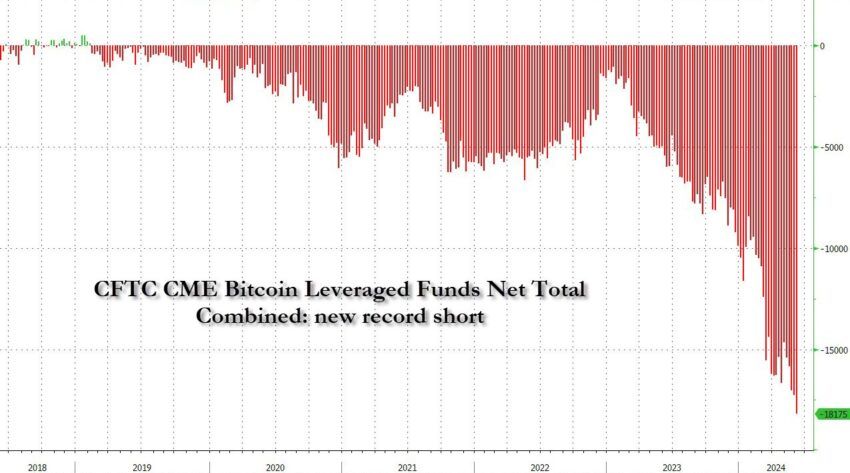

Hedge Funds Enhance Quick Positions on Bitcoin

Furthermore, this week has witnessed a exceptional enhance in hedge funds’ quick positions on Bitcoin. Knowledge from the Chicago Mercantile Alternate (CME) Group’s Commitments of Merchants report exhibits these positions have hit a report excessive.

This implies a bearish stance on Bitcoin amongst institutional traders. Because of this, Bitcoin’s value has fallen by practically 6% this week, including to the speculative nature of the market.

Learn extra: The right way to Quick Bitcoin: A Step-by-Step Information

Furthermore, this week, there have been web outflows from the spot Bitcoin ETFs. They recorded a web outflow of $390.7 million, following a 19-day streak of inflows into Bitcoin ETFs.

| Date | IBIT | FBTC | BITB | ARKB | BTCO | EZBC | BRRR | HODL | BTCW | GBTC | DEFI | Whole |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| June 10, 2024 | 6.3 | -3.0 | 7.6 | 0.0 | -20.5 | 0.0 | -15.8 | 0.0 | 0.0 | -39.5 | 0.0 | -64.9 |

| June 11, 2024 | 0.0 | -7.4 | -11.7 | -56.5 | 0.0 | 0.0 | 0.0 | -3.8 | 0.0 | -121.0 | 0.0 | -200.4 |

| June 12, 2024 | 15.6 | 50.6 | 14.5 | 8.5 | 0.0 | 0.0 | 0.0 | 11.6 | 0.0 | 0.0 | 0.0 | 100.8 |

| 13 Jun 2024 | 18.2 | -106.4 | -9.8 | -52.7 | -2.7 | 0.0 | 0.0 | -11.3 | 0.0 | -61.5 | 0.0 | -226.2 |

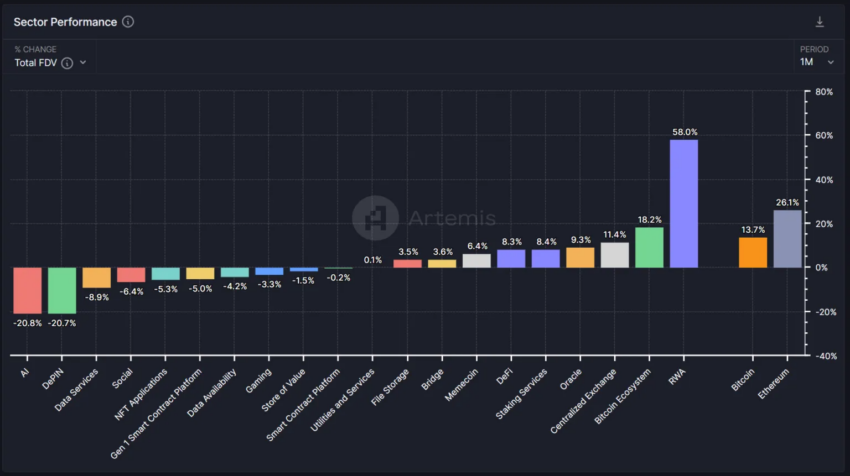

Actual-World Asset Sector Leads Efficiency

Moreover, the tokenization of real-world property (RWAs) has emerged because the highest-performing crypto sector. Based on information from Artemis Terminal, RWA has achieved a efficiency enhance of 58%, surpassing property like Ethereum and Bitcoin.

Furthermore, there was progress in tokenization tasks and constructive regulatory discussions, highlighting the sector’s increasing significance in monetary markets.

Learn extra: How To Put money into Actual-World Crypto Property (RWA)?

Crypto Consultants Spotlight Altcoin Alternatives

Distinguished crypto figures Arthur Hayes and Raoul Pal have supplied their views on promising altcoins. Hayes is optimistic concerning the prospects of Ethena and Ether.Fi, noting their potential to disrupt incumbents like Tether and Circle.

Hayes additionally believes that Aptos may quickly lead the Layer-1 blockchain sector. Then again, Pal emphasizes the necessity for strategic funding choices, advising in opposition to clinging to outdated market narratives. He continues to help Solana, which he considers a smart funding selection all through the market cycles.

“Maintain on to your cash, however don’t [screw] it up by proudly owning the unsuitable stuff. You [don’t want to] miss out on the complete rally, which I’ve seen [because] you’re nonetheless caught within the final narrative from three cycles in the past,” Pal defined.

Learn extra: Which Are the Best Altcoins To Invest in June 2024?

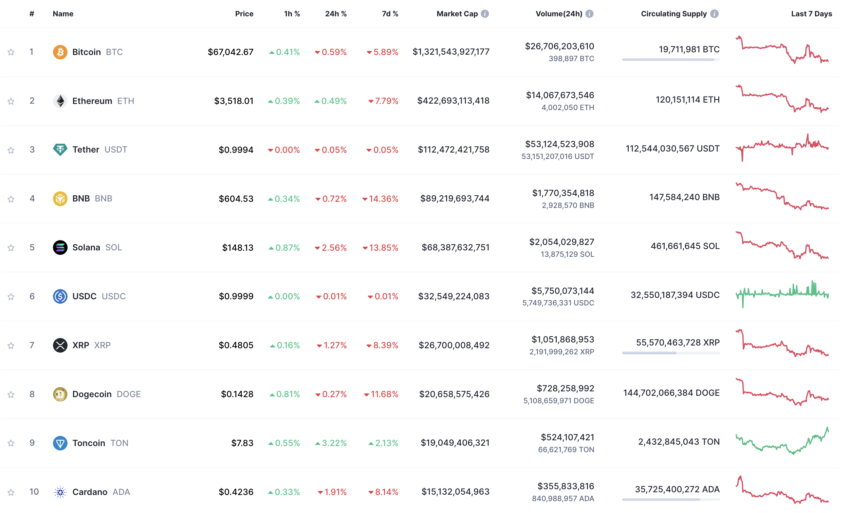

This Week’s Crypto Top 10

The crypto market has experienced volatility this week, with most major assets declining. Bitcoin and Ethereum have dropped by 5.89% and 7.79%, respectively.

Following a latest excessive, BNB has suffered a 14.36% correction, and Solana’s worth has decreased by 13.85%. In the meantime, XRP and Dogecoin have additionally confronted downturns. Quite the opposite, Toncoin has managed a modest enhance, underscoring its diverse efficiency throughout totally different crypto property.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.