This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

So far, the AI trade has appeared to follow the same pattern in tech to which we’ve grown accustomed: A select few winners take it all.

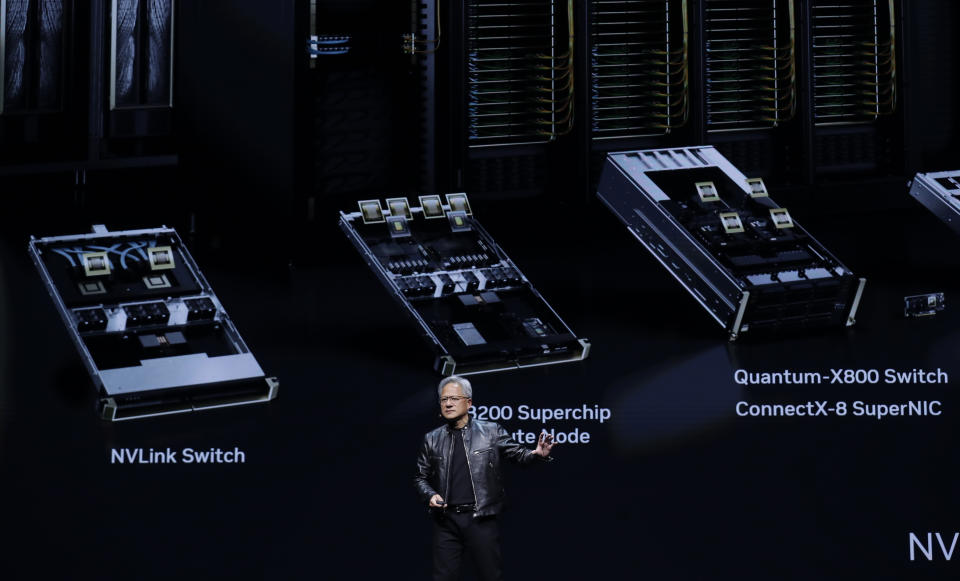

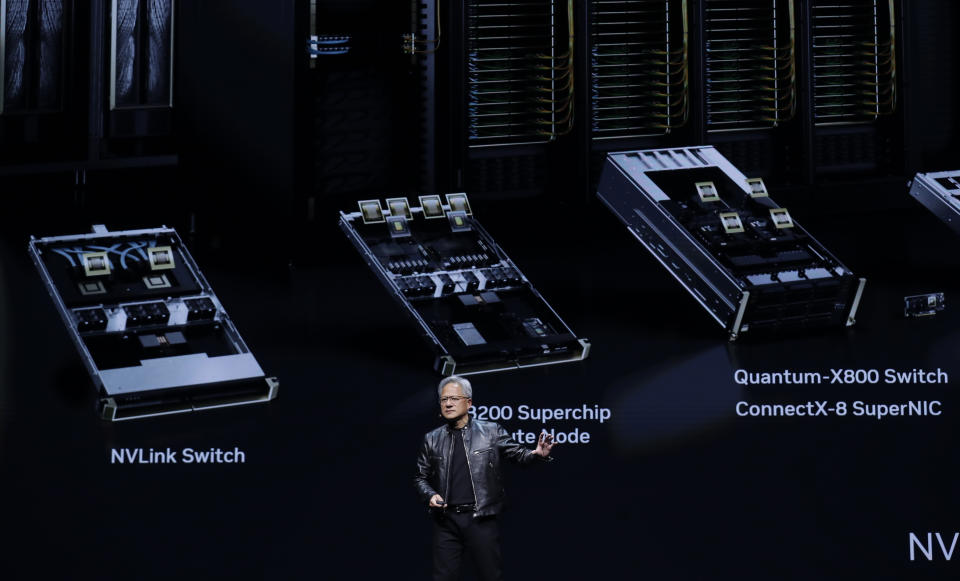

After computers, phones, and search providers, chip companies and AI engines are simply the next in line to capitalize on the innovations of the moment, and we’re all familiar with the hockey-stick growth. (Congratulations to Nvidia on its 10-for-1 split.)

These developments have led to sky-high market concentration, with the weight of both the S&P 500’s top five and top 10 continuing to rise to eye-watering levels as they power the market to new record highs.

If you’re looking for more tech moonshots, it certainly feels as if the AI cake is baked by now. Hardware and chips are firmly leading the charge, with general productivity AI software providers like Google (GOOG, GOOGL) and Microsoft (MSFT) at their heels — the companies delivering the AI goods to the consumers.

But as Bank of America’s head US equity strategist Savita Subramanian wrote in a note to clients Monday, the eventual broadening and dispersal of generative AI tech is not to be underestimated, as it has the capability to supercharge stagnant productivity levels.

Good news for the S&P 500 investors who aren’t watching their Nvidia (NVDA) share counts multiply by 10 this week.

Of course, there has been some broadening already, as Julie Hyman wrote in a Morning Brief last week, as utilities swim in AI’s wake, capitalizing on the need for near-endless electrical power and bringing the stodgy, heavily regulated sector into the movement. But that’s on the supply side.

It’s AI’s demand side that may unlock “the bull case that lies ahead,” Subramanian wrote. According to her team, the S&P’s productivity gains have stalled since the mid-2000 introduction of cloud services, measured by real revenue to the number of workers. Globalization and levered buybacks have “removed the impetus for companies to do the harder efficiency work.”

Which is now back in focus as high inflation gives companies even more reason to try to be more efficient and keep costs down. Productivity gains have already begun to improve since the onset of COVID.

“Gen AI could be a game changer for labor intensive professional services and large banks that have worsened in labor intensity since the Global Financial Crisis,” Subramanian wrote.

To believe in the big AI names means believing in AI’s actual ability to transform society, technology, and the economy. There are no Nvidia clients without the companies that are building AI software. That software needs customers who see it worthwhile to pony up.

And assuming AI can deliver actual productivity gains, the table is set for a paradigm shift in efficiency. And thus, profit.

“A decade of underinvestment has resulted in aged, inefficient capital stock ripe for a replacement cycle,” Subramanian wrote. “Today, Corporate America has the impetus, as well as new tools, to grow efficient. This is unequivocally bullish.”

Ethan Wolff-Mann is a Senior Editor at Yahoo Finance, running newsletters. Follow him on Twitter @ewolffmann.

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.