Earnings outcomes usually point out what course an organization will take within the months forward. With Q1 now behind us, let’s take a look at Yum China (NYSE:YUMC) and its friends.

Conventional fast-food eating places are famend for his or her pace and comfort, boasting menus crammed with acquainted and budget-friendly objects. Their reputations for on-the-go consumption make them favored locations for people and households needing a fast meal. This class of eating places, nonetheless, is combating the notion that their meals are unhealthy and made with inferior substances, a battle that is particularly related in the present day given the shoppers growing concentrate on well being and wellness.

The 14 conventional quick meals shares we observe reported an honest Q1; on common, revenues have been in step with analyst consensus estimates. Shares, particularly progress shares the place money flows additional sooner or later are extra essential to the story, had finish of 2023. However the starting of 2024 has seen extra risky inventory efficiency on account of combined inflation knowledge, and whereas a few of the conventional quick meals shares have fared considerably higher than others, they collectively declined, with share costs falling 2.2% on common because the earlier earnings outcomes.

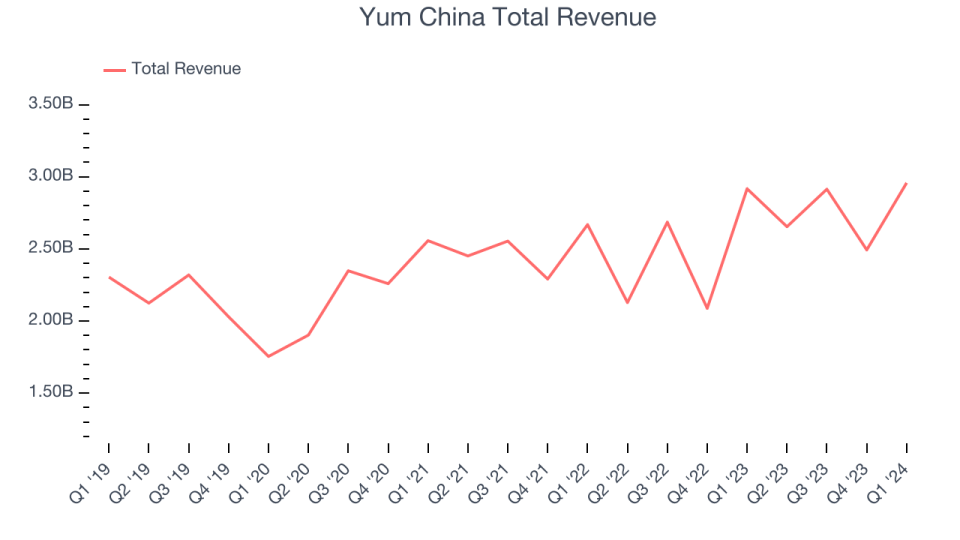

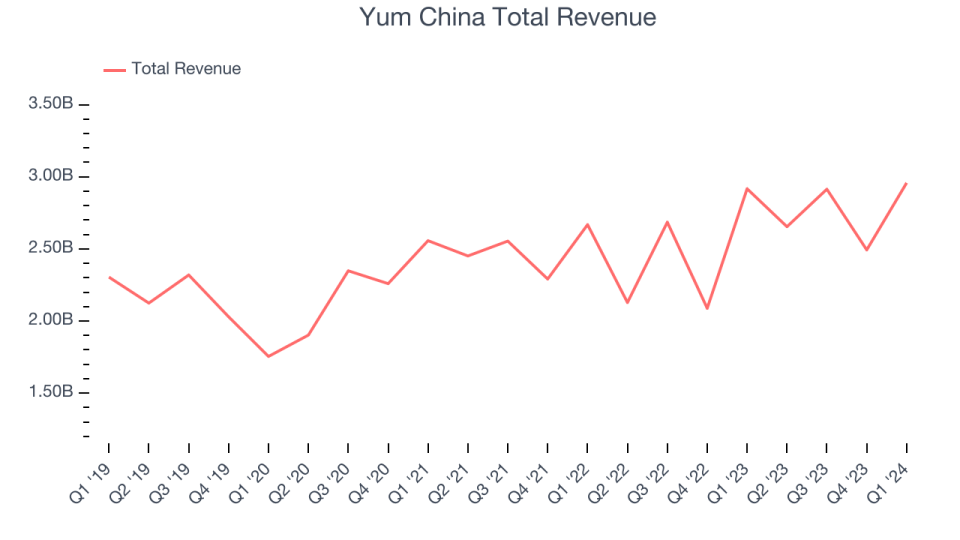

Yum China (NYSE:YUMC)

One in all China’s largest restaurant firms, Yum China (NYSE:YUMC) is an impartial entity spun off from Yum! Manufacturers in 2016.

Yum China reported revenues of $2.96 billion, up 1.4% yr on yr, falling wanting analysts’ expectations by 3.2%. It was a combined quarter for the corporate, with a powerful beat of analysts’ gross margin estimates. Alternatively, its identical retailer gross sales missed and led to income beneath expectations.

Joey Wat, CEO of Yum China, commented, “We achieved stable gross sales progress within the first quarter with whole revenues hitting an all-time excessive. Our core working revenue grew modestly from final yr’s excessive base and EPS was up double digits excluding international forex. In the meantime, we’re marching ahead with our growth initiatives in a disciplined method, bringing our whole retailer rely to a milestone of 15,000 shops.”

The inventory is down 12.7% because the outcomes and at the moment trades at $34.94.

Is now the time to purchase Yum China? Access our full analysis of the earnings results here, it’s free.

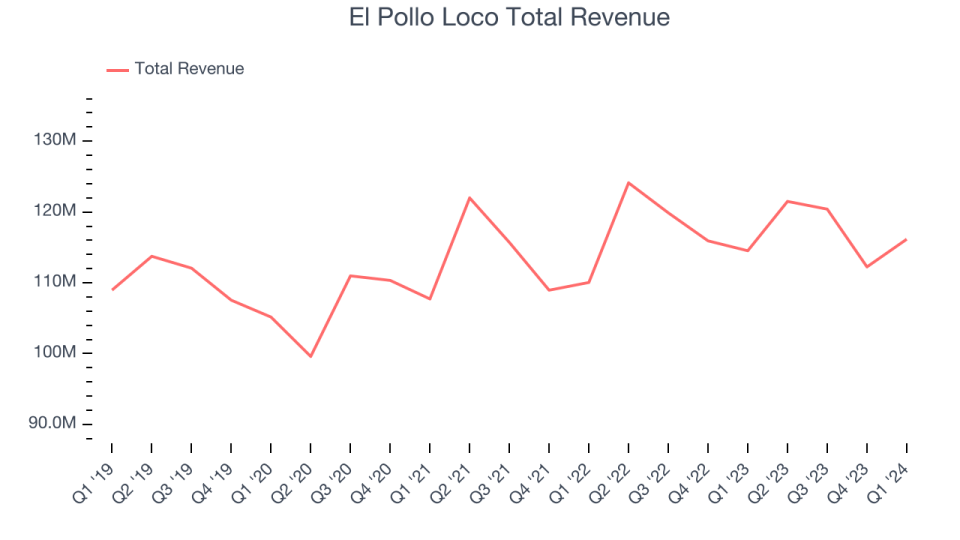

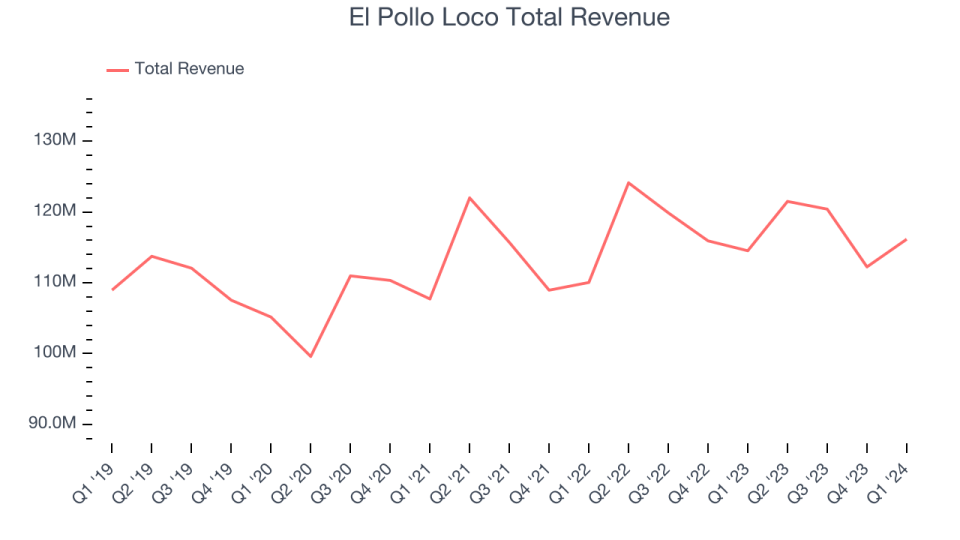

Finest Q1: El Pollo Loco (NASDAQ:LOCO)

With a reputation that interprets into ‘The Loopy Hen’, El Pollo Loco (NASDAQ:LOCO) is a quick meals chain identified for its citrus-marinated, fire-grilled hen recipe that hails from the coastal city of Sinaloa, Mexico.

El Pollo Loco reported revenues of $116.2 million, up 1.4% yr on yr, outperforming analysts’ expectations by 4.6%. It was an unbelievable quarter for the corporate, with a powerful beat of analysts’ earnings and gross margin estimates.

The inventory is up 23.7% because the outcomes and at the moment trades at $10.63.

Is now the time to purchase El Pollo Loco? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Starbucks (NASDAQ:SBUX)

Began by three associates in Seattle’s historic Pike Place Market, Starbucks (NASDAQ:SBUX) is a globally-renowned coffeehouse chain that provides a wide array of high-quality espresso, drinks, and meals objects.

Starbucks reported revenues of $8.56 billion, down 1.8% yr on yr, falling wanting analysts’ expectations by 6.5%. It was a weak quarter for the corporate, with a miss of analysts’ gross margin and earnings estimates.

The inventory is down 10.3% because the outcomes and at the moment trades at $79.38.

Read our full analysis of Starbucks’s results here.

Dutch Bros (NYSE:BROS)

Began in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE:BROS) is a dynamic espresso chain that’s captured the hearts of espresso lovers throughout america.

Dutch Bros reported revenues of $275.1 million, up 39.5% yr on yr, surpassing analysts’ expectations by 7.6%. It was an excellent quarter for the corporate, with a powerful beat of analysts’ earnings estimates and a stable beat of analysts’ gross margin estimates.

Dutch Bros pulled off the most important analyst estimates beat and quickest income progress amongst its friends. The inventory is up 40.3% because the outcomes and at the moment trades at $39.9.

Read our full, actionable report on Dutch Bros here, it’s free.

Portillo’s (NASDAQ:PTLO)

Begun as a Chicago scorching canine stand in 1963, Portillo’s (NASDAQ:PTLO) is an informal restaurant chain that serves Chicago-style scorching canine and beef sandwiches in addition to fries and shakes.

Portillo’s reported revenues of $165.8 million, up 6.3% yr on yr, falling wanting analysts’ expectations by 5.2%. It was a weak quarter for the corporate, with a miss of analysts’ gross margin and adjusted EBITDA estimates.

The inventory is down 14.6% because the outcomes and at the moment trades at $10.35.

Read our full, actionable report on Portillo’s here, it’s free.

Be part of Paid Inventory Investor Analysis

Assist us make StockStory extra useful to traders like your self. Be part of our paid person analysis session and obtain a $50 Amazon present card to your opinions. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.