Steel cord maker Insteel (NYSE: IIIN) disappointed the marketplace’s earnings assumptions in Q3 CY2024, with sales dropping 14.7% year on year to $134.3 million. Its GAAP revenue of $0.24 per share was likewise 22.6% listed below experts’ agreement price quotes.

Is currently the moment to purchase Insteel? Find out in our full research report.

Insteel (IIIN) Q3 CY2024 Emphasizes:

-

Income: $134.3 million vs expert price quotes of $145.2 million (7.5% miss out on)

-

EPS: $0.24 vs expert assumptions of $0.31 (22.6% miss out on)

-

” As we move on right into 2025, we expect a progressive renovation in company problems throughout our markets,”

-

Gross Margin (GAAP): 9.1%, in accordance with the very same quarter in 2014

-

Complimentary Capital Margin: 10.8%, below 22.1% in the very same quarter in 2014

-

Market Capitalization: $573.6 million

” As we move on right into 2025, we expect a progressive renovation in company problems throughout our markets,” commented H.O. Woltz III, Insteel’s Head of state and chief executive officer.

Firm Review

Expanding from a little cord maker to among the biggest in the united state, Insteel (NYSE: IIIN) supplies steel cord strengthening items for concrete.

Industrial Structure Products

Industrial structure items business, which typically offer much more difficult tasks, can supplement their core company with higher-margin setup and consulting solutions earnings. Much more lately, breakthroughs to deal with labor accessibility and work website efficiency have actually stimulated development. Furthermore, business in the room that can generate even more energy-efficient products have chances to take share. Nevertheless, these business go to the impulse of industrial building and construction quantities, which often tend to be intermittent and can be affected greatly by financial variables such as rates of interest. Furthermore, the expenses of basic materials can be driven by a myriad of globally variables and considerably affect the success of industrial structure items business.

Sales Development

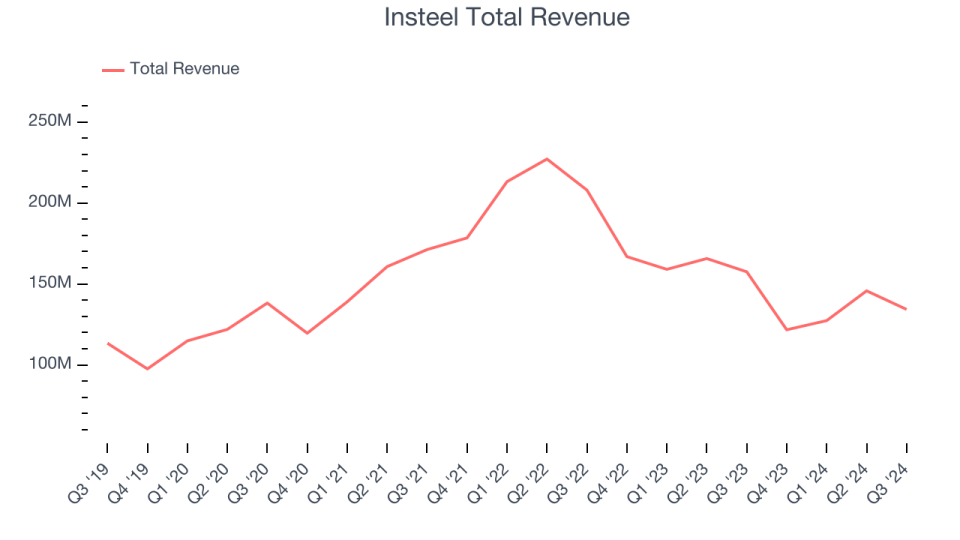

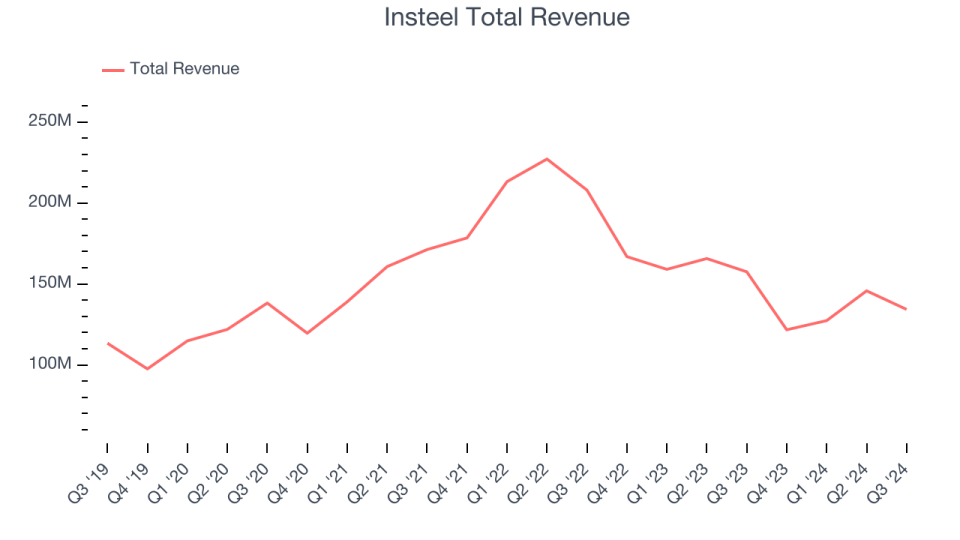

A firm’s lasting efficiency is a sign of its total company top quality. While any kind of company can experience temporary success, top-performing ones appreciate continual development for several years. Over the last 5 years, Insteel expanded its sales at a slow-moving 3% intensified yearly development price. This reveals it stopped working to increase in any kind of significant method and is a harsh beginning factor for our evaluation.

We at StockStory position one of the most focus on lasting development, however within industrials, a half-decade historic sight might miss out on cycles, market fads, or a firm maximizing stimulants such as a brand-new agreement win or an effective product. Insteel’s background reveals it expanded in the past however relinquished its gains over the last 2 years, as its earnings dropped by 20% every year. Insteel isn’t alone in its battles as the Industrial Structure Products market experienced an intermittent decline, with numerous comparable services seeing reduced sales right now.

This quarter, Insteel missed out on Wall surface Road’s price quotes and reported an instead unexciting 14.7% year-on-year earnings decrease, creating $134.3 countless earnings.

Looking in advance, sell-side experts anticipate earnings to expand 9% over the following one year, a velocity versus the last 2 years. This estimate is above-average for the market and reveals the marketplace thinks its more recent product or services will certainly sustain greater development prices.

Today’s young financiers likely have not check out the ageless lessons in Gorilla Video game: Selecting Champions In High Innovation due to the fact that it was created greater than twenty years earlier when Microsoft and Apple were initial developing their superiority. Yet if we use the very same concepts, after that business software program supplies leveraging their very own generative AI abilities might well be the Gorillas of the future. So, because spirit, we are thrilled to offer our Unique Free Record on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

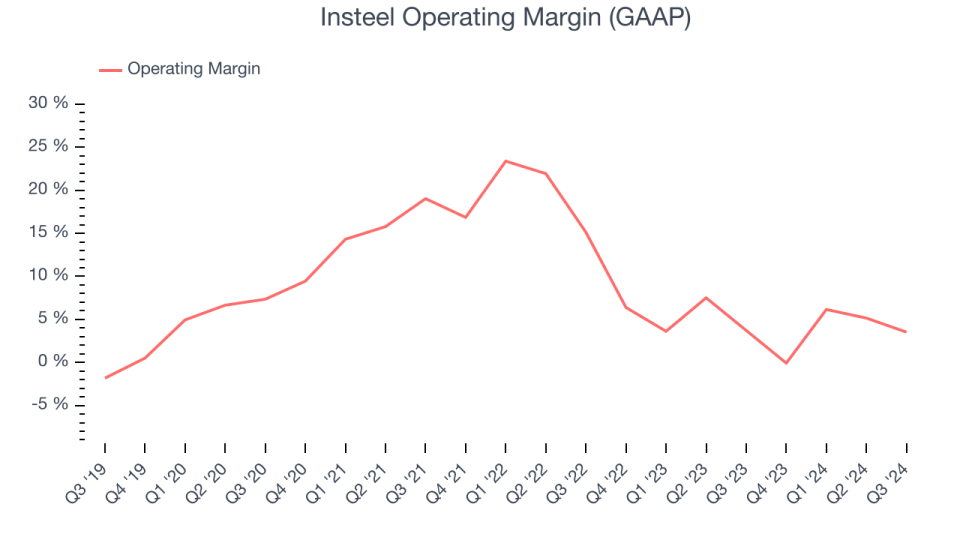

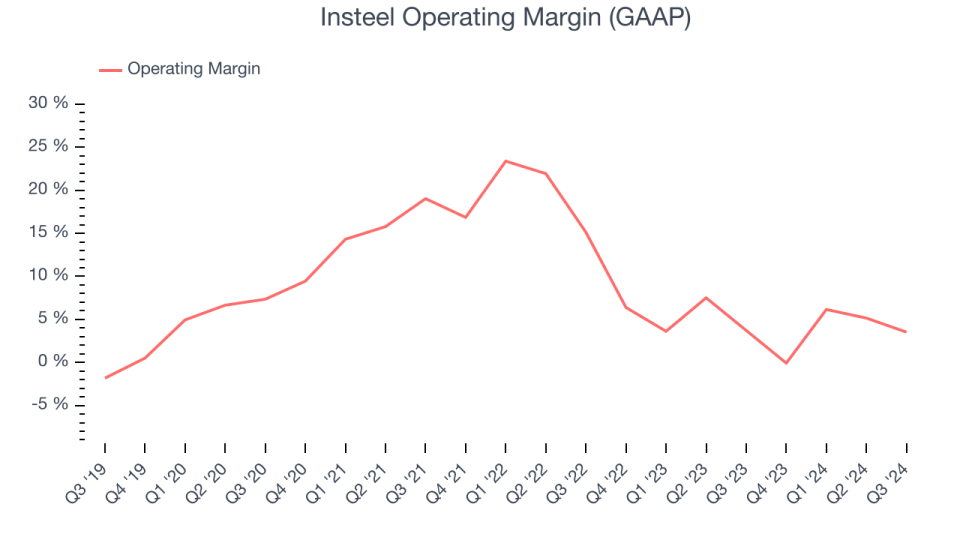

Insteel has actually handled its expense base more than the last 5 years. It showed strong success for an industrials company, generating an ordinary operating margin of 10.7%. This outcome was especially outstanding as a result of its reduced gross margin, which is mainly an aspect of what it offers and takes substantial changes to relocate meaningfully. Firms have even more control over their operating margins, and it’s a program of well-managed procedures if they’re high when gross margins are reduced.

Examining the fad in its success, Insteel’s yearly operating margin lowered by 1.4 portion factors over the last 5 years. Despite the fact that its margin is still high, investors will certainly intend to see Insteel end up being much more rewarding in the future.

This quarter, Insteel produced an operating revenue margin of 3.5%, in accordance with the very same quarter in 2014. This suggests the firm’s expense framework has actually lately been steady.

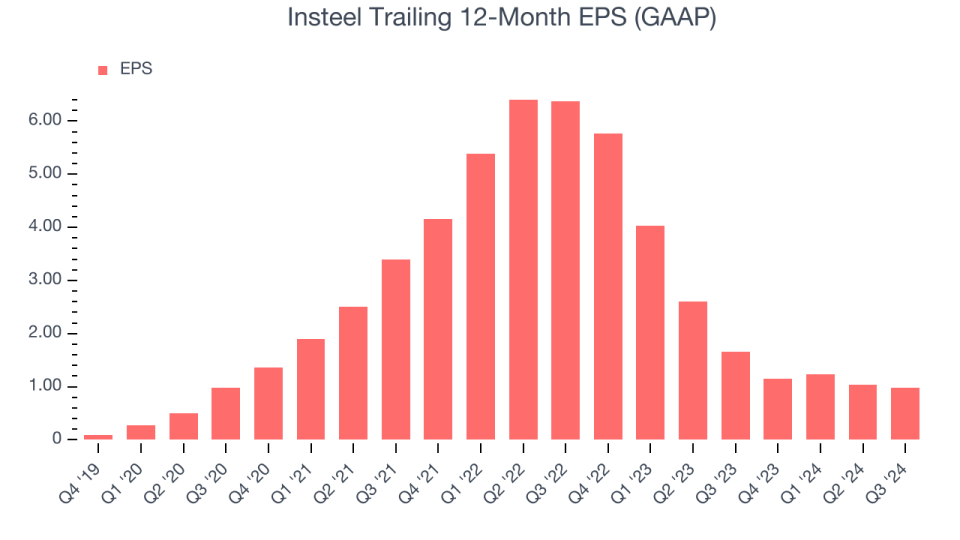

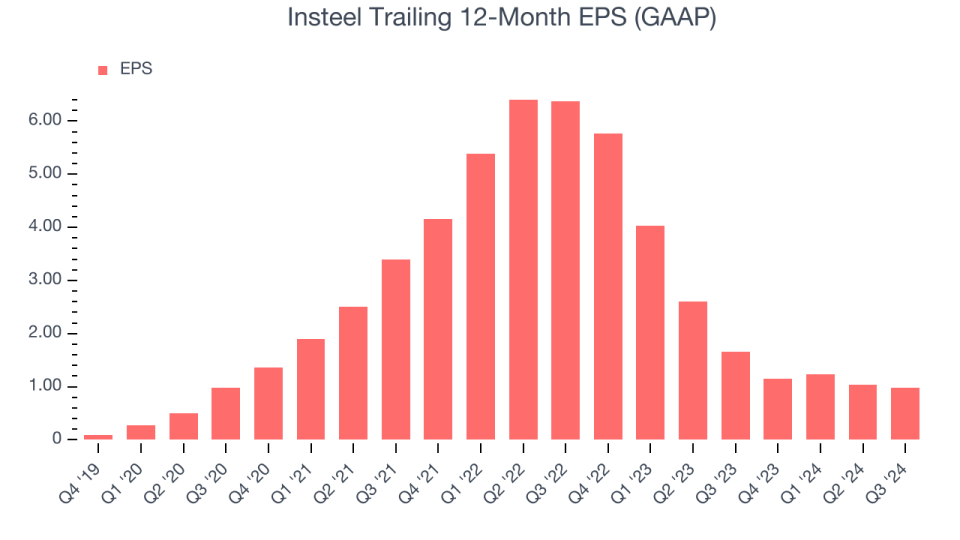

Profits Per Share

Examining lasting earnings fads informs us regarding a firm’s historic development, however the lasting adjustment in its revenues per share (EPS) indicate the success of that development– for instance, a firm can inflate its sales with extreme investing on marketing and promos.

Insteel’s EPS expanded at an impressive 68.5% intensified yearly development price over the last 5 years, more than its 3% annualized earnings development. Nevertheless, this alone does not inform us a lot regarding its everyday procedures due to the fact that its operating margin really did not increase.

Like with earnings, we assess EPS over a much shorter duration to see if we are missing out on a modification in business. Insteel’s two-year yearly EPS decreases of 60.7% misbehaved and less than its two-year earnings efficiency.

In Q3, Insteel reported EPS at $0.24, below $0.29 in the very same quarter in 2014. This print missed out on experts’ price quotes, however we care much more regarding lasting EPS development than temporary motions. Over the following one year, Wall surface Road anticipates Insteel’s full-year EPS of $0.98 to expand by 106%.

Secret Takeaways from Insteel’s Q3 Outcomes

We battled to discover numerous solid positives in these outcomes. Its earnings regrettably missed out on and its EPS disappointed Wall surface Road’s price quotes. In general, this was an average quarter. The supply traded down 10.4% to $26.43 quickly complying with the outcomes.

Insteel’s revenues record left even more to be wanted. Allow’s expect see if this quarter has actually developed a possibility to purchase the supply. We believe that the current quarter is simply one item of the longer-term company top quality challenge. Top quality, when integrated with evaluation, can assist figure out if the supply is a buy.We cover that in our actionable full research report which you can read here, it’s free

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.