Oil prolonged its gains on Monday following its greatest once a week gain in greater than a year in expectancy of an Israeli revenge versus Iran after recently’s rocket strike.

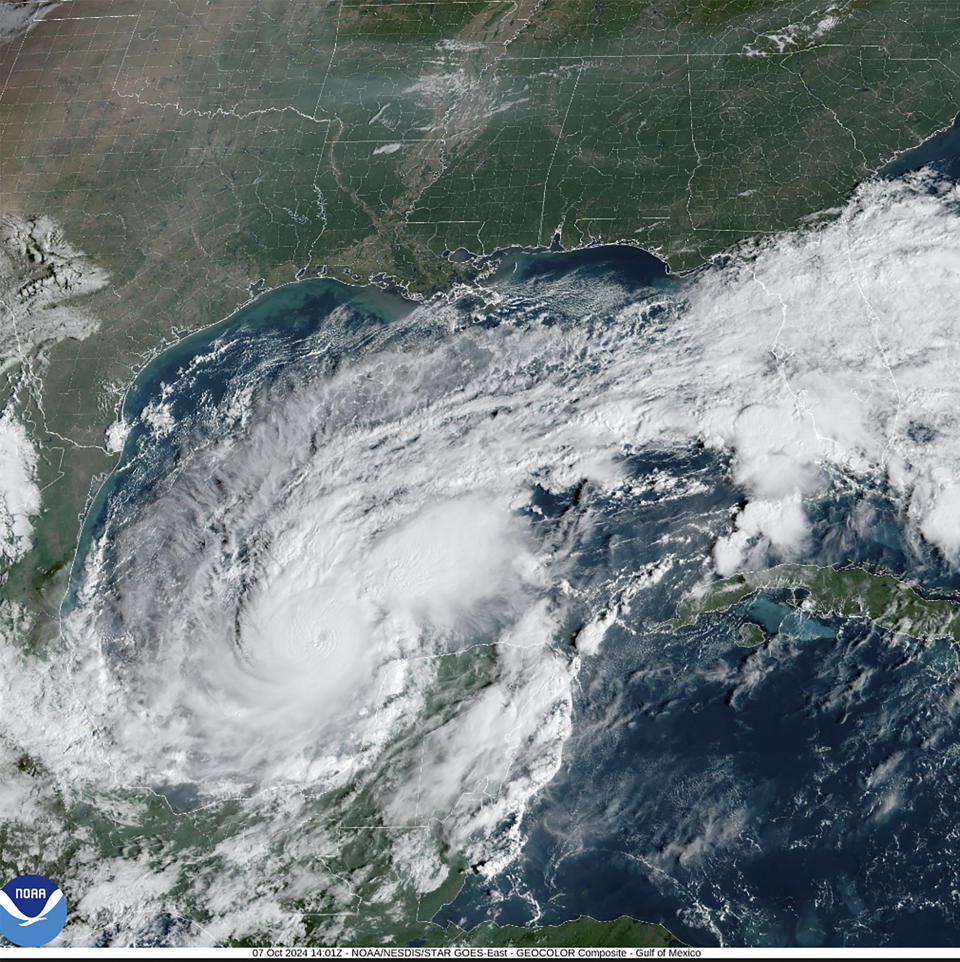

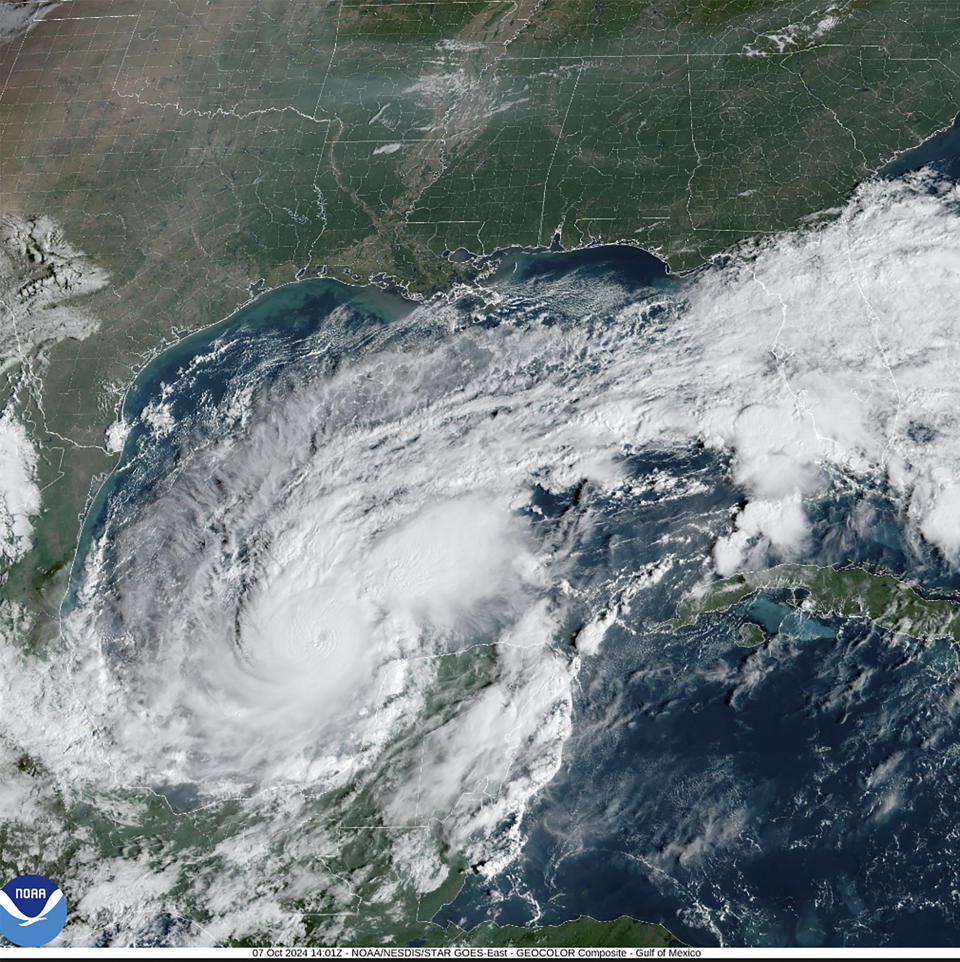

Independently, Storm Milton headed in the direction of Florida off the gulf of Mexico reinforced to Group 5, likewise aiding gas greater crude rates.

West Texas Intermediate (CL= F) progressed greater than 3% to shut at $77.14 per barrel after acquiring greater than 9% recently. Brent (BZ= F), the global benchmark cost, likewise progressed greater than 3.5% to work out at $80.93.

Tel Aviv has actually promised to strike back after Iran introduced some 200 ballistic rockets towards Israel last Tuesday. Oil futures have actually been carrying on conjecture of whether that revenge will certainly consist of targeting Iran’s oil facilities.

” The Iranian armed force has actually reacted by claiming any type of strike from Israel would certainly activate yet a more powerful action from Iran, so the geopolitical phases impact on crude remains to expand,” Dennis Kissler, BOK Financial’s elderly vice head of state of trading, composed on Monday.

Throughout Friday’s session, oil pared gains after Head of state Biden prevented Israel from targeting Iran’s oil areas. The comments came a day after unrefined leapt greater than 5% after the head of state appeared to recommend that the United States was going over such an opportunity with Israel.

Iran generates greater than 3 million barrels of oil a day. Disrupting supply would send out rates higher while removing deliveries on the Straight of Hormuz, a chokepoint for unrefined deliveries, would certainly trigger a lot more higher stress, according to experts.

” If there’s a grip there, and there’s a significant obstruction or significant hold-ups, we must remove $80[for Brent] That is mosting likely to press oil rates dramatically greater. That is a video game changer,” Blue Line Futures creator Expense Baruch informed Yahoo Money recently.

Nonetheless, experts indicate extra capability anticipated to find onto the marketplace from the Company of the Oil Exporting Countries (OPEC). The oil partnership has actually suggested it will certainly begin taking a break volunteer manufacturing cuts in December.

Under 2 theoretical circumstances where Iran’s oil supply is disrupted by either 2 million or 1 million barrels daily, Goldman Sachs sees Brent getting to an optimal of $90 or the mid-$ 80s, specifically, supplied that OPEC swiftly offsets the deficiency.

The company forecasts in the lack of significant interruptions to oil supply between East, Brent will certainly remain to sell the $70-$ 85 array, with an ordinary cost of $77 per barrel in the 4th quarter of 2024.

The opportunity of disruptions from Storm Milton in the gulf of Mexico has actually likewise maintained unrefined markets anxious.

Chevron (CVX) said it left all workers from its Blind Belief system in the united state Gulf of Mexico and shut-in the center to prepare for Milton.

Although Florida’s west coastline might see the most awful winds and rainfall from Milton considering that 2017, the harsh climate is anticipated to miss out on “many oil and gas manufacturing systems,” stated Bok Financial’s Kissler.

Ines Ferre is an elderly company press reporter for Yahoo Money. Follow her on Twitter at @ines_ferre.

Go Here for the most up to date securities market information and thorough evaluation, consisting of occasions that relocate supplies

Review the most up to date monetary and company information from Yahoo Money

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.