Completion of the revenues period is constantly a great time to take a go back and see that radiated (and that not a lot). Allow’s have a look at exactly how cybersecurity supplies made out in Q2, beginning with Tenable (NASDAQ: TENB).

Cybersecurity remains to be just one of the fastest-growing sections within software application completely factor. Virtually every business is gradually locating itself coming to be a modern technology business and dealing with increasing cybersecurity threats. Companies are speeding up fostering of cloud-based software application, relocating information and applications right into the cloud to conserve expenses while boosting efficiency. This movement has actually opened them to a wide range of brand-new risks, like workers accessing information using their mobile phone while on an open network, or logging right into an online user interface from a laptop computer in a brand-new place.

The 9 cybersecurity supplies we track reported a slower Q2. En masse, earnings defeated experts’ agreement quotes by 1.8% while following quarter’s profits advice remained in line.

Rising cost of living advanced in the direction of the Fed’s 2% objective just recently, leading the Fed to minimize its plan price by 50bps (half a percent or 0.5%) in September 2024. This is the initial cut in 4 years. While CPI (rising cost of living) analyses have actually been encouraging recently, work actions have actually approached uneasy. The marketplaces will certainly be discussing whether this price cut’s timing (and extra possible ones in 2024 and 2025) is suitable for sustaining the economic situation or a little bit far too late for a macro that has actually currently cooled down way too much.

While some cybersecurity supplies have actually gotten on rather far better than others, they have actually jointly decreased. Usually, share rates are down 3.2% given that the most recent revenues outcomes.

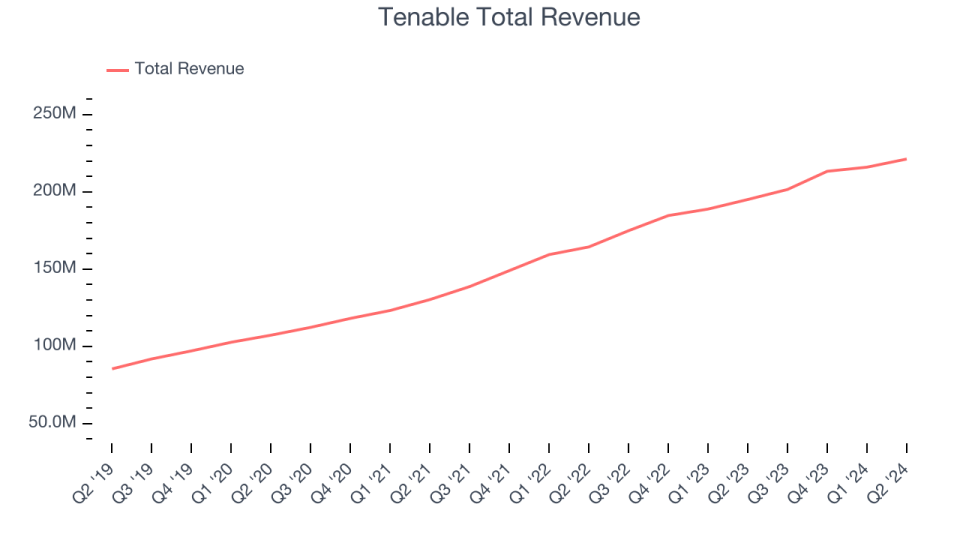

Weakest Q2: Tenable (NASDAQ: TENB)

Established In 2002 by 3 cybersecurity professionals, Tenable (NASDAQ: TENB) supplies software application as a solution that assists business recognize where they are revealed to cyber protection threat and exactly how to minimize it.

Tenable reported earnings of $221.2 million, up 13.4% year on year. This print went beyond experts’ assumptions by 1.2%. Regardless of the top-line beat, it was still an unsatisfactory quarter for the business with underwhelming profits advice for the following quarter and a miss out on of experts’ ARR (yearly reoccuring profits) quotes.

” We provided better-than-expected profits, running revenue and unlevered capital in Q2,” stated Amit Yoran, Chairman and Chief Executive Officer of Tenable.

Unsurprisingly, the supply is down 13.9% given that reporting and presently trades at $39.61.

Is currently the moment to acquire Tenable? Access our full analysis of the earnings results here, it’s free.

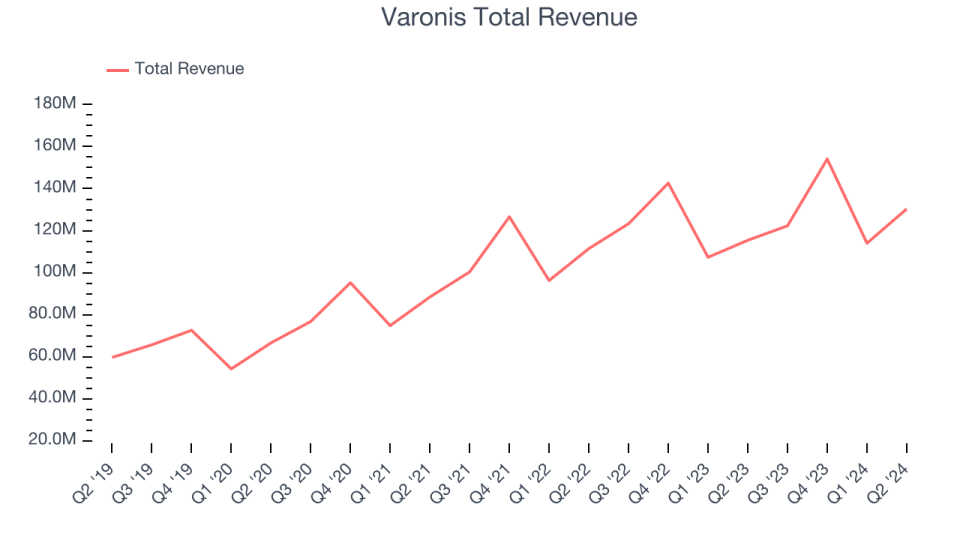

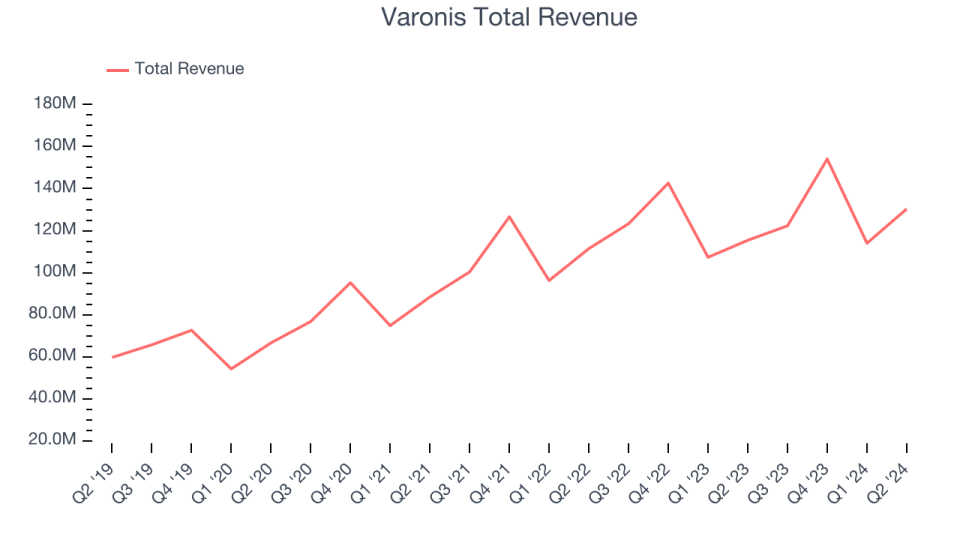

Ideal Q2: Varonis (NASDAQ: VRNS)

Started by a duo of previous Israeli Protection Forces cyber war designers, Varonis (NASDAQ: VRNS) provides software-as-service that assists clients safeguard information from cyber risks and obtain exposure right into exactly how business information is being made use of.

Varonis reported earnings of $130.3 million, up 12.9% year on year, outshining experts’ assumptions by 4.4%. Business had a really solid quarter with a remarkable beat of experts’ payments quotes and hopeful profits advice for the following quarter.

Varonis attained the highest possible full-year advice raising amongst its peers. The marketplace appears pleased with the outcomes as the supply is up 14.8% given that coverage. It presently trades at $55.59.

Is currently the moment to acquire Varonis? Access our full analysis of the earnings results here, it’s free.

CrowdStrike (NASDAQ: CRWD)

Started by George Kurtz, the previous CTO of the anti-viruses business McAfee, CrowdStrike (NASDAQ: CRWD) supplies cybersecurity software application that safeguards business from violations and assists them discover and react to cyber strikes.

CrowdStrike reported earnings of $963.9 million, up 31.7% year on year, in accordance with experts’ assumptions. It was a softer quarter as it published underwhelming profits advice for the following quarter and a miss out on of experts’ payments quotes.

CrowdStrike provided the weakest full-year advice upgrade in the team. Remarkably, the supply is up 8% given that the outcomes and presently trades at $285.22.

Read our full analysis of CrowdStrike’s results here.

Rapid7 (NASDAQ: RPD)

Established In 2000 with the concept that network protection comes prior to endpoint protection, Rapid7 (NASDAQ: RPD) supplies software application as a solution that assists business recognize where they are revealed to cyber protection threats, promptly discover violations and react to them.

Rapid7 reported earnings of $208 million, up 9.2% year on year. This outcome covered experts’ assumptions by 1.9%. Taking a go back, it was a combined quarter as it additionally generated speeding up consumer development however a miss out on of experts’ payments quotes.

The business included 22 clients to get to a total amount of 11,484. The supply is up 15.3% given that reporting and presently trades at $38.12.

Read our full, actionable report on Rapid7 here, it’s free.

Palo Alto Networks (NASDAQ: PANW)

Established In 2005 by cybersecurity designer Nir Zuk, Palo Alto Networks (NASDAQ: PANW) makes software and hardware cybersecurity items that safeguard business from cyberattacks, violations, and malware risks.

Palo Alto Networks reported earnings of $2.19 billion, up 12.1% year on year. This print covered experts’ assumptions by 1.2%. It was a sufficient quarter as it additionally installed a good beat of experts’ payments quotes.

The supply is down 2.3% given that reporting and presently trades at $335.16.

Read our full, actionable report on Palo Alto Networks here, it’s free.

Sign Up With Paid Supply Capitalist Research Study

Assist us make StockStory extra handy to capitalists like on your own. Join our paid individual study session and get a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.