Specialist devices and devices producer Snap-on (NYSE: SNA) satisfied Wall surface Road’s profits assumptions in Q3 CY2024, however sales dropped 8.5% year on year to $1.15 billion. Its GAAP revenue of $4.70 per share was 2.5% over experts’ agreement quotes.

Is currently the moment to acquire Snap-on? Find out in our full research report.

Snap-on (SNA) Q3 CY2024 Emphasizes:

-

Earnings: $1.15 billion vs expert quotes of $1.16 billion (in line)

-

EPS: $4.70 vs expert quotes of $4.58 (2.5% beat)

-

” Our team believe that our markets and our procedures have and have actually shown proceeding and significant durability versus the unpredictabilities of the existing setting.”

-

Gross Margin (GAAP): 51.2%, according to the very same quarter in 2014

-

Cost-free Capital Margin: 22.1%, up from 18% in the very same quarter in 2014

-

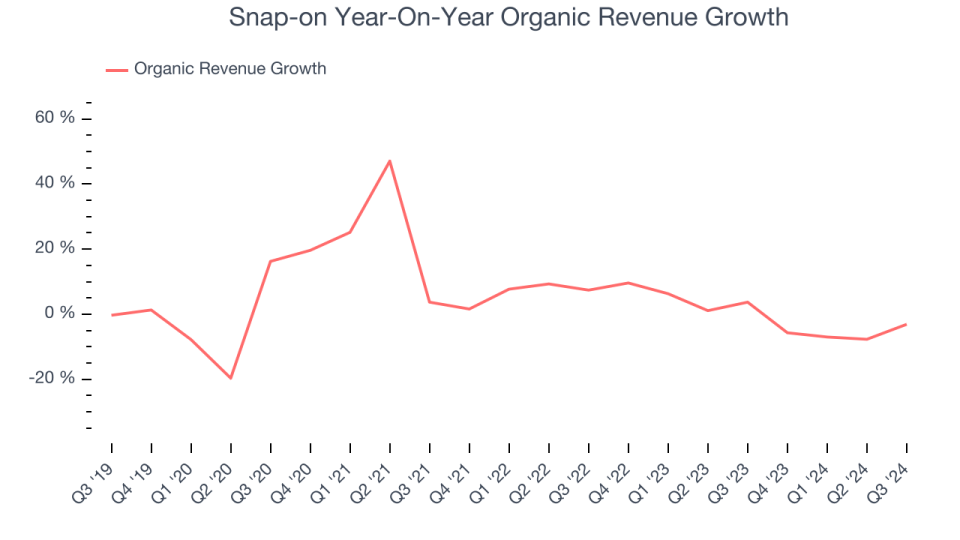

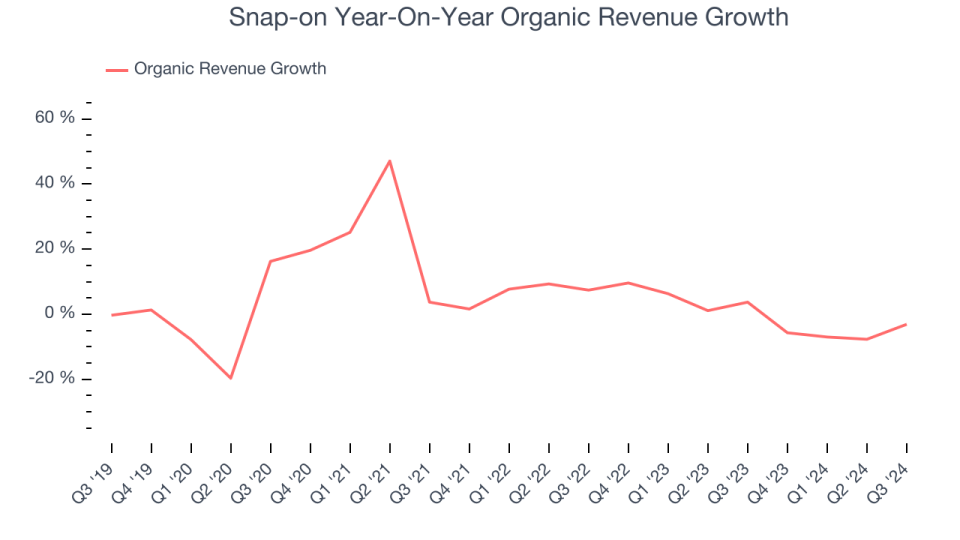

Organic Earnings dropped 3.1% year on year (3.7% in the very same quarter in 2014)

-

Market Capitalization: $15.7 billion

” We’re motivated by our 3rd quarter 2024 results as our services stayed solid, producing a well balanced result and supplying earnings gains in these difficult times,” claimed Nick Pinchuk, Snap-on chairman and ceo.

Firm Review

Established In 1920, Snap-on (NYSE: SNA) is a worldwide service provider of devices, devices, and diagnostics for different markets such as lorry fixing, aerospace, and the armed force.

Specialist Devices and Devices

Automation that enhances effectiveness and linked devices that accumulates analyzable information have actually been trending, developing brand-new need. Some expert devices and devices firms likewise offer software application to come with dimension or automated equipment, including a stream of persisting earnings to their services. On the various other hand, expert devices and devices firms go to the impulse of financial cycles. Customer investing and rate of interest, as an example, can substantially affect the commercial manufacturing that drives need for these firms’ offerings.

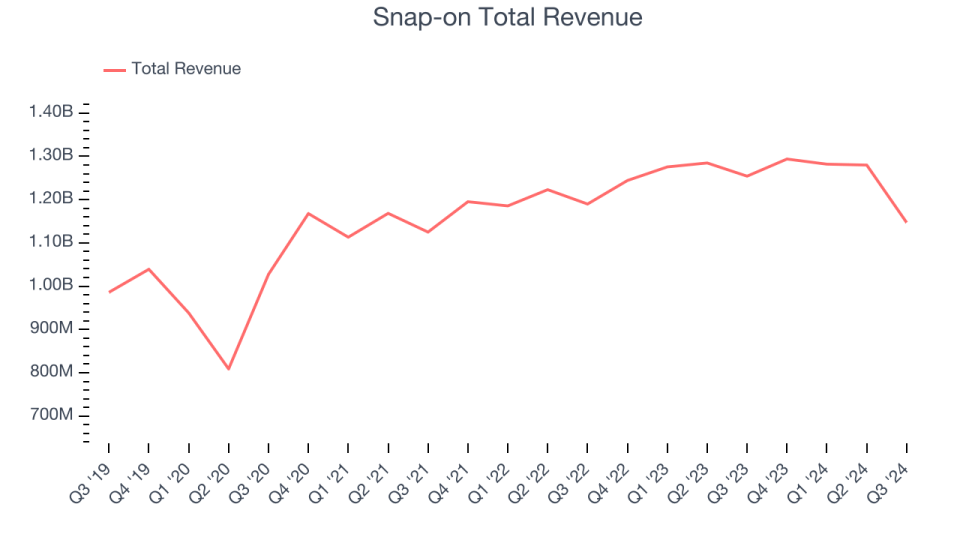

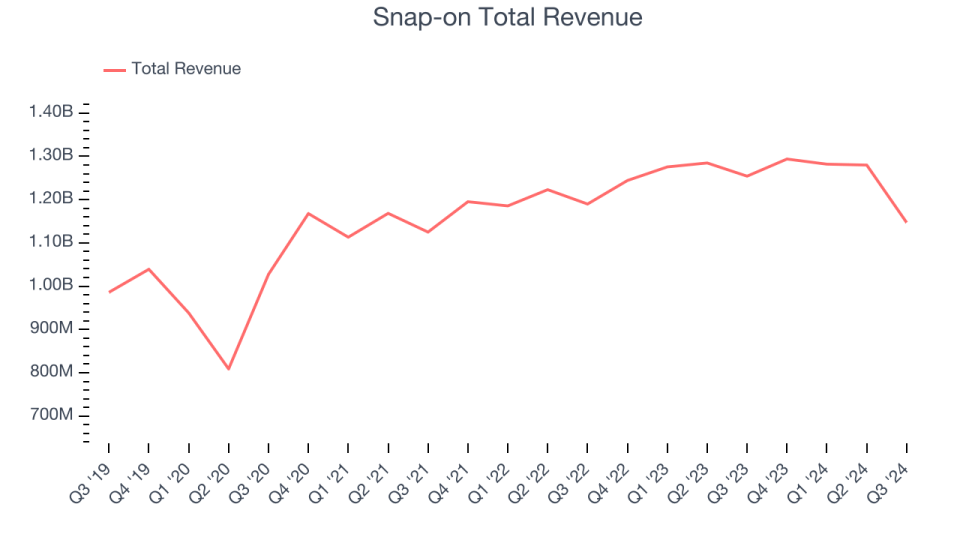

Sales Development

Taking a look at a firm’s lasting efficiency can offer hints regarding its organization top quality. Any type of organization can set up a great quarter or 2, however the most effective constantly expand over the long run. Over the last 5 years, Snap-on expanded its sales at a slow-moving 4.2% worsened yearly development price. This reveals it stopped working to broaden in any kind of significant means and is a harsh beginning factor for our evaluation.

We at StockStory position one of the most focus on lasting development, however within industrials, a half-decade historic sight might miss out on cycles, market fads, or a firm maximizing drivers such as a brand-new agreement win or an effective product. Snap-on’s current background reveals its need reduced as its annualized profits development of 2.2% over the last 2 years is listed below its five-year fad. We likewise keep in mind several various other Specialist Devices and Devices services have actually encountered decreasing sales as a result of intermittent headwinds. While Snap-on expanded slower than we would certainly such as, it did carry out much better than its peers.

Snap-on likewise reports natural profits, which removes out single occasions like purchases and money changes since they do not properly mirror its principles. Over the last 2 years, Snap-on’s natural profits was level. Since this number is less than its typical profits development, we can see that some combination of purchases and international exchange prices improved its heading efficiency.

This quarter, Snap-on reported an instead unexciting 8.5% year-on-year profits decrease to $1.15 billion of profits, according to Wall surface Road’s quotes.

Looking in advance, sell-side experts anticipate profits to decrease 3% over the following twelve month, a slowdown versus the last 2 years. This estimate is underwhelming and suggests the marketplace thinks its product or services will certainly encounter some need obstacles.

Unless you have actually been living under a rock, it needs to be evident now that generative AI is mosting likely to have a substantial effect on just how huge companies work. While Nvidia and AMD are trading near to all-time highs, we favor a lesser-known (however still successful) semiconductor supply gaining from the surge of AI. Click here to access our free report on our favorite semiconductor growth story.

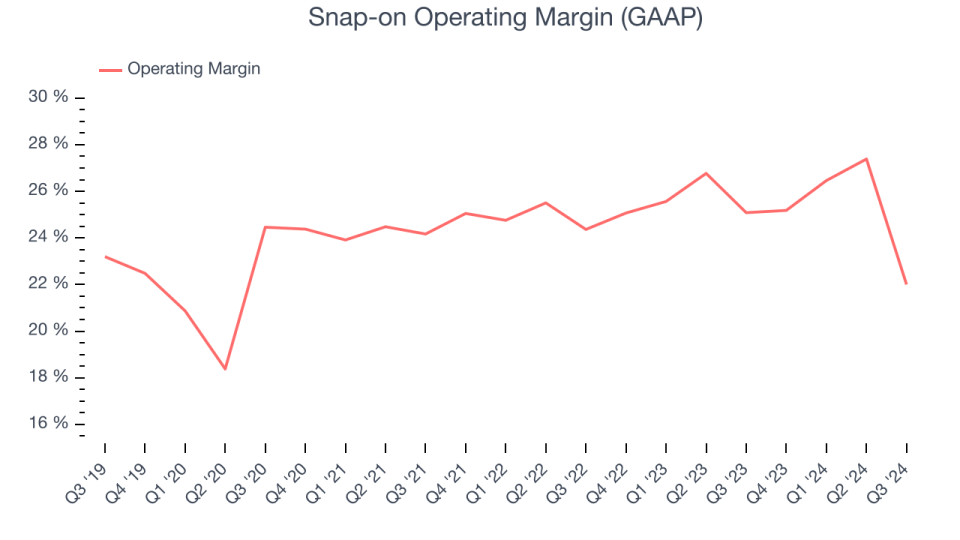

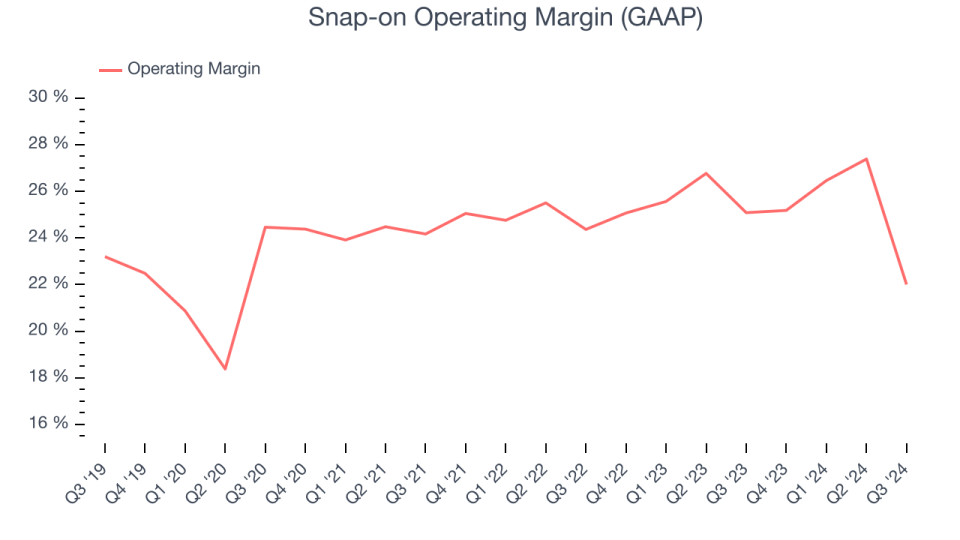

Operating Margin

Snap-on has actually been a well-oiled maker over the last 5 years. It showed elite earnings for an industrials organization, flaunting an ordinary operating margin of 24.5%. This outcome isn’t unexpected as its high gross margin offers it a beneficial beginning factor.

Checking out the fad in its earnings, Snap-on’s yearly operating margin climbed by 3.6 percent factors over the last 5 years, revealing its effectiveness has actually boosted.

This quarter, Snap-on produced an operating revenue margin of 22%, down 3.1 percent factors year on year. Considering that Snap-on’s operating margin lowered greater than its gross margin, we can think it was lately much less effective since costs such as advertising and marketing, R&D, and management expenses boosted.

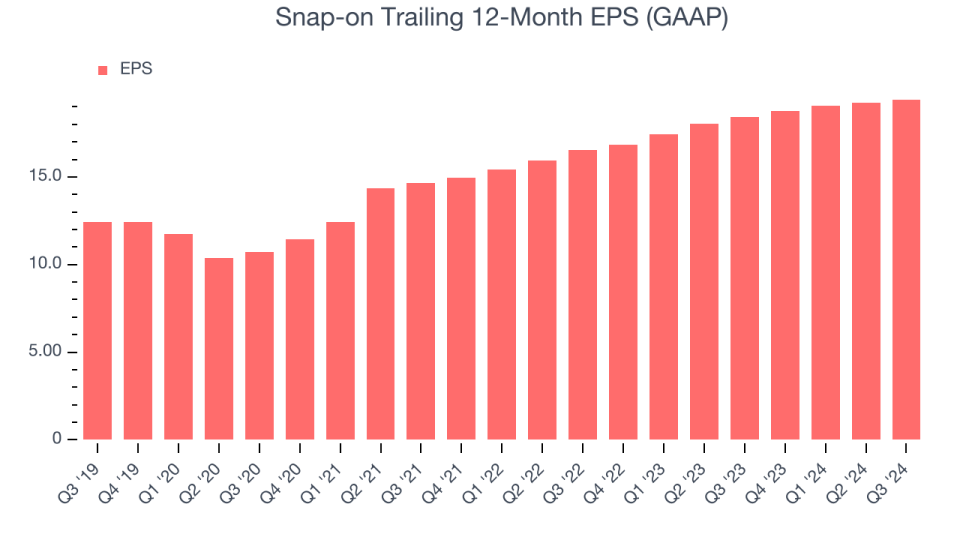

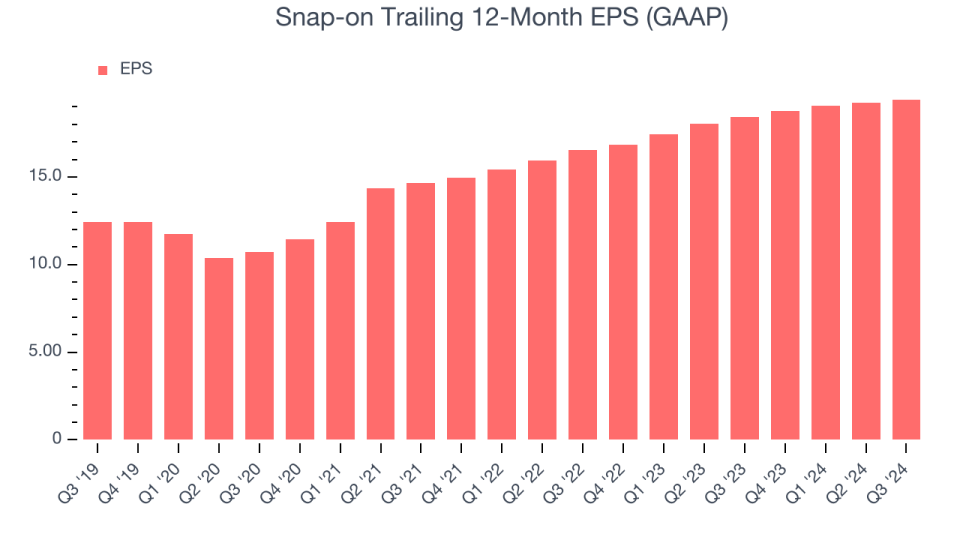

Revenues Per Share

Evaluating lasting profits fads informs us regarding a firm’s historic development, however the lasting adjustment in its revenues per share (EPS) indicate the earnings of that development– as an example, a firm might inflate its sales with extreme investing on advertising and marketing and promos.

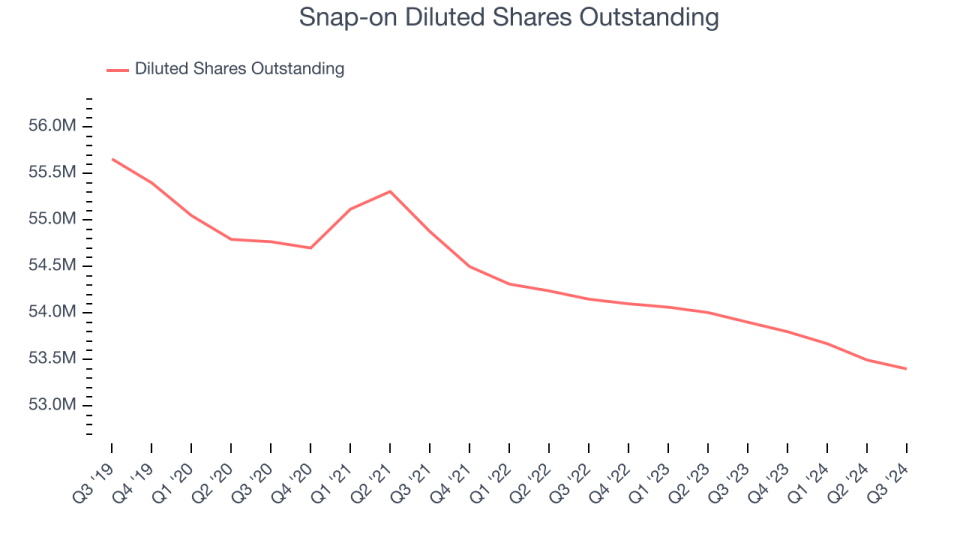

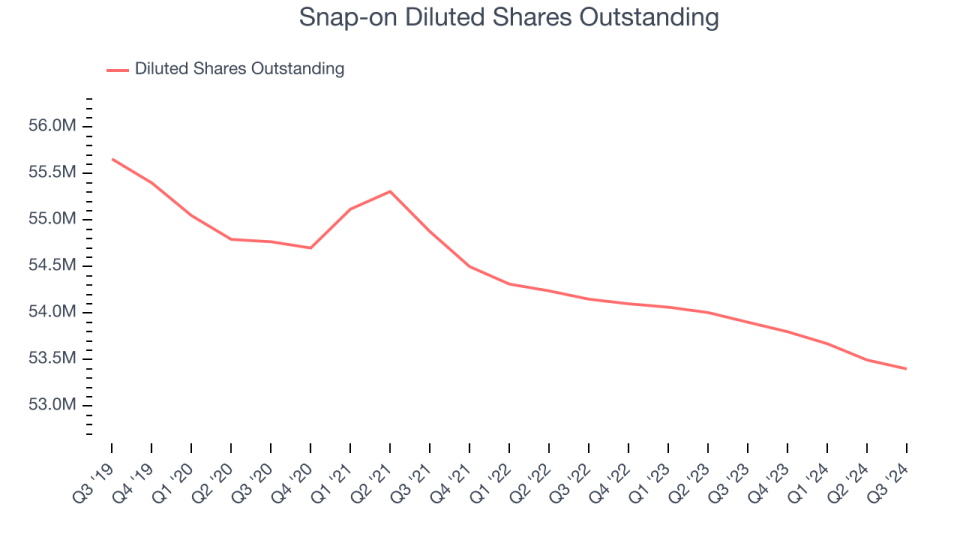

Snap-on’s EPS expanded at a good 9.3% worsened yearly development price over the last 5 years, more than its 4.2% annualized profits development. This informs us the business ended up being a lot more successful as it increased.

Diving right into Snap-on’s top quality of revenues can provide us a much better understanding of its efficiency. As we pointed out previously, Snap-on’s operating margin decreased this quarter however increased by 3.6 percent factors over the last 5 years. Its share matter likewise reduced by 4.1%, and these variables with each other declare indicators for investors since enhancing earnings and share buybacks turbocharge EPS development about profits development.

Like with profits, we evaluate EPS over a much shorter duration to see if we are missing out on an adjustment in business. For Snap-on, its two-year yearly EPS development of 8.4% resembles its five-year fad, suggesting steady revenues power.

In Q3, Snap-on reported EPS at $4.70, up from $4.51 in the very same quarter in 2014. This print defeated experts’ quotes by 2.5%. Over the following twelve month, Wall surface Road anticipates Snap-on’s full-year EPS of $19.42 to expand by 1.8%.

Trick Takeaways from Snap-on’s Q3 Outcomes

In spite of about in line reported profits, we took pleasure in seeing Snap-on go beyond experts’ natural profits assumptions this quarter. We were likewise pleased its EPS outmatched Wall surface Road’s quotes. Generally, this quarter had some essential positives. The supply stayed level at $298.42 quickly complying with the outcomes.

Is Snap-on an eye-catching financial investment possibility right now?We assume that the current quarter is simply one item of the longer-term organization top quality challenge. Top quality, when integrated with evaluation, can aid figure out if the supply is a buy.We cover that in our actionable full research report which you can read here, it’s free

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.