On June 13, crypto-focused enterprise capital agency Paradigm introduced the profitable elevating of $850 million for its third fund.

This fund targets early-stage tasks, reflecting Paradigm’s continued perception within the crypto trade’s transformative potential.

Paradigm’s Newest Fund: A Rebound within the Crypto Market

Paradigm emphasised its perception within the vital technical and financial shift that crypto represents, which has grown stronger over the previous six years. They pointed to Bitcoin’s monetization to over $1 trillion and the scaling of blockchains like Ethereum and Solana. Furthermore, they famous the worldwide adoption of stablecoins.

Moreover, the agency additionally highlighted the fast progress in frontier analysis and the emergence of latest infrastructure enabling shopper functions. It famous that a whole bunch of hundreds of thousands of individuals now personal crypto, making this phase a key participant on the worldwide political stage.

Learn extra: How To Fund Innovation: A Information to Web3 Grants

Bloomberg reported that discussions about Paradigm’s third fund have been circulating since April. At the moment, Paradigm reportedly mentioned with buyers the prospects of elevating between $750 million and $850 million. This improvement signifies a rebound within the crypto market, positioning Paradigm’s fund as one of many largest for the reason that crypto market’s earlier downturn.

Matt Huang, co-founder of Paradigm, acknowledged that accelerating a constructive future for crypto is extra essential than ever. He emphasised Paradigm’s position not simply as buyers however as builders.

“Over the previous few years, we’ve launched a number of open-source tasks, together with Foundry, a well-liked Ethereum improvement device, and Reth, a high-performance Ethereum execution node, with the objective of pushing the crypto frontier ahead. We’re excited to dedicate vital effort to such tasks over the approaching years,” Huang outlined.

Along with Paradigm, different enterprise capital giants like Galaxy Digital have additionally introduced vital funds for the crypto trade this yr. In April, Galaxy Digital unveiled a brand new $100 million fund named Galaxy Ventures Fund I, LP. This fund goals to again as much as 30 promising early-stage crypto startups inside the subsequent three years.

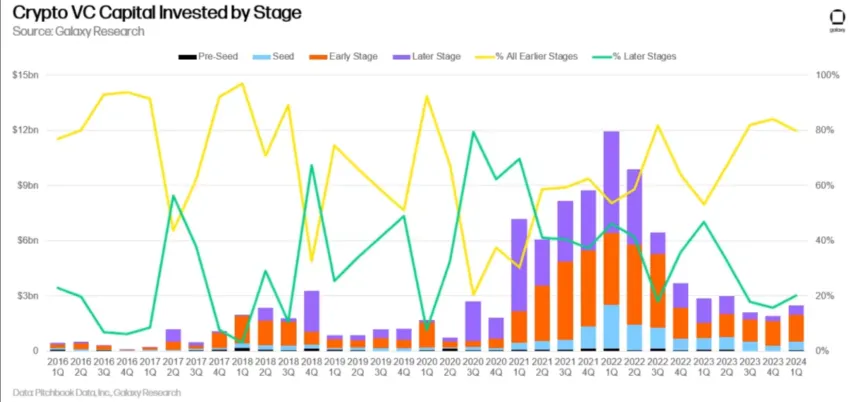

Paradigm’s newest transfer aligns with the broader pattern amongst enterprise capitalists. A latest report from Galaxy Digital Analysis revealed that in Q1 2024, about 80% of the capital went to early-stage corporations. In the meantime, the remaining 20% went to later-stage corporations.

Learn extra: Crypto Hedge Funds: What Are They and How Do They Work?

The report famous that crypto-focused early-stage enterprise funds have remained lively, with many nonetheless sitting on dry powder from their 2021 and 2022 fundraises. This enables compelling early-stage companies to nonetheless supply funding.

Nevertheless, many massive generalist enterprise capital companies have exited the sector or dramatically diminished their publicity. This has made it harder for later-stage startups to lift funds. Moreover, on the deal facet, the share of pre-seed offers elevated modestly in Q1, suggesting some development in newly based startups.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.