Water control and step firm Badger Meter (NYSE: BMI) missed out on Wall surface Road’s earnings assumptions in Q3 CY2024, however sales increased 11.9% year on year to $208.4 million. Its GAAP earnings of $1.08 per share was 6.5% over experts’ agreement price quotes.

Is currently the moment to purchase Badger Meter? Find out in our full research report.

Badger Meter (BMI) Q3 CY2024 Emphasizes:

-

Earnings: $208.4 million vs expert price quotes of $212.2 million (1.8% miss out on)

-

EPS: $1.08 vs expert price quotes of $1.01 (6.5% beat)

-

” Taking into consideration our stabilizing stockpile, solid proposal channel and positive order prices, we expect supplying high single-digit sales development prices over the cycle, keeping in mind the dominating disproportion typical in the market.” (assumption for Q4 earnings development is 12%)

-

Gross Margin (GAAP): 40.2%, up from 39.1% in the very same quarter in 2014

-

Cost-free Capital Margin: 20.1%, up from 15.3% in the very same quarter in 2014

-

Market Capitalization: $6.46 billion

” We were pleased with our 3rd quarter economic efficiency supplying solid sales development, document operating earnings margins and durable capital generation. Sales in the quarter remained to gain from strong need for our tailorable water administration services. Significantly, we accomplished document operating earnings margins of 19.5%, the outcome of desirable sales mix, price/cost administration, solid operating implementation and proceeded marketing, design and management (SEA) cost take advantage of,” claimed Kenneth C. Bockhorst, Chairman, Head Of State and Ceo.

Firm Summary

The programmer of the globe’s initial frost-proof water meter in 1905, Badger Meter (NYSE: BMI) supplies water control and step devices to numerous sectors.

Assessment Instruments

Dimension and examination tool business might delight in extra constant need due to the fact that items such as water meters are non-discretionary and mandated for substitute at foreseeable periods. In the last years, digitization and information collection have actually driven development in the area, resulting in step-by-step sales. However like the more comprehensive industrials field, dimension and examination tool business go to the impulse of financial cycles. Rates of interest, as an example, can substantially affect civil, industrial, and property building tasks that drive need.

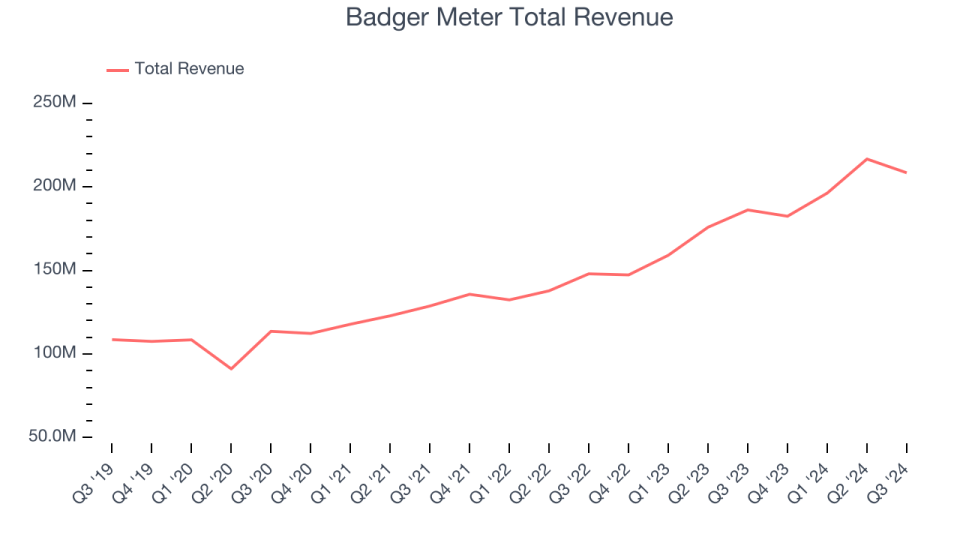

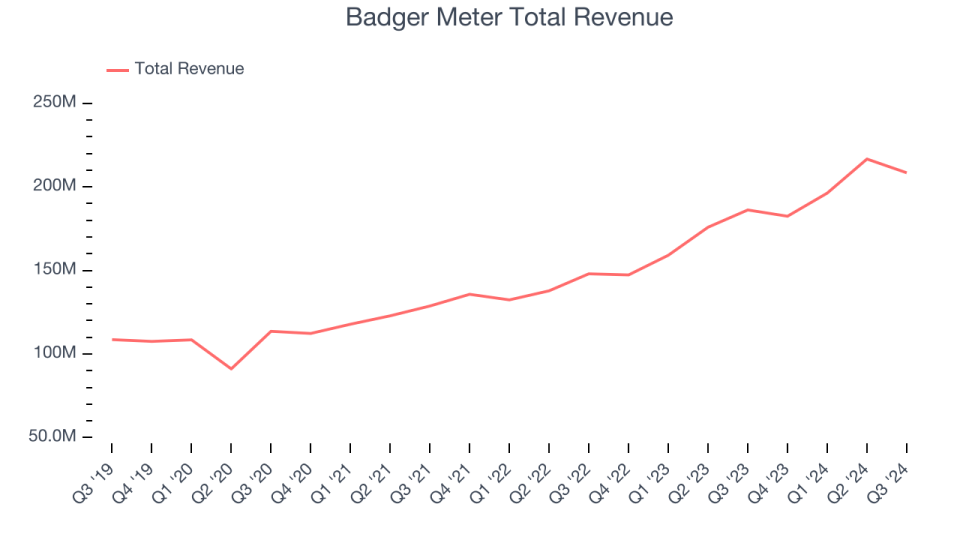

Sales Development

Analyzing a business’s lasting efficiency can supply hints concerning its organization high quality. Any type of organization can install a great quarter or 2, however the most effective continually expand over the long run. Over the last 5 years, Badger Meter expanded its sales at a remarkable 13.8% worsened yearly development price. This is a terrific base for our evaluation due to the fact that it reveals Badger Meter’s offerings reverberate with clients.

Long-lasting development is one of the most vital, however within industrials, a half-decade historic sight might miss out on brand-new market patterns or need cycles. Badger Meter’s annualized earnings development of 20.5% over the last 2 years is over its five-year pattern, recommending its need was solid and lately sped up.

This quarter, Badger Meter’s earnings expanded 11.9% year on year to $208.4 million, disappointing Wall surface Road’s price quotes.

Looking in advance, sell-side experts anticipate earnings to expand 11.1% over the following one year, a slowdown versus the last 2 years. Still, this forecast is notable and highlights the marketplace is considering success for its services and products.

Below at StockStory, we absolutely comprehend the capacity of thematic investing. Varied victors from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Beast Drink (MNST) can all have actually been determined as encouraging development tales with a megatrend driving the development. So, because spirit, we have actually determined a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

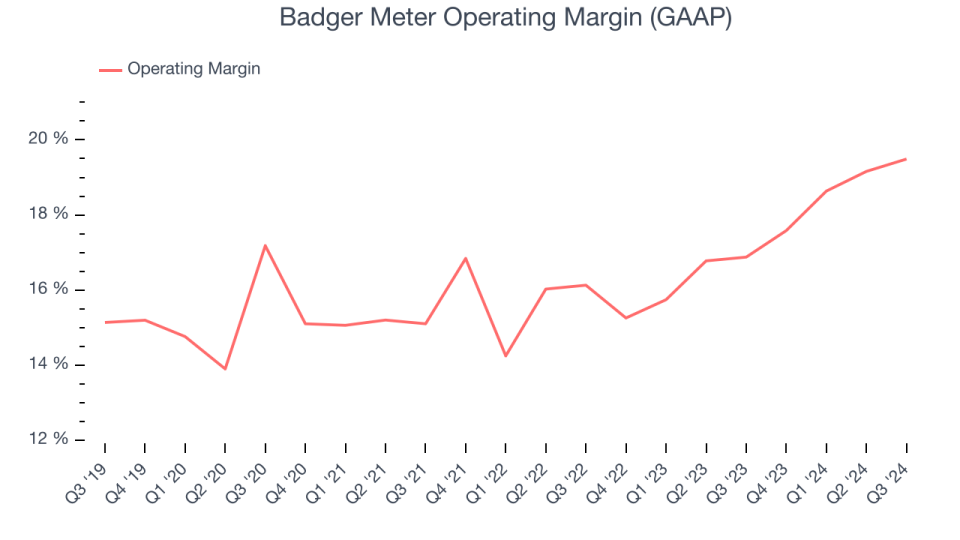

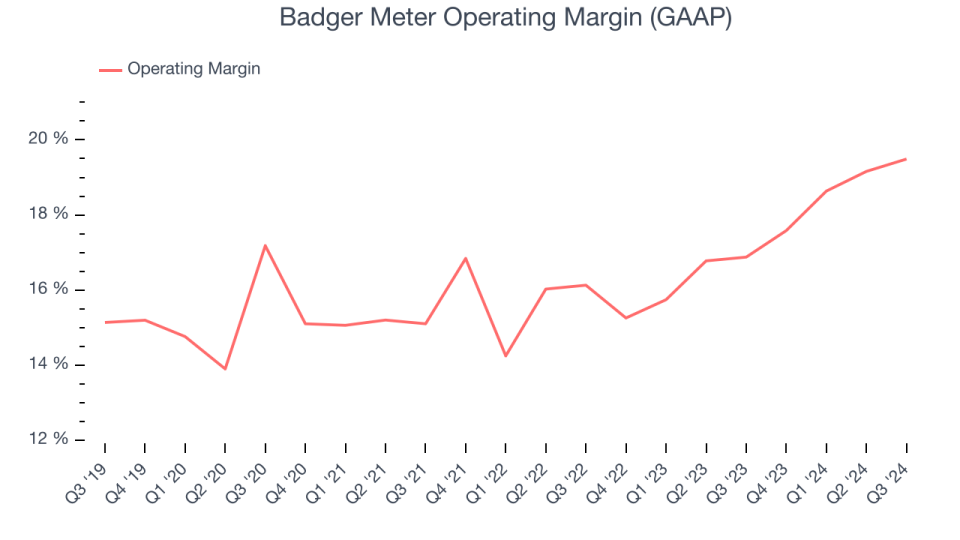

Operating Margin

Operating margin is a crucial step of success as it reveals the section of earnings left after representing all core expenditures– whatever from the price of products marketed to marketing and salaries. It’s likewise beneficial for contrasting success throughout business with various degrees of financial obligation and tax obligation prices due to the fact that it leaves out passion and tax obligations.

Badger Meter has actually been a well-oiled device over the last 5 years. It showed elite success for an industrials organization, flaunting an ordinary operating margin of 16.5%. This outcome isn’t shocking as its high gross margin offers it a desirable beginning factor.

Examining the pattern in its success, Badger Meter’s yearly operating margin increased by 3.4 portion factors over the last 5 years, as its sales development offered it running take advantage of.

In Q3, Badger Meter produced an operating earnings margin of 19.5%, up 2.6 portion factors year on year. The boost was motivating, and because its operating margin increased greater than its gross margin, we can presume it was lately extra reliable with expenditures such as advertising, R&D, and management expenses.

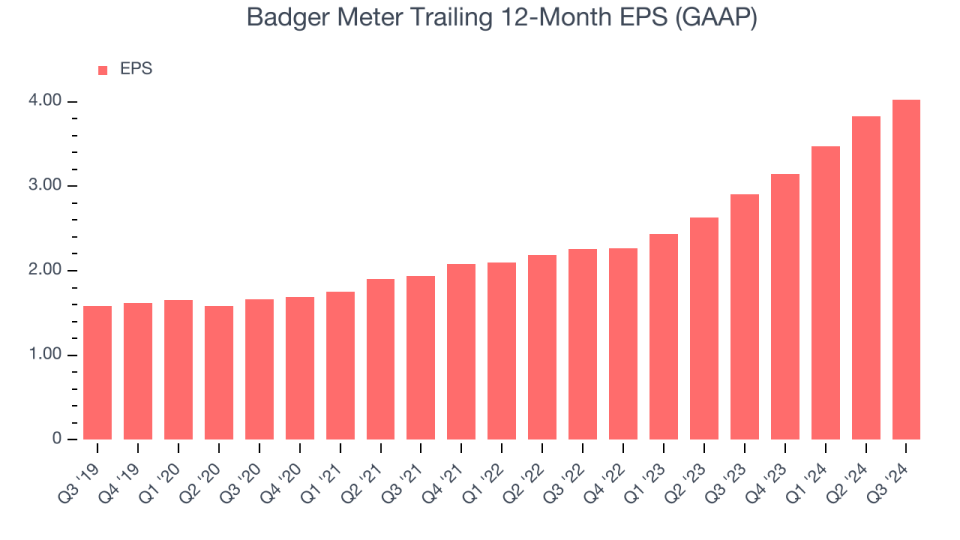

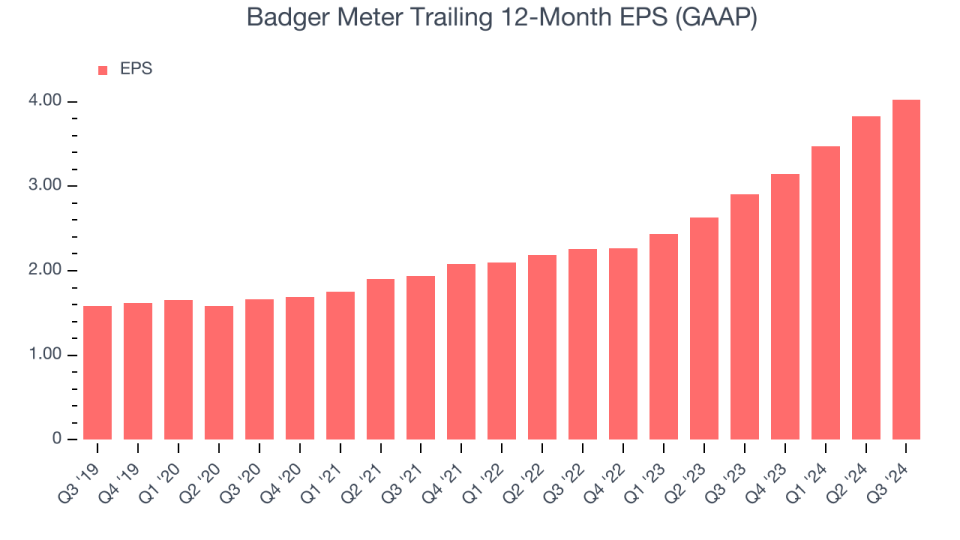

Revenues Per Share

We track the lasting development in profits per share (EPS) for the very same factor as lasting earnings development. Contrasted to earnings, nevertheless, EPS highlights whether a business’s development paid.

Badger Meter’s EPS expanded at an astonishing 20.6% worsened yearly development price over the last 5 years, more than its 13.8% annualized earnings development. This informs us the firm came to be extra lucrative as it increased.

We can take a much deeper check out Badger Meter’s profits high quality to much better comprehend the motorists of its efficiency. As we pointed out previously, Badger Meter’s operating margin increased by 3.4 portion factors over the last 5 years. This was one of the most pertinent variable (in addition to the earnings influence) behind its greater profits; tax obligations and passion expenditures can likewise influence EPS however do not inform us as much concerning a business’s basics.

Like with earnings, we assess EPS over a much more current duration due to the fact that it can provide understanding right into an arising motif or advancement for business. For Badger Meter, its two-year yearly EPS development of 33.6% was more than its five-year pattern. We enjoy it when profits development increases, particularly when it increases off a currently high base.

In Q3, Badger Meter reported EPS at $1.08, up from $0.88 in the very same quarter in 2014. This print defeated experts’ price quotes by 6.5%. Over the following one year, Wall surface Road anticipates Badger Meter’s full-year EPS of $4.03 to expand by 13.2%.

Trick Takeaways from Badger Meter’s Q3 Outcomes

It was excellent to see Badger Meter defeated experts’ EPS assumptions this quarter. On the various other hand, its earnings sadly missed out on. Looking in advance, the firm asked for “high single-digit sales development”, listed below Agreement assumptions, which is asking for 12% development in Q4. Generally, this was a sub-par quarter. The supply traded down 4.8% to $209 promptly after reporting.

The current quarter from Badger Meter’s had not been that excellent. One profits record does not specify a business’s high quality, however, so allow’s discover whether the supply is a purchase the existing price.The most recent quarter does issue, however not almost as high as longer-term basics and appraisal, when making a decision if the supply is a buy.We cover that in our actionable full research report which you can read here, it’s free

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.