(*) By Ankur Banerjee( *) SINGAPORE (Reuters) – Gold rates leapt to videotape high and the buck got on the surge once again on Wednesday, maintaining the stress on the yen and the euro, while supplies in Asia faltered as capitalists hesitated to put significant wagers in advance of a fiercely disputed united state political election.( *) The changing assumptions around exactly how quick and deep the Federal Get will certainly reduce prices have actually additionally injured threat view, with investors currently preparing for the united state reserve bank to be gauged in its relieving.( *) That has actually taken united state Treasury accept a three-month height and the buck to multi-month highs versus the euro, sterling and the yen, which is currently back at 150 per buck degrees, triggering spoken cautions from Japanese authorities.( *) MSCI’s widest index of Asia-Pacific shares outside Japan was last 0.06% greater. Tokyo’s Nikkei was somewhat reduced in very early trading.( *)” Volatility within an array bound profession is progressively coming to be the standard, as markets support for critical weeks in advance, consisting of the united state governmental political election and a hefty company incomes program,” stated Anderson Alves, an investor with ActivTrades.( *) China and Hong Kong supplies made a constant open of profession on Wednesday, as the assurance of federal government aid for the economic climate sustained the significant indexes to work out in at greater degrees.( *) Moving energy in the direction of a most likely Donald Trump presidency has actually remained in emphasis for capitalists, with Trump plans consisting of tolls and constraints on undocumented migration anticipated to raise rising cost of living. That subsequently has actually sustained the buck on assumptions united state prices might continue to be fairly high for a longer-than-anticipated duration.( *) Trump’s probabilities of defeating Vice Head of state Kamala Harris, the Autonomous prospect, have actually just recently bordered greater on wagering internet sites, though viewpoint surveys reveal the race to the White Residence stays as well limited to call.( *) With much less than 2 weeks to choose the Nov. 5 political election, capitalists are girding for volatility in the marketplace.( *) The return on benchmark united state 10-year notes was 4.216% in Oriental hours after touching a three-month high of 4.222% in the previous session.( *)” The Treasury sell-off has actually grown today as markets recognize that the Fed dangers reigniting rising cost of living if it relieves right into a solid economic climate,” stated Prashant Newnaha, an elderly Asia-Pacific prices planner at TD Stocks.( *)” Trump’s enhancing political election probabilities are additionally solidifying market assumptions for the Fed to proceed relieving right into 2025 and the opportunity of the Fed relocating to the sidelines for 6 months following year can not be eliminated.”( *) Markets are presently valuing in 41 basis factors (bps) of cuts for the year, with one more 100 bps valued in for following year.( *) Tale Continues( *) Investors prepare for the Fed to reduce loaning prices by 25 bps following month, having actually solidified their wagers of a bigger cut in the wake of solid financial information. The Fed started its relieving cycle with a 50 bps reduced in September.( *) The assumptions of a gauged rate of price cuts from the Fed has actually led the buck higher in current weeks. The buck index, which gauges the united state money versus 6 competitors, touched 104.17, its greatest considering that Aug. 2.( *) The yen glided to a three-month low of 151.74 per buck in the Oriental early morning, while the euro struck $1.0792, its most affordable degree sine Aug. 2.( *) In products, gold rates struck a document high of $2,749.07 in very early profession prior to quiting several of the gains to work out near $2,743.42 as the problem between East together with unpredictability around the Fed expectation and united state political election stirs need for safe-haven properties. (*) Brent crude futures dropped 0.4% to $75.73 a barrel, while West Texas Intermediate unrefined futures alleviated 0.38% to $71.47 per barrel after a sharp surge up until now today. (*)( Coverage by Ankur Banerjee; Modifying by Shri Navaratnam; To review Reuters Markets and Money information, click For the state of play of Oriental stock exchange please click: )( *).

Check Also

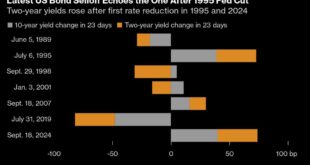

Moving Fed Sights Increase Buck, Weigh on Supplies: Markets Cover

( Bloomberg)– The buck increased, evaluating on Oriental shares as danger hunger remained suppressed provided …

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.