Constancy’s Director of International Macro, Jurrien Timmer, not too long ago commented on the controversy over whether or not Bitcoin or gold is a extra dependable retailer of worth, outlining eventualities for when every of those asset lessons is or shouldn’t be capable of hedge towards inflation primarily based on the financial surroundings.

The Idea Of Cash Provide And Asset Valuation

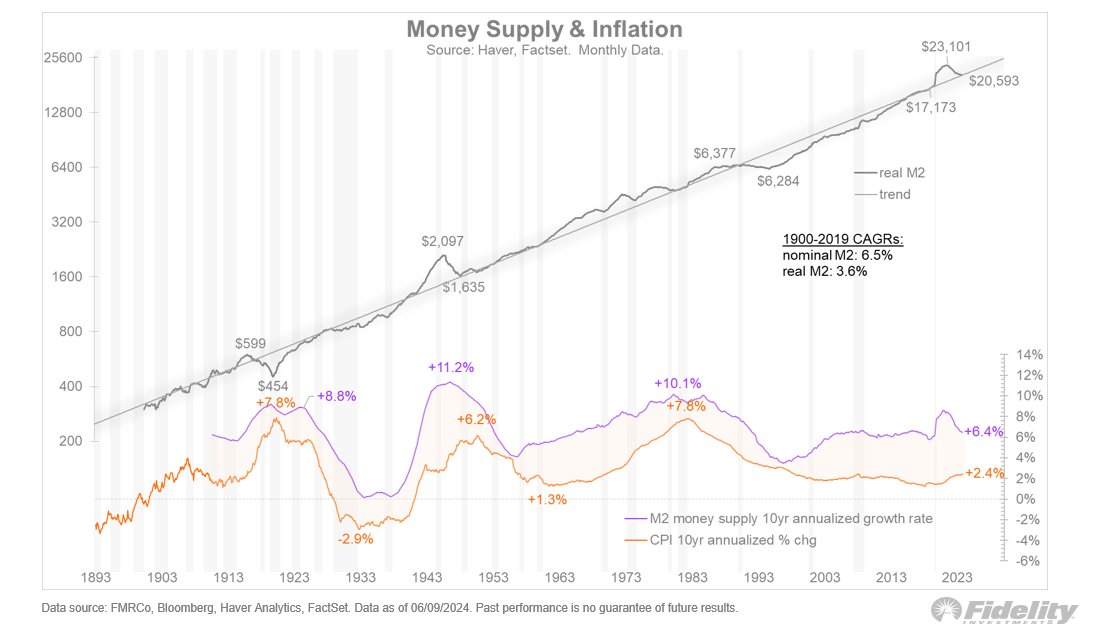

Timmer’s reasoning is constructed on the idea of “fiscal dominance,” the place the federal government strikes to increase the cash provide, threatening the buying energy of the forex. He notes the inflation within the works, as confirmed by the historic M2 cash provide/CPI relationship.

And whereas BTC and gold are arguably essentially the most inflation-resistant property primarily based on the speculation, Timmer believes that such an surroundings had but to materialize absolutely, even after the Federal Reserve’s current hawkishness.

Moreover, for the love of volatility, Bitcoin can also be known as “digital gold,” “gold 2.0,” and “exponential gold” as a result of, on the one hand, Bitcoin has all of the financial gadgets that gold has. Nonetheless, it’s also a New web know-how, in line with Timmer.

Nevertheless, for Bitcoin to enter and preserve its place with gold, fiat financial aggregates must continue to grow for an extreme quantity above the conventional tendencies.

Whereas there was a spike within the M2 cash provide through the current pandemic, tightening financial coverage by the Federal Reserve made it short-lived, in line with Timmer. This means that gold and Bitcoin is perhaps untimely of their roles as absolute shops of worth.

At present, Bitcoin’s worth has surged to $69,523, following the latest CPI report indicating a slowdown in inflation, which could recommend a strengthening of its place as a retailer of worth.

This report was additionally mirrored positively in gold’s worth because the asset might see a 0.91% surge over the previous 24 hours with a present buying and selling worth of $2,336.

Results of Treasury Yield Correlations on Bitcoin

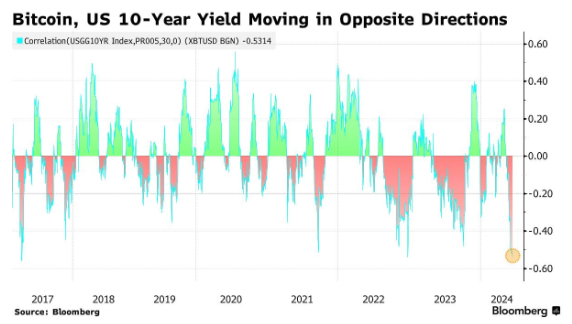

In the meantime, in line with the most recent data reported by Barchart, the Bitcoin (BTC) worth has misplaced its correlation with the 10-year U.S. Treasury (UST) bond yield because the correlation has dropped to its lowest degree during the last 14 years, equaling -53.

The cut up signifies that BTC is now progressing independently, with out the market being swayed by standard fiscal devices such because the yield on S Treasury bonds. This metric determines investor yields in authorities securities.

This might recommend that Bitcoin is anchored extra loosely to conventional monetary methods, which may very well be the start of its evolution right into a pluck of its distinctive asset class.

If Bitcoin continues to decouple from these conventional monetary metrics, it might drastically improve its case for being a greater non-traditional hedge towards fiscal instability.

Nevertheless, the widespread limitations of Bitcoin and gold as shops of worth, Timmer acknowledges, are primarily based on financial situations which can be but to play out, particularly the place the cash provide and inflation are involved.

Featured picture created with DALL-E, Chart from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.