Diner dining establishment chain Denny’s (NASDAQ: DENN) disappointed the marketplace’s profits assumptions in Q3 CY2024, with sales dropping 2.1% year on year to $111.8 million. Its non-GAAP earnings of $0.14 per share was additionally 8.8% listed below experts’ agreement quotes.

Is currently the moment to get Denny’s? Find out in our full research report.

Denny’s (DENN) Q3 CY2024 Emphasizes:

-

Profits: $111.8 million vs expert quotes of $115.5 million (3.2% miss out on)

-

Readjusted EPS: $0.14 vs expert assumptions of $0.15 (8.8% miss out on)

-

EBITDA: $20.02 million vs expert quotes of $22.3 million (10.2% miss out on)

-

EBITDA advice for the complete year is $82.5 million at the middle, listed below expert quotes of $83.19 million

-

Gross Margin (GAAP): 32.2%, below 40.2% in the very same quarter in 2014

-

Locations: 1,586 at quarter end, below 1,644 in the very same quarter in 2014

-

Same-Store Sales were level year on year (1.8% in the very same quarter in 2014)

-

Market Capitalization: $341.1 million

Kelli Valade, Ceo, specified, “Our 3rd quarter sales results straight mirror continuous brand name financial investments and committed concentrate on worth that caused exceeding the group. Denny’s residential system-wide same-restaurant sales ** outshined the BBI Household Eating index for the 3rd successive quarter driven by the relaunch of our follower preferred $2-$ 4-$ 6-$ 8 worth food selection and the ongoing development of off-premises with our 3rd digital brand name, Banda Burrito. Keke’s additionally seasoned considerable consecutive renovation in same-restaurant sales ** as our efforts to establish fundamental advertising and marketing techniques and broaden the alcohol program proceeded our initiatives to shut the void to the affordable collection. We are additionally really thrilled to be holding a Financier Day today.”

Business Review

Open up all the time, Denny’s (NASDAQ: DENN) is a chain of restaurant dining establishments offering morning meal and conventional American price.

Sit-Down Eating

Sit-down dining establishments supply a total eating experience with table solution. These facilities cover numerous foods and are renowned for their cozy friendliness and inviting setting, making them ideal for family members events, unique celebrations, or just loosening up. Their considerable food selections vary from appetisers to indulgent treats and red wines and mixed drinks. This room is incredibly fragmented and competitors consists of whatever from publicly-traded firms having several chains to single-location mom-and-pop dining establishments.

Sales Development

Assessing a firm’s long-lasting efficiency can disclose understandings right into its organization high quality. Any kind of organization can have temporary success, however a top-tier one maintains development for many years.

Denny’s is a tiny dining establishment chain, which occasionally brings negative aspects contrasted to bigger rivals gaining from far better brand name understanding and economic situations of range.

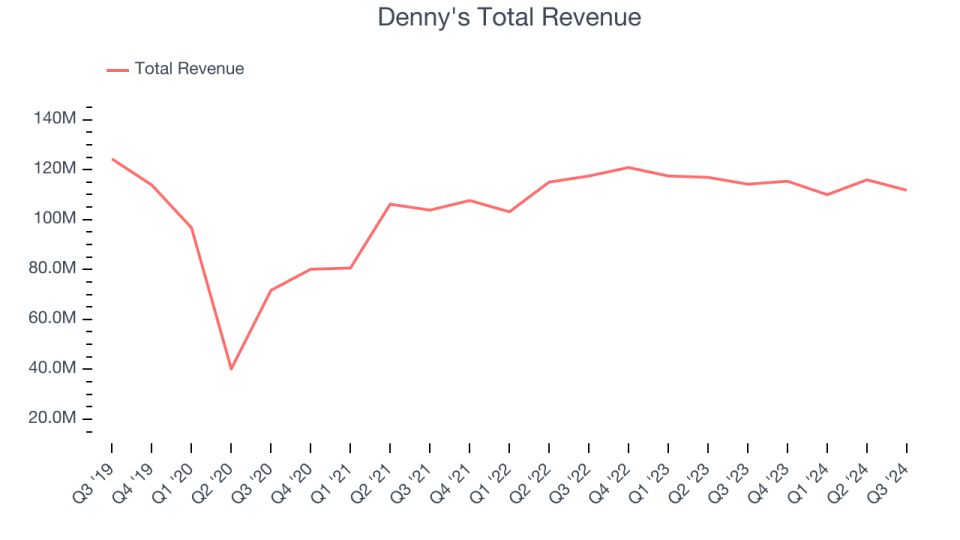

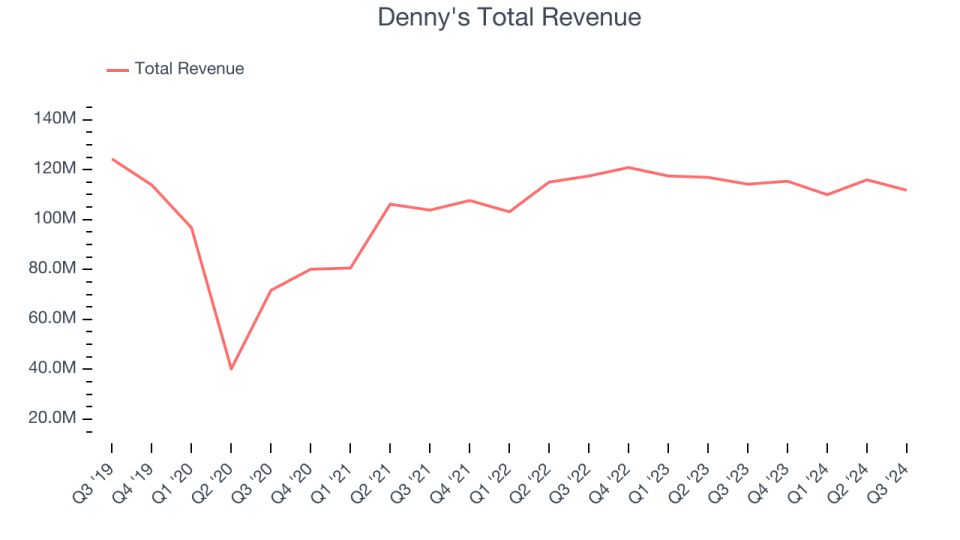

As you can see below, Denny’s profits decreased by 5.1% annually over the last 5 years (we contrast to 2019 to stabilize for COVID-19 influences) as it shut dining establishments.

This quarter, Denny’s missed out on Wall surface Road’s quotes and reported an instead unexciting 2.1% year-on-year profits decrease, producing $111.8 countless profits.

Looking in advance, sell-side experts anticipate profits to expand 4.7% over the following one year, a velocity versus the last 5 years. While this forecast reveals the marketplace assumes its more recent offerings will certainly militarize far better efficiency, it is still listed below the field standard.

When a firm has even more money than it recognizes what to do with, redeeming its very own shares can make a great deal of feeling– as long as the rate is right. Fortunately, we have actually located one, a low-cost supply that is spurting complimentary capital AND redeeming shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Dining Establishment Efficiency

Variety Of Dining Establishments

The variety of eating places a dining establishment chain runs is an important vehicle driver of just how rapidly company-level sales can expand.

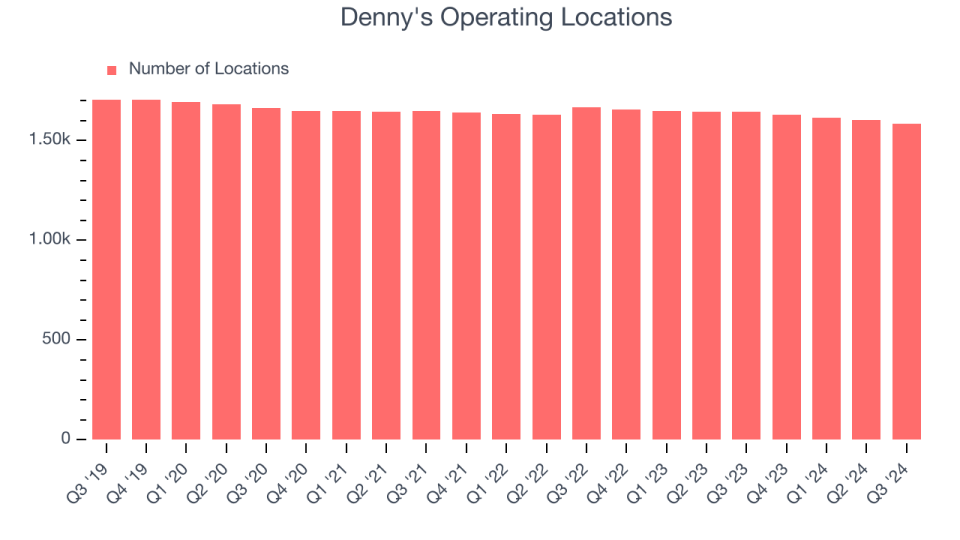

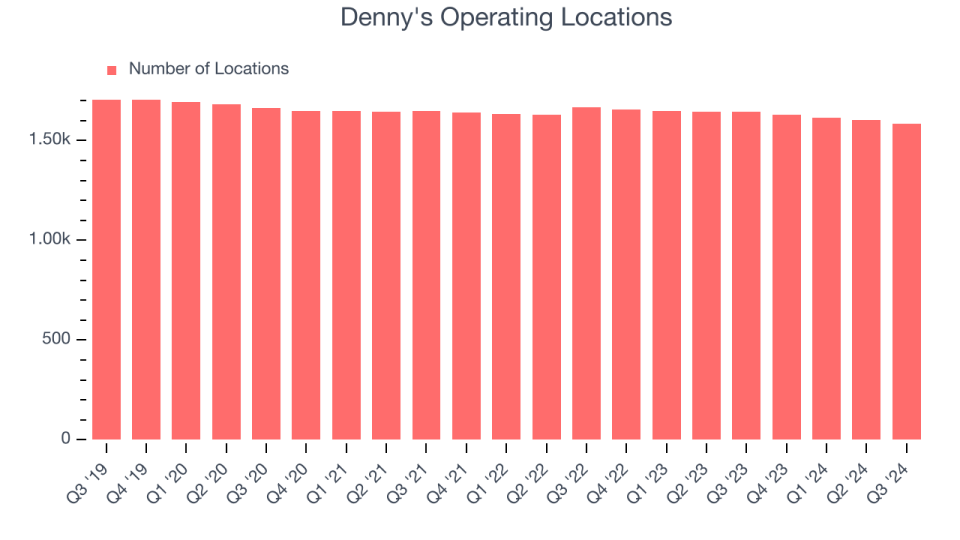

Denny’s run 1,586 places in the most up to date quarter. Over the last 2 years, the firm has actually normally shut its dining establishments, balancing 1% yearly decreases.

When a chain shutters dining establishments, it generally indicates need for its dishes is subsiding, and it is reacting by shutting underperforming places to enhance productivity.

Same-Store Sales

A business’s dining establishment base just paints one component of the image. When need is high, it makes good sense to open up much more. Yet when need is reduced, it’s sensible to shut some places and make use of the cash in various other methods. Same-store sales is a sector action of whether profits is expanding at those existing dining establishments and is driven by client check outs (typically called website traffic) and the ordinary investing per client (ticket).

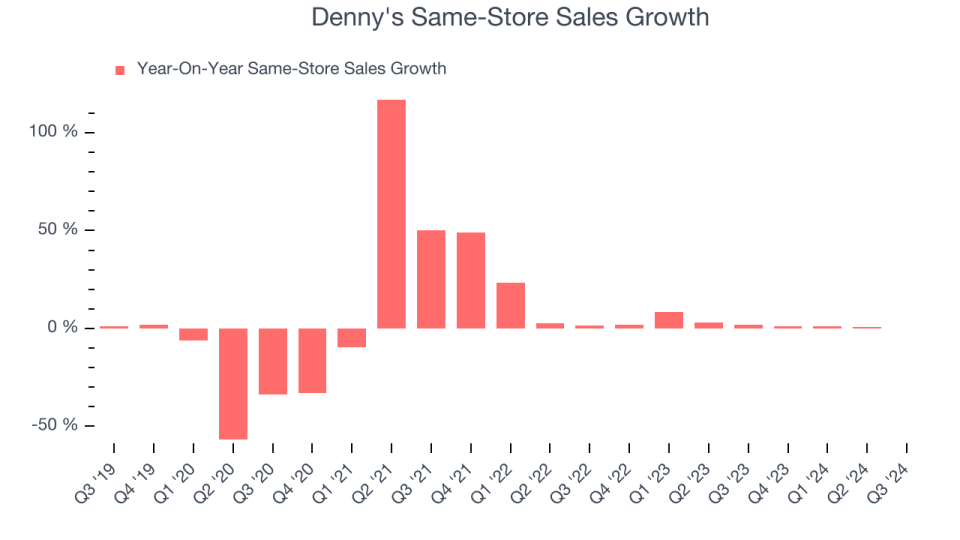

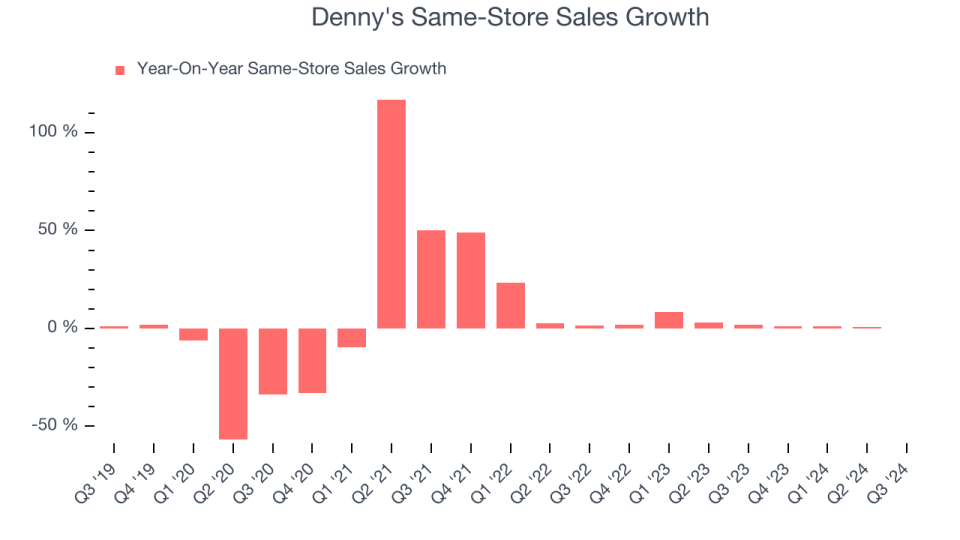

Denny’s need climbed over the last 2 years and somewhat exceeded the market. Typically, the firm’s same-store sales have actually expanded by 2.3% annually. Provided its decreasing dining establishment base over the very same duration, this efficiency originates from a combination of greater costs and boosted foot website traffic at existing places (closing dining establishments can occasionally enhance same-store sales).

In the most up to date quarter, Denny’s year on year same-store sales were level. By the firm’s criteria, this development was a significant slowdown from the 1.8% year-on-year boost it published one year earlier. We’ll be viewing Denny’s carefully to see if it can reaccelerate development.

Trick Takeaways from Denny’s Q3 Outcomes

We battled to locate several solid positives in these outcomes. Its profits however missed out on experts’ assumptions and its EBITDA disappointed Wall surface Road’s quotes. In general, this quarter might have been far better. The supply continued to be level at $6.61 right away adhering to the outcomes.

Denny’s really did not reveal it’s finest hand this quarter, however does that produce a possibility to get the supply right now?If you’re making that choice, you ought to take into consideration the larger photo of evaluation, organization high qualities, along with the most up to date profits.We cover that in our actionable full research report which you can read here, it’s free

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.