SushiSwap (SUSHI) exhibits clear bearish developments on the each day chart, however it’s struggling to interrupt key resistance ranges.

Latest on-chain evaluation highlights SUSHI’s downward trajectory, notably after breaking under important assist ranges.

SushiSwap Reveals Robust Bearish Pattern in Worth Motion

The worth of SUSHI is displaying clear bearish indicators on the each day chart. It has repeatedly examined each the 200 EMA (inexperienced) and the 100 EMA (blue) whereas transferring inside the Ichimoku Cloud.

On June 7, throughout Bitcoin’s correction to $66,800, SUSHI broke under the Ichimoku Cloud’s baseline, an important assist and resistance degree marked in crimson.

Learn Extra: How To Use SushiSwap: A Step-by-Step Information

After breaking the decrease boundary of the Ichimoku Cloud, SUSHI discovered this degree to behave as robust resistance on subsequent makes an attempt to interrupt again above it. That is evident from the chart.

With Bitcoin’s current drop from $70,000, SUSHI adopted swimsuit, declining 12% to per week low of $0.935. This pattern is decidedly bearish, and for SUSHI to show bullish once more, it will must climb again into the Ichimoku Cloud and break above the baseline in crimson.

SUSHI Holders on Ethereum are Dealing with Bearish Developments

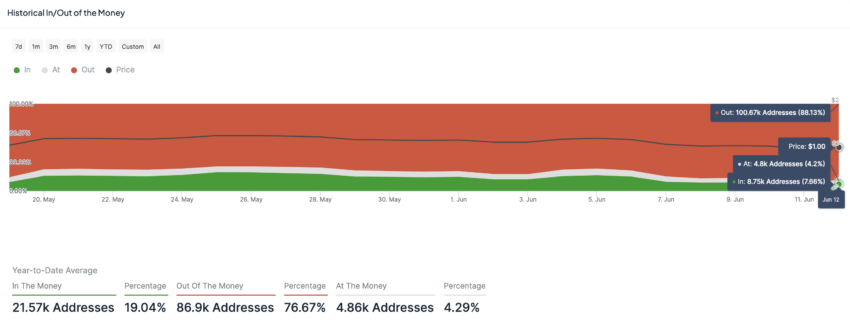

The next chart shows the historic In/Out of the Cash addresses for SUSHI holders on the Ethereum blockchain. This indicator offers insights into the profitability of addresses holding SUSHI based mostly on the token’s present value.

On the Ethereum blockchain, 100,670 addresses, or 88.13%, maintain SUSHI at a loss. In the meantime, 8,750 addresses, representing 7.66%, are worthwhile, and 4,800 addresses, or 4.2%, are breaking even.

From June 1 to June 12, there have been notable modifications within the profitability of addresses holding SUSHI on Ethereum.

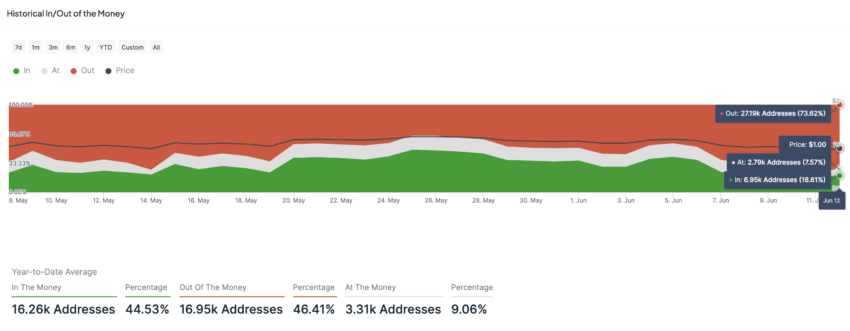

Holders on Arbitrum Confront Losses Amidst Declining Market Circumstances

Because the begin of the month on the Arbitrum community, the variety of addresses holding SUSHI and being Out of the Cash elevated by 10.35k, an increase of 13.30%. Conversely, the variety of addresses On the Cash decreased by 2.39k, a drop of 36.30%. Moreover, addresses Within the Cash fell by 7.95k, representing a decline of fifty.92%.

These shifts point out a bearish pattern, with a better share of SUSHI holders now experiencing losses in comparison with the beginning of the month.

Learn Extra: SushiSwap (SUSHI) Worth Prediction 2024/2025/2030

Between June 1 and June 12, there have been notable shifts within the addresses holding SUSHI on the Arbitrum community. The variety of addresses at a loss, or Out of the Cash, surged by 23,804, marking a rise of 47.78%. On the flip facet, the On the Cash addresses, these in breaking even positions, dropped by 7,081, a lower of 48.34%. Within the Cash addresses, or these in revenue, fell by 16,724, a decline of 47.06%.

This pattern highlights a rising bearish sentiment. On the Arbitrum Community, extra SUSHI holders at the moment are dealing with losses than at the start of the month.

Technical indicators level to continued downward strain to $0.768 (the native value low). A major variety of holders are experiencing losses throughout each the Ethereum and Arbitrum networks.

For SUSHI to show bullish once more, it will must climb again above the baseline in crimson.

Disclaimer

Consistent with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.