By Tom Westbrook

SINGAPORE (Reuters) – A rising yen steadied on Monday as Japan’s inbound head of state indicated financial plan ought to stay accommodative, while the buck slid on asset money underpinned by capitalist assumptions of a turn-around in China’s economic climate.

Japan’s yen had actually jumped on Friday when Shigeru Ishiba, a previous support priest and once movie critic of strongly simple plan won the management of the judgment Liberal Democratic Event, which regulates parliament and will certainly elect him right into workplace.

The yen slid regarding 0.4% to 142.75 per buck after leaping 1.8% on Friday. Ishiba informed public broadcaster NHK that from the federal government’s viewpoint, plan has to stay accommodative as a pattern provided existing financial problems.

Experts claimed that sufficed to stop briefly the sharp increase in the yen following his triumph which the chance of a breeze political election in the coming months – something Ishiba meant on Sunday – might evaluate on the yen a minimum of over the short-term.

” A political election primarily takes the Financial institution of Japan out of the formula up until December … a minimal yen adverse,” claimed Ray Attrill, National Australia Financial institution’s head of fx approach.

Somewhere else the euro was steady at $1.1172 and admirable traded at $1.3381 with markets aiming to united state tasks information on Friday as the following significant information factor that might lead the rate of united state rates of interest cuts.

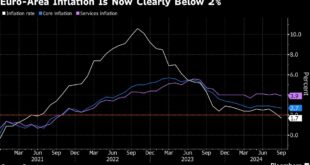

European rising cost of living information on Tuesday and Chinese information due in the future Monday are likewise acutely waited for.

The Australian and New Zealand bucks traded near the 2024 highs they struck on Friday as price cuts and assumptions of monetary assistance in China increased hopes of an enhancement in the slowing down economic climate.

The Australian buck increased 0.3% to $0.6920, after reaching a 20-month high of $0.6937 on Friday. The New Zealand buck was up 0.3% at $0.6360 after striking its highest possible given that December on Friday.

Recently the united state Federal Book’s favoured rising cost of living step revealed rising cost of living going for a quite benign 2.2% for the twelve month to August, sending out united state returns and the buck lower.

” The pattern over following year or two is for the buck to decrease,” claimed Republic Financial institution of Australia planner Joe Capurso.

” Rising cost of living is in control. Rate of interest are dropping which benefits the worldwide financial expectation, helpful for danger taking and helpful for asset money like the Aussie.”

Beijing’s boating of stimulation actions drove a rally in China’s yuan recently, also as rates of interest were reduced, as capitalists stacked right into Chinese supplies which scratched their ideal week in a years. The yuan damaged the mental 7-per-dollar mark in overseas profession on Friday and was last at 6.9761 in advance of the onshore open.

( Coverage by Tom Westbrook.; Modifying by Shri Navaratnam)

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.