As the Q2 revenues period ends, it’s time to analyze this quarter’s ideal and worst entertainers in the repair and maintenance representatives market, consisting of International Industrial (NYSE: GIC) and its peers.

Supply chain and stock administration are motifs that expanded in emphasis after COVID ruined the international motion of basic materials and parts. Repair and maintenance representatives that flaunt trusted option and rapidly provide items to clients can take advantage of this motif. While shopping hasn’t interrupted commercial circulation as long as customer retail, it is still an actual risk, compeling financial investment in omnichannel capacities to offer clients all over. Furthermore, repair and maintenance representatives go to the impulse of financial cycles that influence the capital expense and building jobs that can juice need.

The 8 repair and maintenance representatives supplies we track reported a blended Q2. En masse, earnings remained in line with experts’ agreement quotes.

The Fed reduced its plan price by 50bps (half a percent) in September 2024, the initial in about 4 years. This notes completion of its most sharp inflation-busting project considering that the 1980s. While CPI (rising cost of living) analyses have actually been encouraging recently, work steps have actually verged on uneasy. The marketplaces will certainly be examining whether this price cut’s timing (and extra possible ones in 2024 and 2025) is optimal for sustaining the economic climate or a little bit far too late for a macro that has actually currently cooled down excessive.

Due to this information, repair and maintenance representatives supplies have actually held stable with share rates up 1.2% generally considering that the most up to date revenues outcomes.

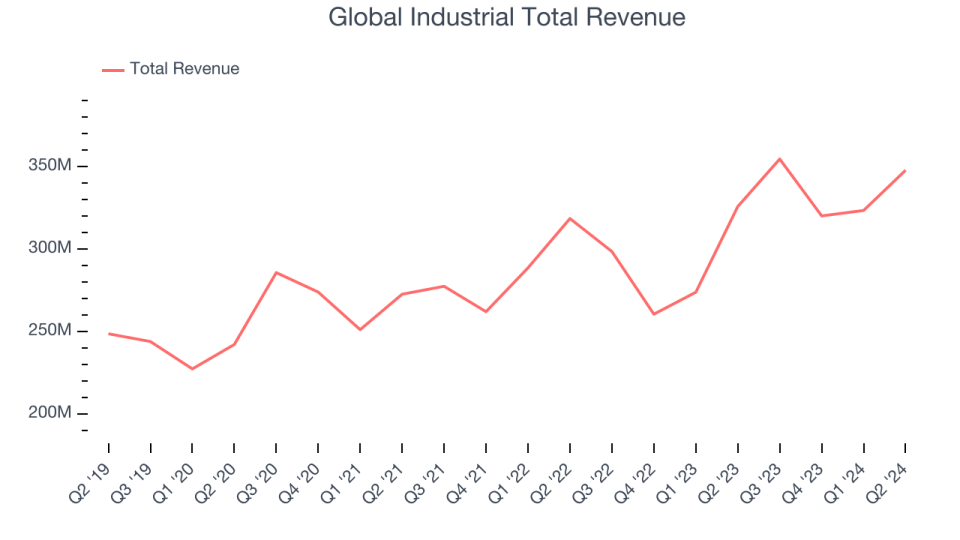

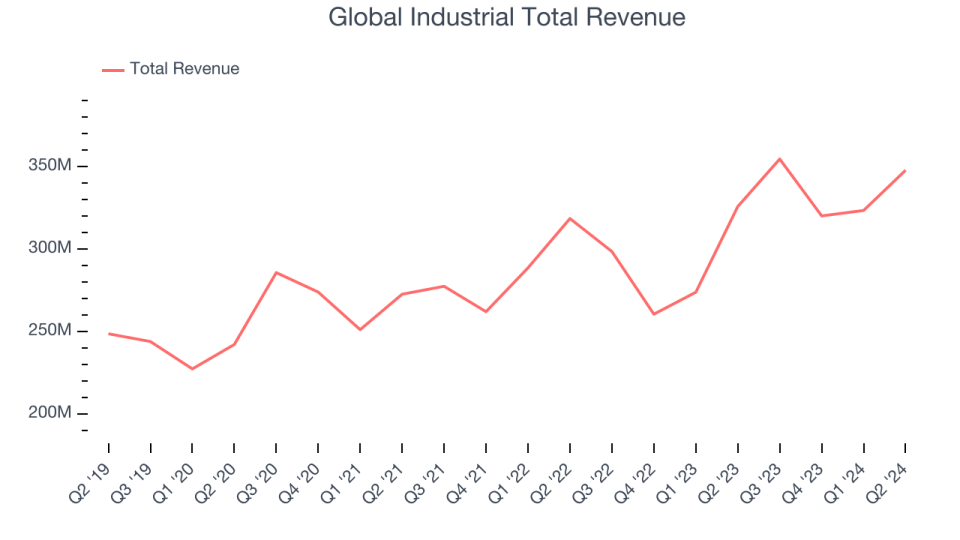

International Industrial (NYSE: GIC)

Previously called Systemax, Global Industrial (NYSE: GIC) disperses commercial and industrial items to services and organizations.

International Industrial reported earnings of $347.8 million, up 6.8% year on year. This print remained in line with experts’ assumptions, however generally, it was a blended quarter for the business with a slim beat of experts’ revenues quotes.

Richard Leeds, Exec Chairman of the Board, claimed, “2nd quarter earnings boosted 6.8% and on a natural basis earnings was up 1.8%. We were pleased with leading line results offered the present market cycle and the soft need atmosphere. Throughout the quarter we saw an extension of mindful client buying actions and combined earnings efficiency on a month-to-month basis. Gross margin enhanced both a previous year and consecutive quarter basis, while our fundamental mirrored intended financial investments in essential development campaigns throughout client experience, advertising and sales.”

Unsurprisingly, the supply is down 8.6% considering that reporting and presently trades at $32.76.

Read our full report on Global Industrial here, it’s free

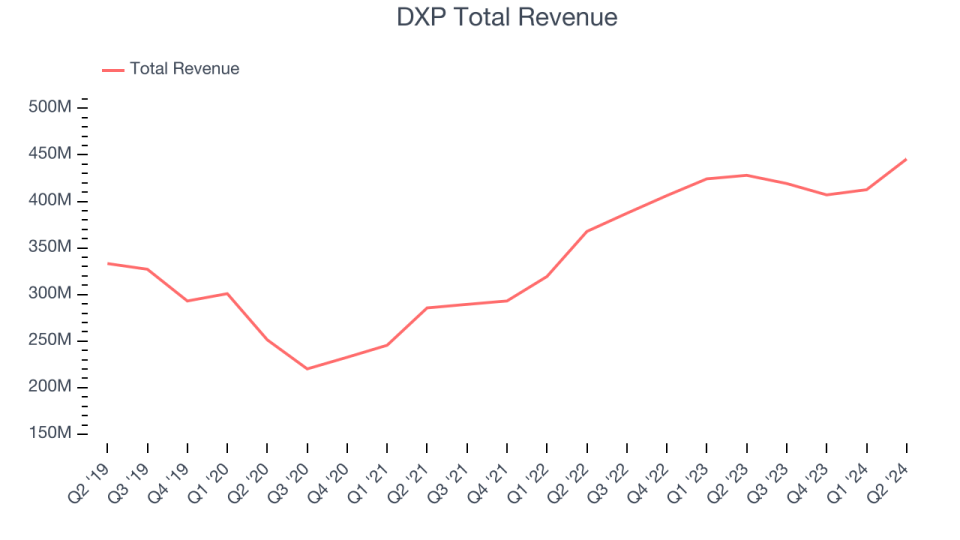

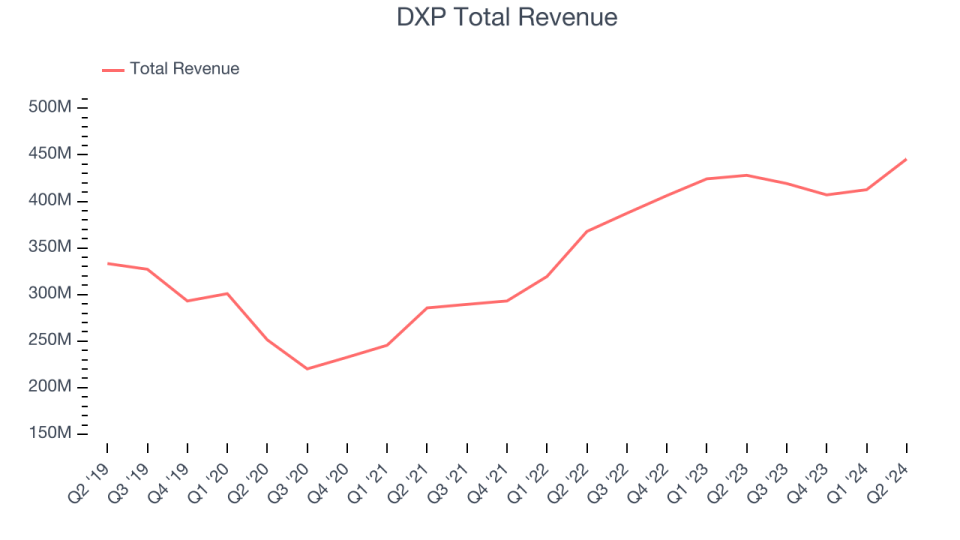

Finest Q2: DXP (NASDAQ: DXPE)

Started throughout the introduction of Big Oil in Texas, DXP (NASDAQ: DXPE) offers pumps, shutoffs, and various other commercial parts.

DXP reported earnings of $445.6 million, up 4.1% year on year, outmatching experts’ assumptions by 2.7%. Business had a spectacular quarter with a remarkable beat of experts’ revenues quotes.

DXP racked up the largest expert approximates defeat amongst its peers. The marketplace appears delighted with the outcomes as the supply is up 6.9% considering that coverage. It presently trades at $51.06.

Is currently the moment to purchase DXP? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: WESCO (NYSE: WCC)

Based in Pittsburgh, WESCO (NYSE: WCC) offers electric, commercial, and interactions items and boosts them with solutions such as supply chain administration.

WESCO reported earnings of $5.48 billion, down 4.6% year on year, disappointing experts’ assumptions by 1.5%. It was an unsatisfactory quarter as it published a miss out on of experts’ revenues quotes.

As anticipated, the supply is down 5.9% considering that the outcomes and presently trades at $164.60.

Read our full analysis of WESCO’s results here.

Circulation Solutions (NASDAQ: DSGR)

Established In 1952, Circulation Solutions (NASDAQ: DSGR) offers supply chain options and disperses commercial, safety and security, and upkeep items to numerous markets.

Circulation Solutions reported earnings of $439.5 million, up 16.3% year on year. This print fulfilled experts’ assumptions. Much more generally, it was a softer quarter as it logged a miss out on of experts’ revenues quotes.

Circulation Solutions provided the fastest earnings development amongst its peers. The supply is up 10.4% considering that reporting and presently trades at $37.01.

Read our full, actionable report on Distribution Solutions here, it’s free.

Fastenal (NASDAQ: FAST)

Established In 1967, Fastenal (NASDAQ: FAST) offers commercial and building materials, consisting of bolts, devices, safety and security items, and several various other item classifications to services worldwide.

Fastenal reported earnings of $1.92 billion, up 1.8% year on year. This outcome fulfilled experts’ assumptions. Zooming out, it was a blended quarter as it additionally taped a slim beat of experts’ revenues quotes however a miss out on of experts’ operating margin quotes.

The supply is up 9.9% considering that reporting and presently trades at $70.54.

Read our full, actionable report on Fastenal here, it’s free.

Sign Up With Paid Supply Capitalist Study

Assist us make StockStory extra handy to capitalists like on your own. Join our paid customer research study session and get a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.