Wrapping up Q1 earnings, we take a look at the numbers and key takeaways for the on line casino operator shares, together with Monarch (NASDAQ:MCRI) and its friends.

On line casino operators get pleasure from restricted competitors as a result of playing is a extremely regulated trade. These firms may also get pleasure from wholesome margins and earnings. Have you ever ever heard the phrase ‘the home at all times wins’? Regulation cuts each methods, nevertheless, and casinos might face stroke-of-the-pen threat that all of the sudden limits what they will or cannot do and the place they will do it. Moreover, digitization is altering the sport, pun supposed. Whether or not it’s on-line poker or sports activities betting in your smartphone, innovation is forcing these gamers to adapt to altering shopper preferences, akin to with the ability to wager wherever on demand.

The 9 on line casino operator shares we monitor reported a slower Q1; on common, revenues beat analyst consensus estimates by 0.5%. Shares–especially these buying and selling at larger multiples–had a robust finish of 2023, however 2024 has seen durations of volatility. Blended indicators about inflation have led to uncertainty round fee cuts, and whereas a number of the on line casino operator shares have fared considerably higher than others, they collectively declined, with share costs falling 3.9% on common because the earlier earnings outcomes.

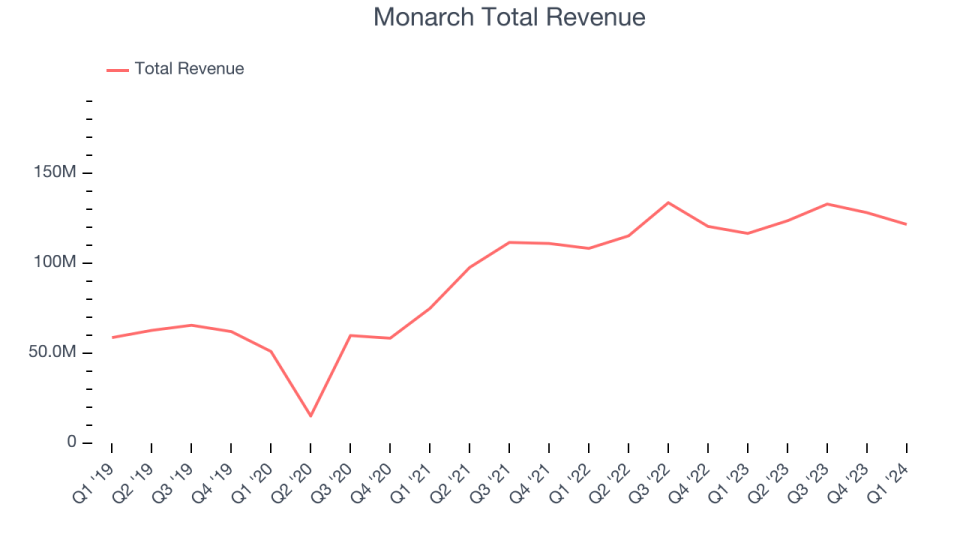

Monarch (NASDAQ:MCRI)

Established in 1993, Monarch (NASDAQ:MCRI) operates luxurious casinos and resorts, providing high-end gaming, eating, and hospitality experiences.

Monarch reported revenues of $121.7 million, up 4.3% yr on yr, falling wanting analysts’ expectations by 0.5%. It was a slower quarter for the corporate, with a miss of analysts’ income and earnings estimates.

CEO Remark John Farahi, Co-Chairman and Chief Govt Officer of Monarch, commented: “Within the first quarter of 2024 web income and adjusted EBITDA grew to all-time first quarter data of $121.7 million and $38.5 million, respectively, and the EBITDA margin improved to 31.7% from 31.3% in the identical interval of the prior yr.

The inventory is down 4% because the outcomes and at the moment trades at $66.6.

Read our full report on Monarch here, it’s free.

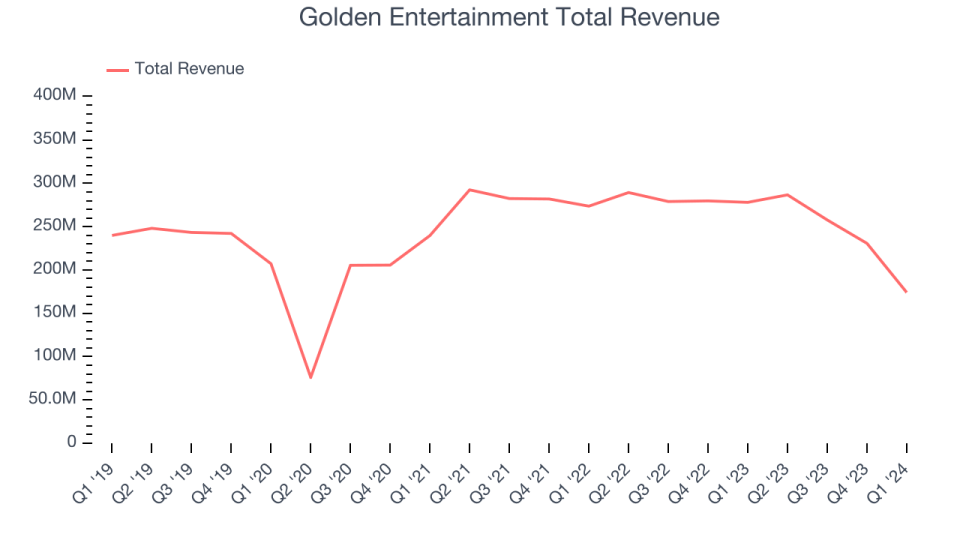

Finest Q1: Golden Leisure (NASDAQ:GDEN)

Based in 2001, Golden Leisure (NASDAQ:GDEN) is a gaming firm working casinos, taverns, and distributed gaming platforms.

Golden Leisure reported revenues of $174 million, down 37.4% yr on yr, outperforming analysts’ expectations by 3.2%. It was a really sturdy quarter for the corporate, with a formidable beat of analysts’ earnings estimates.

Golden Leisure had the slowest income progress amongst its friends. The inventory is down 3% because the outcomes and at the moment trades at $29.72.

Is now the time to purchase Golden Leisure? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Caesars Leisure (NASDAQ:CZR)

Previously Eldorado Resorts, Caesars Leisure (NASDAQ:CZR) is a worldwide gaming and hospitality firm working quite a few casinos, inns, and resort properties.

Caesars Leisure reported revenues of $2.74 billion, down 3.1% yr on yr, falling wanting analysts’ expectations by 2.8%. It was a weak quarter for the corporate, with a miss of analysts’ earnings and adjusted EBITDA estimates.

Caesars Leisure had the weakest efficiency in opposition to analyst estimates within the group. The inventory is up 2.4% because the outcomes and at the moment trades at $36.73.

Read our full analysis of Caesars Entertainment’s results here.

MGM Resorts (NYSE:MGM)

Working a number of properties on the Las Vegas Strip, MGM Resorts (NYSE:MGM) is a worldwide hospitality and leisure firm identified for its resorts and casinos.

MGM Resorts reported revenues of $4.38 billion, up 13.2% yr on yr, surpassing analysts’ expectations by 3.7%. It was a really sturdy quarter for the corporate, with a formidable beat of analysts’ earnings estimates and a good beat of analysts’ working margin estimates.

MGM Resorts scored the most important analyst estimates beat amongst its friends. The inventory is up 2.7% because the outcomes and at the moment trades at $40.8.

Read our full, actionable report on MGM Resorts here, it’s free.

Wynn Resorts (NASDAQ:WYNN)

Based by the previous Mirage Resorts CEO, Wynn Resorts (NASDAQ:WYNN) is a worldwide developer and operator of high-end inns and casinos, identified for its luxurious properties and premium visitor providers.

Wynn Resorts reported revenues of $1.86 billion, up 30.9% yr on yr, surpassing analysts’ expectations by 3.5%. It was a very good quarter for the corporate, with a good beat of analysts’ earnings estimates.

Wynn Resorts scored the quickest income progress amongst its friends. The inventory is down 5.7% because the outcomes and at the moment trades at $91.75.

Read our full, actionable report on Wynn Resorts here, it’s free.

Be a part of Paid Inventory Investor Analysis

Assist us make StockStory extra useful to buyers like your self. Be a part of our paid person analysis session and obtain a $50 Amazon reward card in your opinions. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.