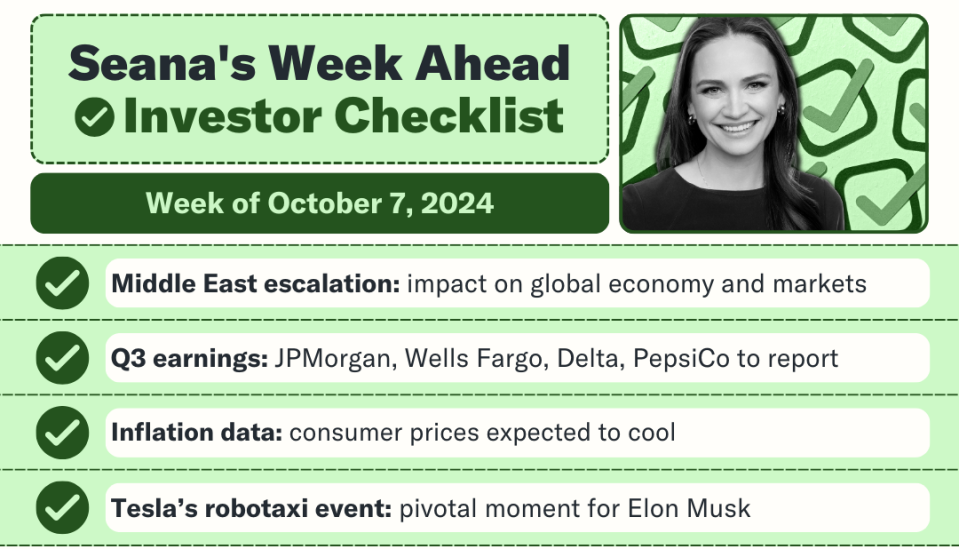

Oil might obtain an additional run as fluid gold.

Crude (CL= F) futures rose 9% recently– its greatest once a week gain because March 2023– driven by intensifying stress in the center East.

Israel’s oath to strike back versus Iran’s projectile assault has actually triggered even more investors to bank on $100 oil, pressing favorable Brent petroleum wagers to a 5-week high.

I had an opportunity to talk with Rystad Power’s Claudio Galimberti, that informed me investors are “plainly considering the threat of a large supply interruption” as stress in the center East climb to “among the highest degree in 4 years.”

Iran is a significant gamer in the worldwide oil market, generating greater than 3 million barrels of oil a day, so the expanding threat of a supply interruption can be a “huge tailwind to costs” in the close to term, according to Blue Line Futures’ Costs Baruch.

” That’s mosting likely to press petroleum costs dramatically greater. That is a video game changer,” Baruch cautioned.

If you’re seeking methods to hedge versus the threat of supply interruption, Galimberti sees Exxon Mobil (XOM), Chevron (CVX), and Covering (SHEL) amongst the “clear recipients” because of restricted direct exposure to the Center East.

Evaluating by the supply relocates this previous week, it appears like Wall surface Road concurs. Exxon shares rose 7.8% to a perpetuity high, while Chevron climbed up 3.6%.

Wall Surface Road has actually been attempting to analyze the threat of a feasible more comprehensive dispute. One situation being gone over is the possible clog of the Strait of Hormuz, an essential passage and center for the worldwide oil market, which makes up almost 30% of globe oil profession.

It’s a prospective hazard that Wall surface Road pros will certainly be checking carefully in the days ahead.

Goldman Sachs’s Jenny Grimberg resembled the climbing threat of substantial interruptions, creating in a note recently that the “greatest effects of the dispute are most likely ahead with a disturbance in power materials, with a prospective closure of the Strait of Hormuz most likely to cause a considerable additional surge in oil costs, which, subsequently, can place restored higher stress on rising cost of living and evaluate on development.”

Goldman price quotes Brent can come to a head around $90 per barrel if OPEC transfers to quickly counter a disturbance of 2 million barrels daily for 6 months. Nevertheless, if OPEC does stagnate to support a shortage, the group sees costs coming to a head in the mid $90s.

And pros caution the after effects from any type of additional rise in the center East can spread out much past the power market. Wells Fargo Financial investment Institute’s Paul Christopher claims a broader dispute will certainly motivate financiers to rearrange right into “viewed sanctuaries.”

” It is most likely to cause admiration in the united state buck, Japanese yen, and Swiss franc; greater product and 10-year united state Treasury note costs; and reduced equity markets,” Christopher composed in a customer note recently.

Seana Smith is a support at Yahoo Financing. Adhere To Smith on Twitter@SeanaNSmith Tips on bargains, mergings, lobbyist scenarios, or anything else? Email seanasmith@yahooinc.com.

Click on this link for comprehensive evaluation of the current stock exchange information and occasions relocating supply costs

Check out the current economic and service information from Yahoo Financing

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.