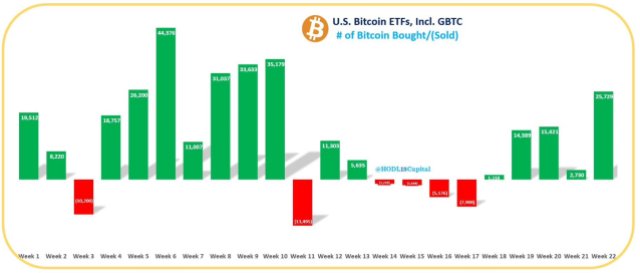

Amid a broader wave of increased adoption and acceptance of Bitcoin, the largest cryptocurrency asset, United States BTC Spot Exchange-Traded Funds (ETFs) in the past week acquired a substantial amount of BTC approximately 25,729.

This development is consistent with current patterns in which significant financial institutions and businesses have begun to accept the asset, thereby strengthening its standing within the international financial system.

Bitcoin Spot ETFs Accumulation Matching Nearly Two Months’ Mining Production

Popular trading platform and analyst TOBTC reported the development on the X (formerly Twitter) platform on Monday. According to the platform, considering the current mining rate of roughly 3.125 BTC for each block, this enormous stockpile is equivalent to roughly two months’ worth of newly mined Bitcoin, with inflows reaching over $1.83 billion.

The increase in ETF holdings is indicative of investors’ rising faith in Bitcoin’s long-term worth and ability to act as a hedge against volatile economic conditions. It also illustrates how BTC is becoming more widely accepted and integrated into traditional financial products, bridging the divide between conventional finance and the developing digital asset market.

Furthermore, TOBTC noted that the acquisition represents the largest weekly purchase since March, when Bitcoin hit its current all-time high, and is nearly equal to the total amount of the crypto asset purchased in May. Following the launch of the products in January, 11 approved ETFs have had net inflows of a whopping $15.69 billion, despite large withdrawals from Grayscale Investment’s fund.

Blackrock Bitcoin ETF (IBIT) currently has the largest BTC holdings for a spot BTC ETF. Thus far, the biggest asset management company in the world, Blackrock has collected an astounding 304,976 BTC, valued at approximately $21 billion for their exchange fund. This enormous investment demonstrates BlackRock‘s belief in the long-term prospects of the digital asset and the expanding institutional interest in cryptocurrencies.

Given the company’s substantial holdings, they may help BTC gain more traction and recognition in the general public as the cryptocurrency industry develops. In addition, with the support of such a prestigious financial firm, the crypto asset appears to have a bright future.

A Major Focus In Digital Asset Investment

It is important to note that BTC has become a significant player in the entire digital asset investment products market. Inflows into digital asset investment products reached $2 billion, raising the total for the last five weeks of inflows to $4.3 billion.

Also, ETP trading volumes increased to about $12.8 billion for the week, which is a 55% upsurge over the previous week. Meanwhile, with $1.97 billion in inflows for the week, Bitcoin was once again the main focus.

TOBTC also underscored that Ethereum witnessed a $69 million net inflows during the period, marking its strongest week since March. This is most likely due to the unexpected decision to permit spot Ethereum ETFs by the US Securities and Exchange Commission (SEC).

Featured image from iStock, chart from Tradingview.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.