Reflecting on cord and satellite supplies’ Q2 profits, we analyze this quarter’s finest and worst entertainers, consisting of WideOpenWest (NYSE: WOW) and its peers.

The huge physical impacts of fiber in the ground or satellites precede make it testing for business in this sector to get used to moving customer practices. Over the last decade-plus, customers have ‘reduce the cable’ to their typical cord registrations for streaming choices. While that is a headwind, this fondness to streaming indicates even more houses require high-speed web, and business that efficiently offer consumers can appreciate high retention prices and prices power given that the choices for web connection in any type of location is typically restricted.

The 6 cord and satellite supplies we track reported a slower Q2. En masse, profits missed out on experts’ agreement price quotes by 0.6% while following quarter’s earnings support remained in line.

After much thriller, the Federal Get reduced its plan price by 50bps (half a percent) in September 2024. This notes the reserve bank’s very first easing of financial plan given that 2020 and completion of its most sharp inflation-busting project given that the 1980s. Rising cost of living had actually started to run warm in 2021 post-COVID because of an assemblage of elements such as supply chain disturbances, labor lacks, and stimulation costs. While CPI (rising cost of living) analyses have actually been encouraging recently, work actions have actually triggered some problem. Moving forward, the marketplaces will certainly dispute whether this price cut (and much more prospective ones in 2024 and 2025) is excellent timing to sustain the economic climate or a little bit far too late for a macro that has actually currently cooled down excessive.

While some cord and satellite supplies have actually made out rather much better than others, they have actually jointly decreased. Generally, share costs are down 1.8% given that the most up to date profits outcomes.

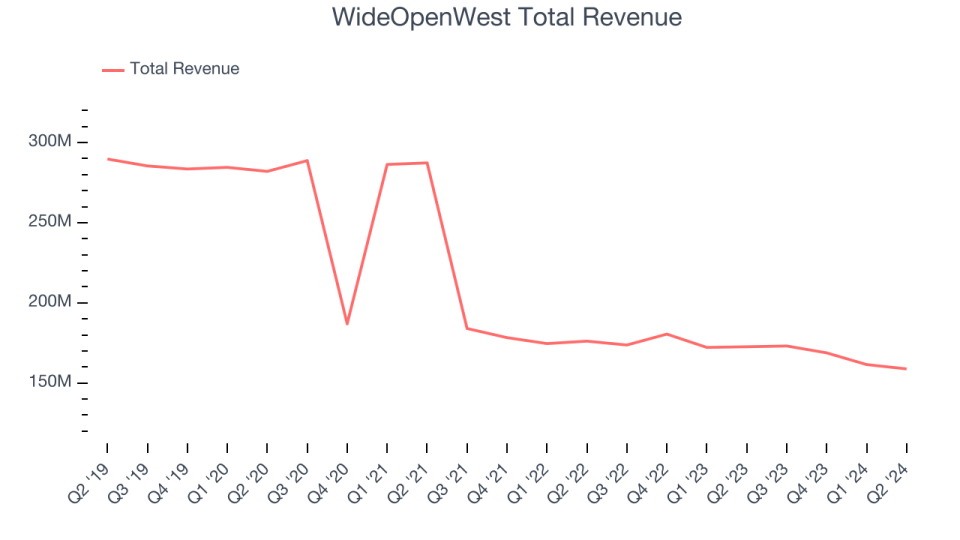

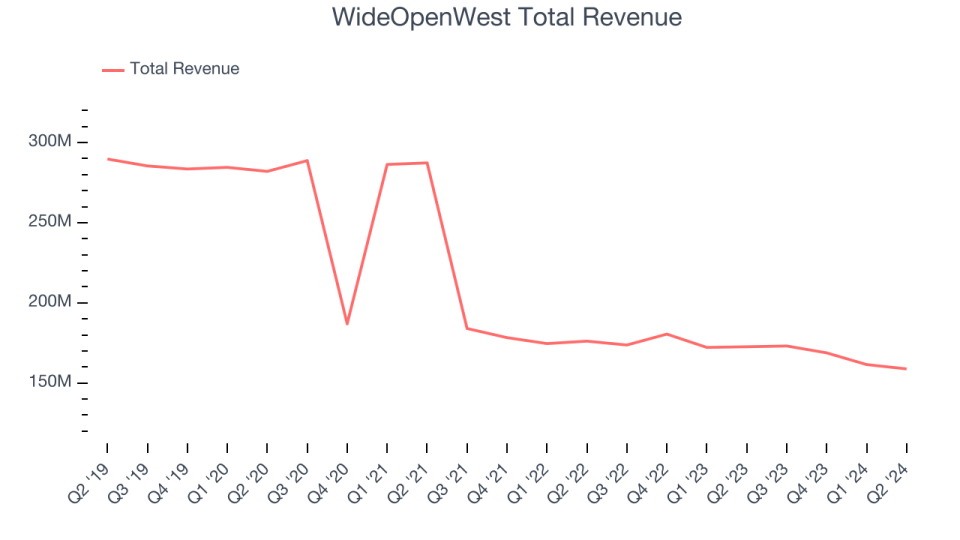

WideOpenWest (NYSE: WOW)

Originally began in Denver as a cable tv supplier, WideOpenWest (NYSE: WOW) offers high-speed web, cord, and telephone solutions to the Midwest and Southeast areas of the united state

WideOpenWest reported profits of $158.8 million, down 8% year on year. This print remained in line with experts’ assumptions, however on the whole, it was a slower quarter for the business with a miss out on of experts’ operating margin price quotes.

” We made considerable progression throughout the quarter, expanding our existence in Greenfield markets while remaining to maintain our customer numbers in our heritage impact,” claimed Teresa Senior citizen, WOW!’s chief executive officer.

WideOpenWest provided the slowest earnings development of the entire team. Surprisingly, the supply is up 3.3% given that reporting and presently trades at $5.33.

Read our full report on WideOpenWest here, it’s free

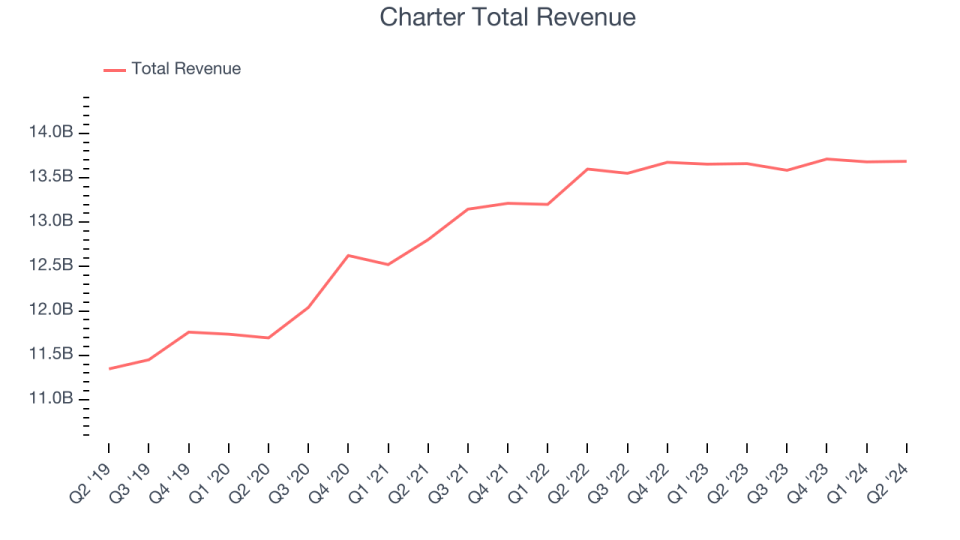

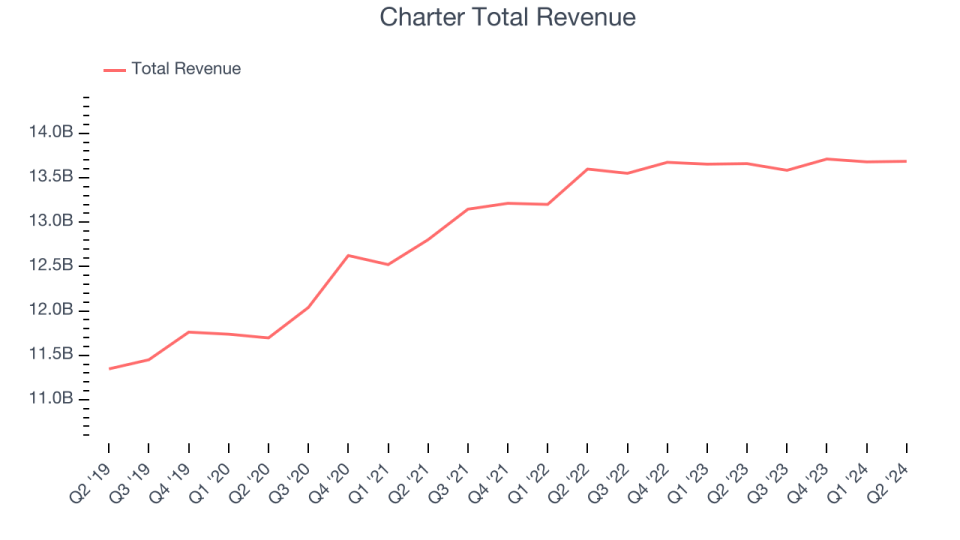

Finest Q2: Charter (NASDAQ: CHTR)

Operating as Range, Charter (NASDAQ: CHTR) is a leading telecoms business using cable television service, high-speed web, and voice solutions throughout the USA.

Charter reported profits of $13.69 billion, level year on year, according to experts’ assumptions. Business had a sufficient quarter with a respectable beat of experts’ profits price quotes.

Charter accomplished the largest expert approximates beat and fastest earnings development amongst its peers. The marketplace appears material with the outcomes as the supply is up 3.6% given that coverage. It presently trades at $326.20.

Is currently the moment to acquire Charter? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Cable Television One (NYSE: CABO)

Established In 1986, Cable Television One (NYSE: CABO) offers high-speed web, cable television service, and telephone solutions, mostly in smaller sized markets throughout the USA.

Wire One reported profits of $394.5 million, down 7% year on year, disappointing experts’ assumptions by 1.3%. It was a softer quarter as it uploaded a miss out on of experts’ profits price quotes.

Wire One provided the weakest efficiency versus expert price quotes in the team. As anticipated, the supply is down 12.3% given that the outcomes and presently trades at $353.56.

Read our full analysis of Cable One’s results here.

Comcast (NASDAQ: CMCSA)

Previously referred to as American Wire Equipments, Comcast (NASDAQ: CMCSA) is an international telecoms business using a vast array of solutions.

Comcast reported profits of $29.69 billion, down 2.7% year on year. This number missed out on experts’ assumptions by 1.1%. In general, it was a blended quarter for the business.

The supply is up 5.3% given that reporting and presently trades at $41.64.

Read our full, actionable report on Comcast here, it’s free.

Sirius XM (NASDAQ: SIRI)

Recognized for its commercial-free songs networks, Sirius XM (NASDAQ: SIRI) is a broadcasting business that offers satellite radio and online radio solutions throughout The United States and Canada.

Sirius XM reported profits of $2.18 billion, down 3.2% year on year. This number remained in line with experts’ assumptions. Extra extensively, it was a slower quarter as it likewise logged a respectable beat of experts’ profits price quotes however full-year earnings support missing out on experts’ assumptions.

The supply is down 29.5% given that reporting and presently trades at $24.35.

Read our full, actionable report on Sirius XM here, it’s free.

Sign Up With Paid Supply Capitalist Research Study

Assist us make StockStory much more handy to financiers like on your own. Join our paid individual research study session and obtain a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.