AstraZeneca (AZN) has lengthy been within the oncology and different illness areas, however rose to recognition in recent times with the success of its COVID-19 vaccine.

The corporate has since withdrawn the vaccine because of low demand and uncommon unintended effects, however is as soon as once more an investor favourite after sharing latest information on its most cancers medication.

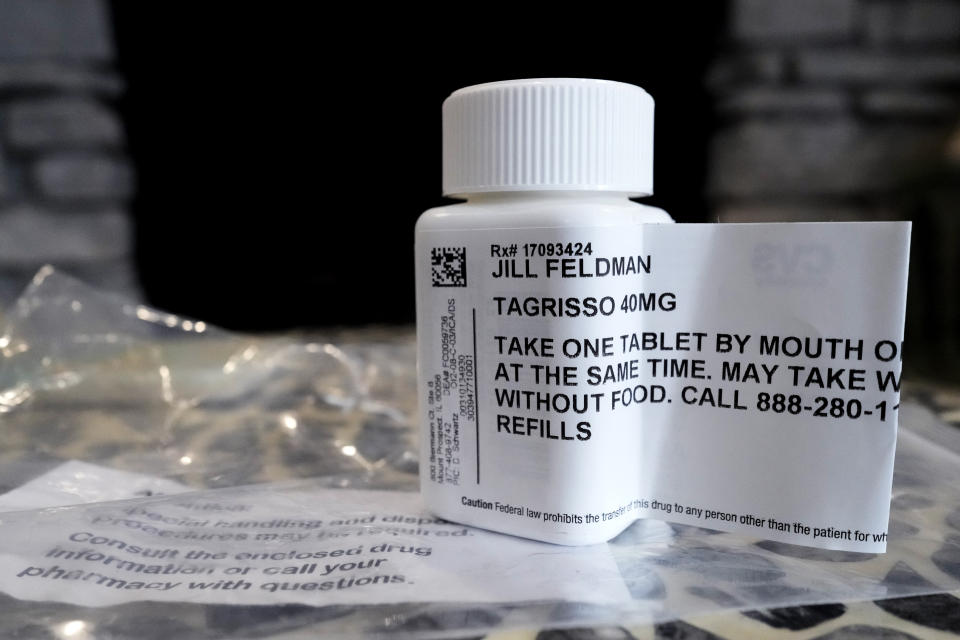

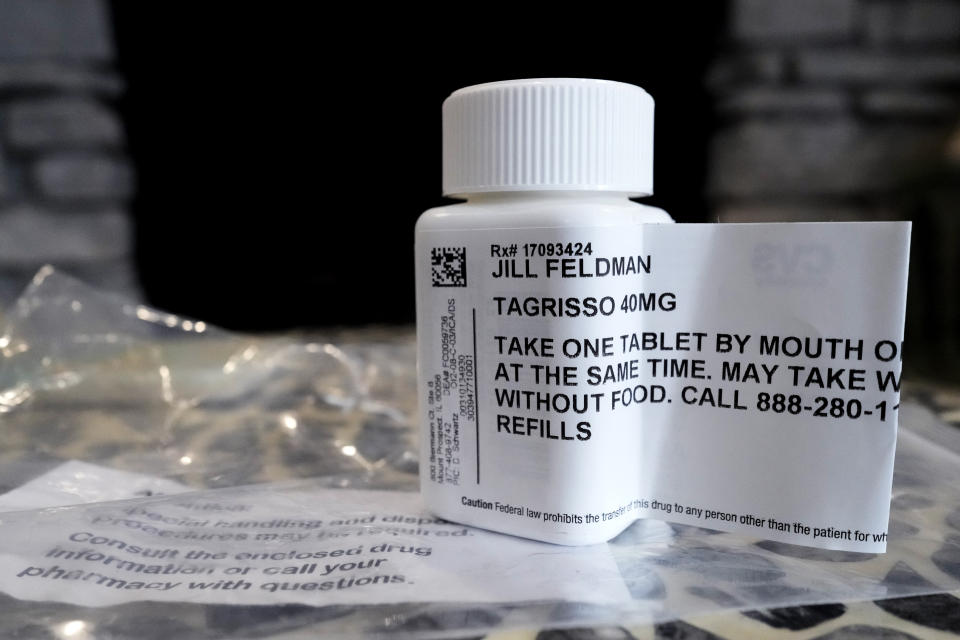

Considered one of its best-performing lung most cancers medication, Tagrisso, first accredited in 2017, has confirmed it will possibly reduce the risk of disease progression by 84% in sufferers with a kind of Stage 3 lung most cancers. These outcomes received it a standing ovation from attendees on the latest American Society of Scientific Oncology convention in Chicago. The corporate additionally revealed a CAR-T remedy candidate — an immunotherapy that’s crafted from an individual’s personal immune system to struggle most cancers — that might reduce tumors in liver most cancers sufferers. As well as, the corporate is engaged on a brand new breast most cancers remedy.

All of this implies the corporate is gearing up for a number of launches and label expansions — and new income streams. AstraZeneca has set a goal to change into an $80 billion firm, in gross sales, by 2030. In 2023, the corporate booked $45.8 billion in income.

CFO Aradhana Sarin mentioned she is now centered on the execution of launching the merchandise after the info reveal.

“We have come a great distance in our oncology portfolio, however we have additionally come a great distance whenever you see the depth of the portfolio,” Sarin instructed Yahoo Finance on the Goldman Sachs annual healthcare convention in Miami Seaside. Sarin added that the corporate is not completed but, with extra information due within the subsequent 18 months.

Prior to now six months, the corporate’s inventory has surged almost 20%, buying and selling at $79 per share Thursday.

Sarin mentioned the corporate goes to realize its income aim, and never by counting on one or two blockbusters. It’s the story the corporate instructed at its Could investor day, the place stakeholders initially felt confused about the big variety of merchandise the corporate was highlighting.

“For us, with regards to communication, it is a balancing act between making it easy sufficient so folks can digest it, but in addition highlighting that it is not one or two merchandise that make or break this firm. It is an enormous breadth and depth of product,” Sarin mentioned.

She added, “My function is to ensure that we’ve got good information and good evaluation to assist choices that we focus on and debate” with a purpose to make the fitting decisions.

Anjalee Khemlani is the senior well being reporter at Yahoo Finance, overlaying all issues pharma, insurance coverage, care providers, digital well being, PBMs, and well being coverage and politics. Comply with Anjalee on all social media platforms @AnjKhem.

Click on right here for in-depth evaluation of the newest well being business information and occasions impacting inventory costs

Learn the newest monetary and enterprise information from Yahoo Finance

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.