( Bloomberg)– A forecasted slide in Halloween usage is the most recent strike for heavily-indebted stores fighting placing expenses and the fad of customers trading to less costly items.

A Lot Of Review from Bloomberg

United States investing for the vacation will certainly visit 5% to $11.6 billion this year, according to the National Retail Federation. Sales of welcoming cards and outfits are most likely to see the best decrease, a hit to sellers reliant on seasonal splurges in what’s currently been a difficult year for the market.

Houses on the reduced end of the earnings range are extensively battling as joblessness has actually bordered higher this year and underlying rising cost of living has actually stayed constantly high. Merchant Michaels Cos. stated on a current revenues call that homes gaining much less than $100,000 are retrenching, leading to reduced basket dimensions.

” 2024 has actually been an ideal tornado for stores of all red stripes,” stated Erica Weisgerber, a companion at law office Debevoise & & Plimpton LLP. “Rising cost of living, high functional prices, and lowered customer investing have actually been specifically testing for brick-and-mortar stores, and online stores have actually had problem with high competitors from shopping titans like Amazon.”

Most of the struggling companies, consisting of Michaels and In your home Team Inc., are possessed by exclusive equity supervisors after acquistions throughout the pandemic proven untimely when rates of interest climbed and rising cost of living kinky home budget plans. Home, apparel and pastime stores control the listing of troubled stores since the dimension of their financial obligation suggests they do not have the liquidity to take on far better capitalized rivals, according to Moody’s Scores.

Still, Michaels and In your home are enthusiastic that they can win a bigger piece of the vacation investing. Hellman & & Friedman LLC’s In your home saw a solid beginning to Halloween investing after level second-quarter web sales of around $443 million, primary monetary police officer Jerry Murray stated on a September revenues phone call.

Beauty Global Monitoring Inc.’s Michaels likewise saw an income pop connected to Halloween as clients started to get supply previously this year, according to individuals on last month’s revenues phone call. That’s a fillip for the company whose revenues decreased by around 20% to $50 million in the 2nd quarter from a year previously, individuals stated, asking not to be recognized as the info is exclusive.

Beauty and Hellman & & Friedman decreased to comment.

The pullback is producing obstacles for the bigger market and has actually added to numerous prominent personal bankruptcies this year, consisting of Joann Inc., Big Lots Inc. and Conn’s Inc. It likewise makes it more challenging to reverse companies merely by reducing prices.

” Merchants are discovering that their low-hanging performance initiatives do not go much sufficient,” stated Holly Etlin, a companion in AlixPartners’ turn-around technique.

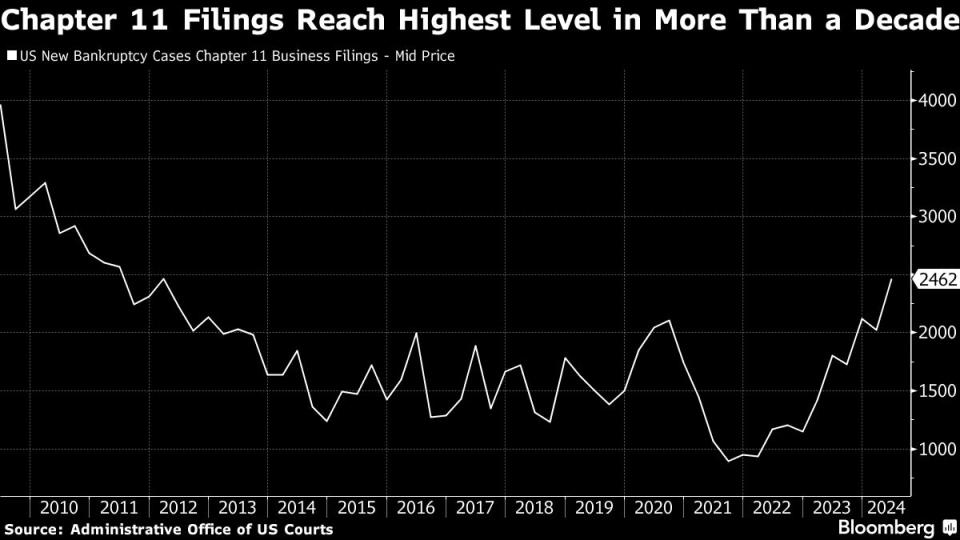

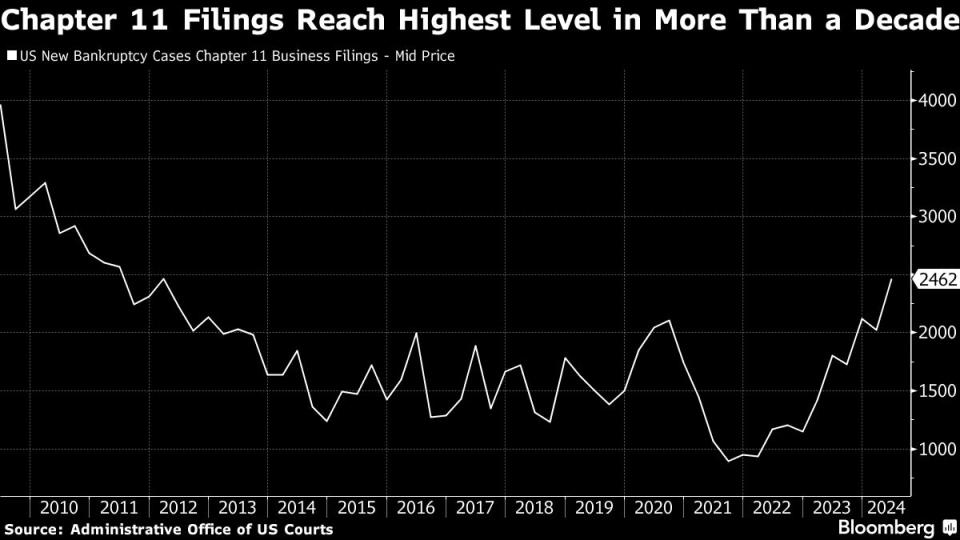

With resources markets rejecting struggling companies, even more stores transformed to insolvency instead of troubled exchanges over the previous year as the business need much deeper restructuring that is best carried out in court, Moody’s Scores stated in a record last month. It belongs to a broader fad that saw quarterly filings for Phase 11 insolvency security surge to the highest degree because 2012 in the 3 months with June.

Personal equity’s prevalent failing to hedge versus increasing loaning prices likewise suggests it’s much less able ahead to the rescue of struggling companies, which can have ripple effects for the economic situation and tasks.

” The exclusive equity gamers that frequently have actually backstopped stores have actually remained in a brand-new offer time-out as multiples broke down and prices for leveraged bargains increased,” stated James Gellert, executive chair in danger analytics carrier RapidRatings International Inc.

Week in Evaluation

-

China’s onshore high-yield financial obligation market today endured its worst day of trading in years as financiers drew cash out of bonds and put it right into supplies in feedback to federal government stimulation. At the same time, residential designer Nation Yard Holdings Co. missed out on a self-imposed time frame for obtaining essential lender assistance for regards to its restructuring strategy.

-

Inflows to exclusive debt funds assisted BlackRock Inc. draw in a document $221 billion of complete customer cash money last quarter, bringing the globe’s biggest cash supervisor to an all-time high of $11.5 trillion of possessions.

-

A possible bidding process battle for HPS Financial investment Allies is readied to swell the ton of money of its 3 creators as competing teams try an item of the heated exclusive debt market.

-

A team of exclusive debt companies consisting of 26North Allies are surrounding an offer to offer to View Equity Partners-backed Alegeus Technologies, after the software application company attempted to re-finance existing financial obligation with a brand-new leveraged financing.

-

Financial institutions led by UBS Team AG marketed $1 billion of leveraged financings to assist fund View Equity Allies’ acquistion of software application firm Jaggaer, the marketplace’s most current purchase offer to consist of a second-lien part. In Europe, Blackstone Inc. is buying a C$ 1.125 billion ($ 822 million) second-lien tranche that is aiding fund AutoScout24’s acquisition of Canadian on-line vehicle industry Investor.

-

K2 Insurance coverage Solutions marketed a bigger-than-planned leveraged financing as the company reduces loaning prices on buyout-related funding by 3 percent factors.

-

Verizon Communications Inc. aligned $10 billion of temporary financial institution financing to assist fund its acquisition of Frontier Communications Moms And Dad Inc.

-

If reduced to scrap condition, Boeing Co. will certainly be the greatest United States business debtor to ever before be removed of its investment-grade scores and sign up with scrap bond indexes, swamping the high-yield market with a document quantity of brand-new financial obligation to soak up.

-

A market for airplane bonds that just about closed down after Russia’s intrusion of Ukraine is revealing indications of life once more.

-

Japan’s Norinchukin Financial institution obtained a ballot of self-confidence from bond financiers on Wednesday, when spreads on the company’s initial buck issuance because it disclosed huge losses tightened up dramatically in additional trading.

-

Gritstone Biography Inc., an injection designer that when promoted its capacity to make a next-generation Covid-19 shot, applied for Phase 11 insolvency in Delaware.

-

Avante Wellness Solutions applied for insolvency in order to market its organization to an associate of exclusive equity company Staple Road Resources.

On the Relocate

-

John Abate, companion and co-head of trading at Silver Factor Resources, is readied to retire by the end of the year after greater than 15 years at the bush fund.

-

Wells Fargo & & Co. is employing Celine Catherin from Deutsche Financial Institution AG as a handling supervisor and co-head of its leveraged distribute.

-

Joshua Baumgarten, co-managing companion and head of debt at TPG Angelo Gordon, is leaving the company after its acquisition in 2015 by TPG Inc.

-

JPMorgan Chase & & Co. has actually employed Mike Shanahan from Goldman Sachs Team Inc. as a handling supervisor in its innovation leveraged money group.

-

Corinthia Global Monitoring has actually hired 3 even more individuals from Barings after poaching a 22-strong group from the United States property supervisor previously this year. The triad are Louis Godest, Christel Huguet and Jan Lübke.

-

JPMorgan Chase & & Co. expert Doug Kravitz signed up with M3 Allies as a handling supervisor concentrated on recommending firm financial institutions in reorganizing situations.

-

Barclays Plc has actually advertised Harry Mateer to head of Americas set earnings, money and products research study. Mateer formerly led the financial institution’s Americas debt research study group.

— With support from Dan Wilchins.

A Lot Of Review from Bloomberg Businessweek

© 2024 Bloomberg L.P.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.