Goldman Sachs (GS) third-quarter earnings rose 45% from a year ago as an increase in dealmaking raised the Wall surface Road titan.

Earnings was almost $3 billion, up from approximately $2 billion in the 3rd quarter of 2023. Financial investment financial charges were $1.8 billion, up 20% from the year-ago duration, as business provided even more financial debt and equity.

Also its consultatory charges were up somewhat many thanks to a rebirth in mergings and purchases.

Goldman’s supply climbed greater than 2% in pre-market trading Tuesday, and it has actually climbed up 28% year to day.

The outcomes supply the most up to date indicator that a two-year-long dealmaking dry spell seems finishing as the Federal Get begins to reduced rates of interest, a relocation that is anticipated to stimulate even more handle the year in advance.

Goldman’s opponents are revealing comparable increases to their Wall surface Road procedures. Financial investment financial charges at Wells Fargo (WFC) were up 37% in the 3rd quarter when contrasted to a year back, while they climbed 31% at JPMorgan (JPM). Financial Institution of America (BAC) reported Tuesday that its financial investment financial charges were up 18%.

A few other components of Goldman additionally prospered. Goldman’s trading earnings climbed 2% year over year, driven by equities deals, while possession and wide range monitoring earnings boosted 16%.

Yet Goldman did upload a pretax hit to profits of $415 million in its customer company relevant partially to a charge card collaboration with General Motors (GM) that Goldman is dropping. Barclays claimed Monday that it is purchasing that company.

The $415 million hit reveals Goldman is still in the middle of a more comprehensive retrenchment out of customer financing as it attempts to re-focus on its core expertises of dealmaking, trading and possession monitoring.

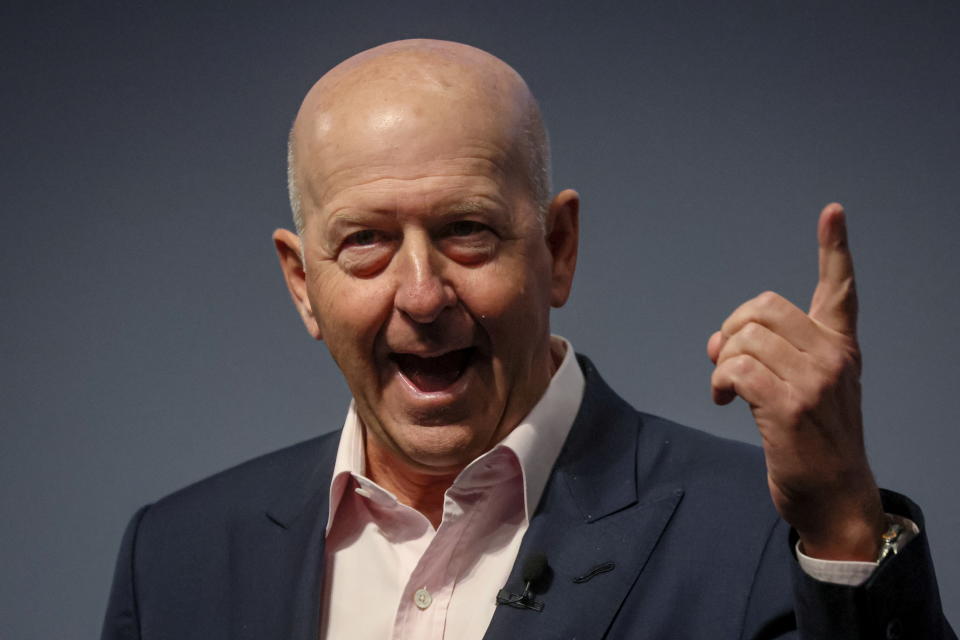

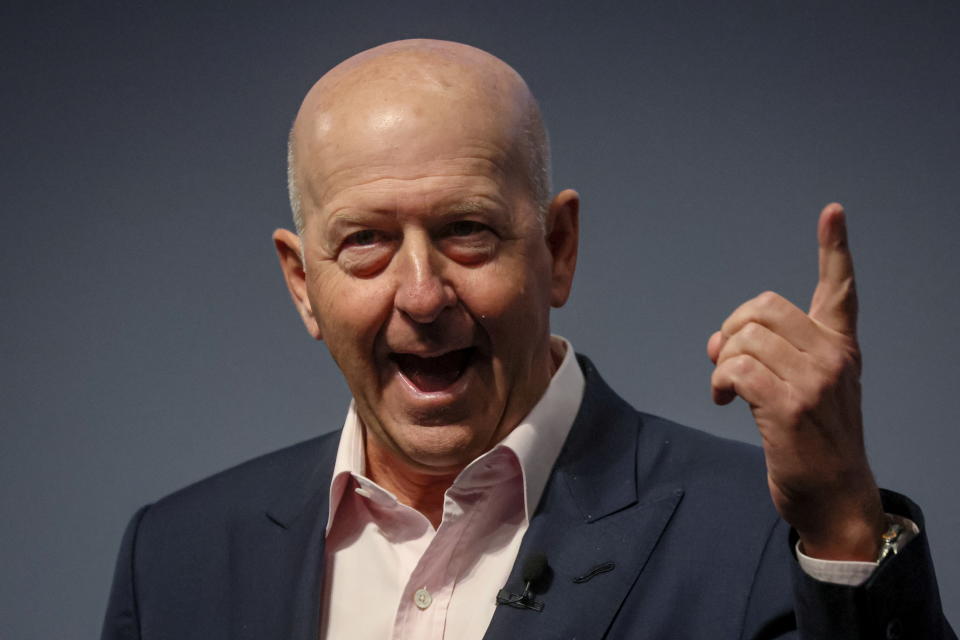

Yet it remains in a much more powerful setting than it was a year back, when chief executive officer David Solomon was coming to grips with a depression in dealmaking, the expensive leave from customer financing, and a collection of prominent separations from the company.

” Our efficiency shows the toughness of our first-rate franchise business in a boosting operating setting,” chief executive officer David Solomon claimed in a declaration.

David Hollerith is an elderly press reporter for Yahoo Money covering financial, crypto, and various other locations in financing.

Visit this site for comprehensive evaluation of the most up to date stock exchange information and occasions relocating supply rates

Review the most up to date economic and company information from Yahoo Money

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.