The value of Curve DAO (CRV) plummeted by as much as 35% inside a number of hours. This sharp decline got here after information broke that Michael Egorov, the founding father of Curve, would possibly face liquidation.

Egorov, a key determine within the decentralized finance (DeFi) sector, is at the moment navigating a precarious buying and selling state of affairs.

Curve Founder’s Potential Liquidation Causes Panic

In line with Arkham, an on-chain evaluation platform, Egorov is near seeing $140 million value of CRV liquidated. He has borrowed round $95.7 million in stablecoins, primarily crvUSD, in opposition to $141 million in CRV distributed throughout 5 accounts on varied lending protocols.

“Based mostly on present charges, Egorov is paying $60 million yearly in an effort to preserve his positions open on Llamalend,” Arkham mentioned.

Learn extra: What Is Curve (CRV)?

Egorov borrowed $50 million by way of the DeFi platform – Llamalend at an annual share yield (APY) of roughly 120%. This excessive charge is essentially because of the close to absence of crvUSD obtainable to borrow in opposition to CRV on Llamalend. Notably, three of Egorov’s accounts comprise greater than 90% of the crvUSD borrowed on this protocol.

Moreover, data from Spot On Chain reveals that Egorov presently has 139 million CRV tokens value $37 million as collateral, with money owed amounting to $27 million throughout three platforms. In line with the most recent replace from Arkham, Egorov’s $140 million positions have been liquidated.

“The value of CRV fell by way of Egorov’s liquidation threshold this morning, along with his total 9-figure lending place liquidated throughout 5 protocols,” Arkham said.

The falling value of CRV has additionally impacted different main gamers available in the market. For instance, a crypto whale, 0xF07, was compelled to switch 29.62 million CRV, valued at roughly $7.68 million, to Binance because of a liquidation on Fraxlend.

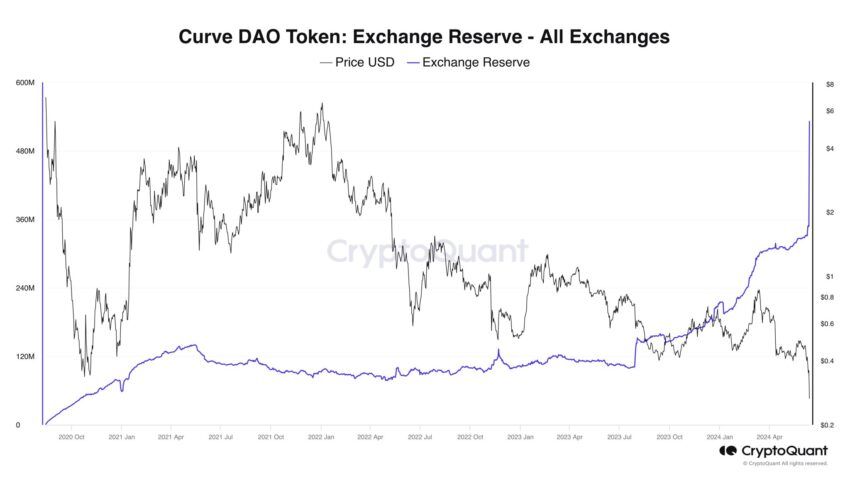

That being mentioned, Ki Younger Ju, founding father of one other on-chain evaluation platform – CryptoQuant, noticed a big enhance within the CRV steadiness on exchanges, reaching an all-time excessive. It surged by 57% in simply 4 hours.

After initially dropping from $0.35 to $0.21, the value of CRV has since proven resilience, recovering to about $0.26, marking an 18% rebound. This situation highlights the unstable and unpredictable nature of the crypto markets.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.