MicroStrategy has unveiled a strategic initiative to reinforce its Bitcoin (BTC) holdings. It introduced an providing of $500 million in convertible senior notes due 2032.

This transfer, focused at certified institutional patrons, highlights the agency’s dedication to Bitcoin as a central funding asset.

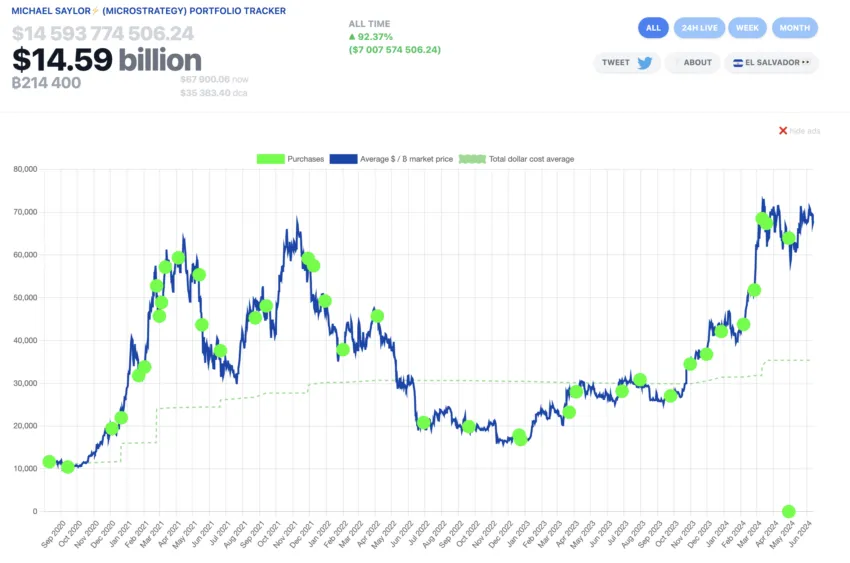

MicroStrategy’s Bitcoin Portfolio is Value Over $14 Billion

These convertible senior notes supply a twin profit, permitting holders to transform their funding into firm inventory below predefined situations. Structured as unsecured and senior, these notes guarantee precedence in reimbursement over different money owed and fairness ought to chapter happen.

MicroStrategy has set curiosity funds on a semi-annual foundation. The total maturity of the principal is ready for June 2032 until actions similar to redemption or conversion happen sooner.

Learn extra: Who Owns the Most Bitcoin in 2024?

Highlighting the flexibleness of this monetary instrument, MicroStrategy might enable preliminary patrons to accumulate an extra $75 million in notes throughout the first 13 days post-issuance, probably growing the overall increase to $575 million.

“MicroStrategy intends to make use of the web proceeds from the sale of the notes to accumulate further Bitcoin and for common company functions,” the agency announced.

Presently, MicroStrategy holds 214,400 BTC, valued at roughly $14.59 billion, yielding an unrealized revenue of over 92.37%.

Moreover, MicroStrategy has been on the forefront of incorporating blockchain know-how into its enterprise mannequin. The current introduction of the Orange protocol at its annual occasion exemplifies this. Orange employs Bitcoin’s blockchain to safe digital identities, which marks a major stride in blockchain utilization for knowledge safety.

The specifics of the observe conversion, to be decided at pricing, will supply flexibility when it comes to changing into both MicroStrategy’s class A standard inventory or money. This function makes the notes interesting to traders searching for each security and potential upside.

Learn extra: High 11 Public Firms Investing in Cryptocurrency

MicroStrategy’s twin deal with increasing its Bitcoin reserves and its blockchain purposes displays a complete technique geared toward monetary progress and technological management.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.