Data shows the Bitcoin whales on cryptocurrency exchanges Bybit and HTX have opened massive long positions at the current price levels.

Bitcoin Taker Buy Sell Ratio Has Spiked For Bybit and HTX Recently

In a new post on X, CryptoQuant founder and CEO Ki Young Ju has revealed that the whales on the HTX platform have opened large long positions recently. The indicator of relevance here is the “Taker Buy Sell Ratio,” which keeps track of the ratio between the Bitcoin taker buy and taker sell volumes.

When the value of this metric is greater than 1, it means the taker buy or long volume is greater than the taker sell or short volume right now. Such a trend implies the derivatives market currently shares a bullish majority sentiment.

On the other hand, the indicator being less than this threshold can imply the dominance of a bearish mentality in the sector, as the short volume outweighs the long volume.

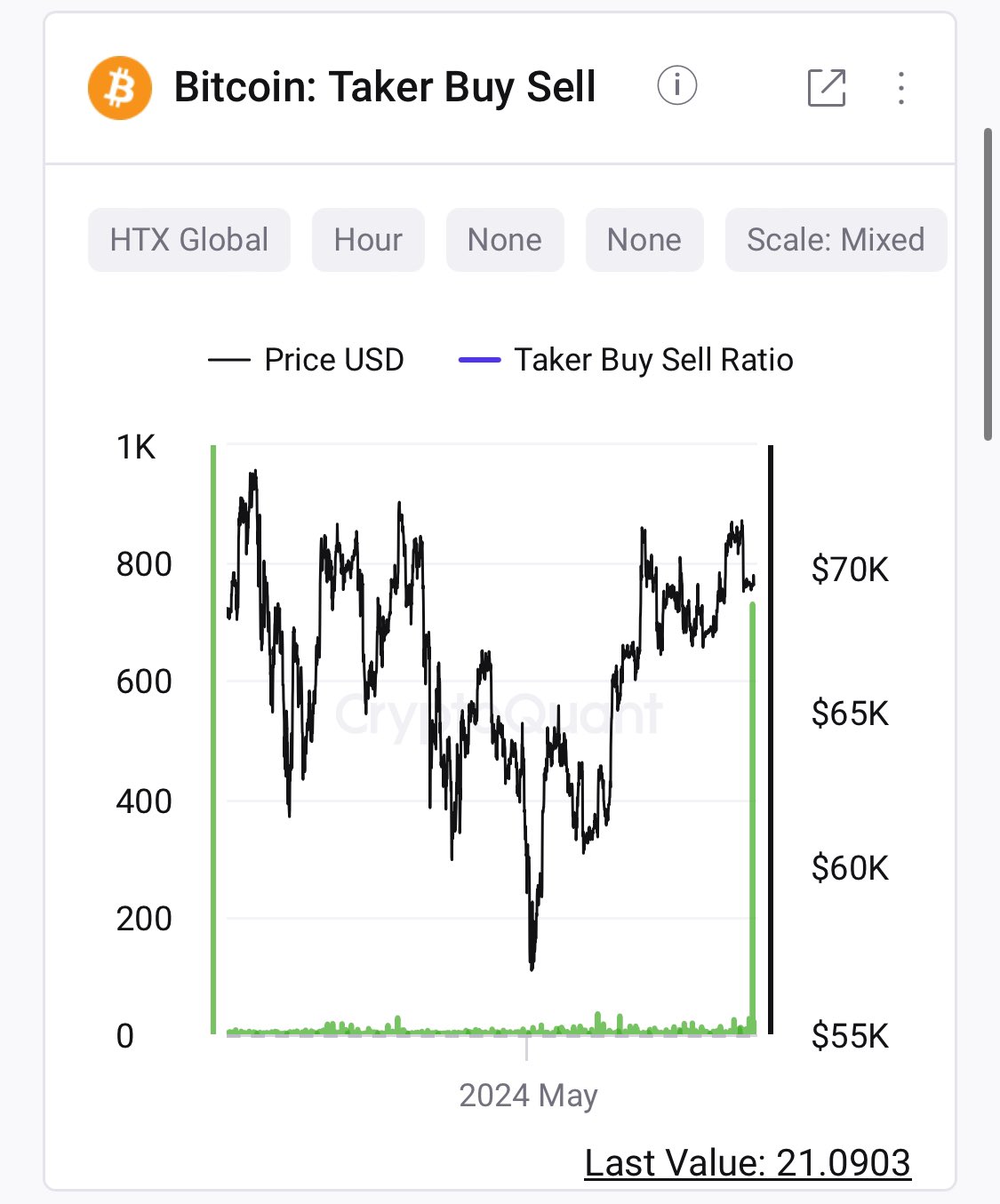

Now, here is a chart that shows the recent trend in the Bitcoin Taker Buy Sell Ratio specifically for the HTX exchange:

The value of the metric appears to have been quite high in recent days | Source: @ki_young_ju on X

As the above graph shows, the Bitcoin Taker Buy Sell Ratio for HTX has recently spiked extremely high. This would imply that the platform’s users have just opened a large number of long positions.

This sharp increase in the indicator has come following BTC’s drop towards the $69,000 level. Thus, it would appear that the whales on the exchange think this dip is worth making large bullish bets at.

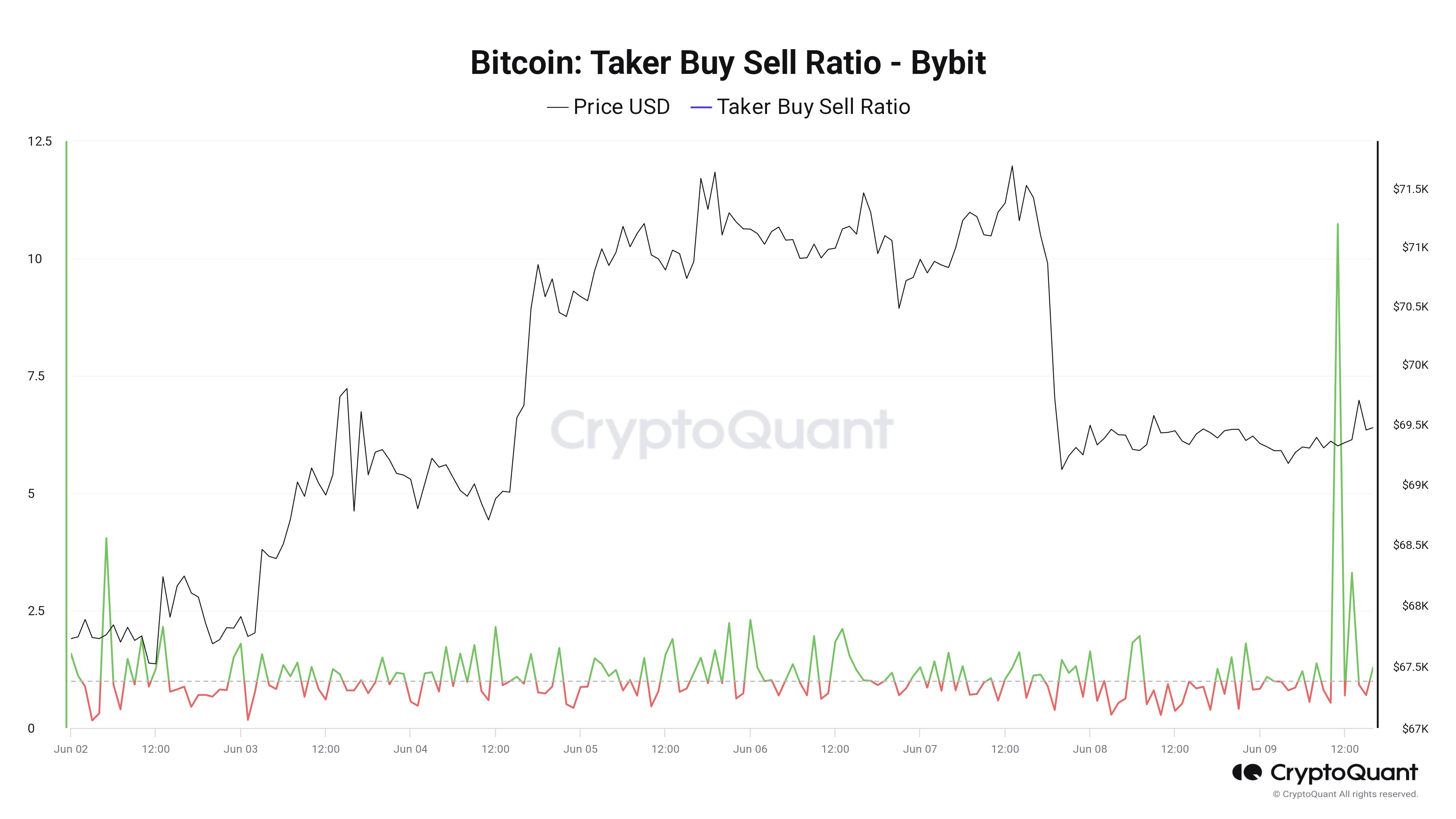

Another member of the CryptoQuant staff, Maartunn, has made a quote-repost of the post from Ju about this development at HTX and has noted that the Bybit platform has also witnessed a large spike in the Taker Buy Sell Ratio at the recent lows.

Looks like the metric has also registered a large value for this exchange | Source: @JA_Maartun on X

From the graph, it’s apparent that while the spike in the Bitcoin Taker Buy Sell Ratio for Bybit has also indeed been quite large on its own, the scale of it is still not quite as extraordinary as what has been observed on HTX.

Nonetheless, the metric reaching these highs implies that the orders on the platform from the whales have also heavily tended towards the long side. Thus, it would appear that the large entities from at least two exchanges have decided to open up big bullish bets at the recent price levels.

It now remains to be seen whether these long positions will pay off for these colossal Bitcoin investors.

BTC Price

Bitcoin has been moving sideways since the plunge a few days ago, as its price is still trading around $69,420.

The price of the coin hasn't made any notable recovery from the plummet yet | Source: BTCUSD on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.