-

united state tasks record, Powell speech will certainly remain in emphasis today.

-

Tesla is a buy with better-than-expected Q3 shipments anticipated.

-

Levi Strauss is a sell with underwhelming incomes on deck.

-

Seeking even more workable profession concepts to browse the existing market volatility? Unlock access to InvestingPro for less than $8 a month!

united state supplies finished combined on Friday, with the Dow Jones Industrial Standard shutting at a fresh document as investors absorbed controlled rising cost of living information that enhanced hopes of one more outsized rates of interest reduced at the Federal Get’s November plan conference.

All 3 significant united state supply indexes published a 3rd straight week of gains, with the leading Dow and benchmark S&P 500 both increasing regarding 0.6% through. The tech-heavy Nasdaq Compound progressed virtually 1% throughout the week.

Resource: Investing.com

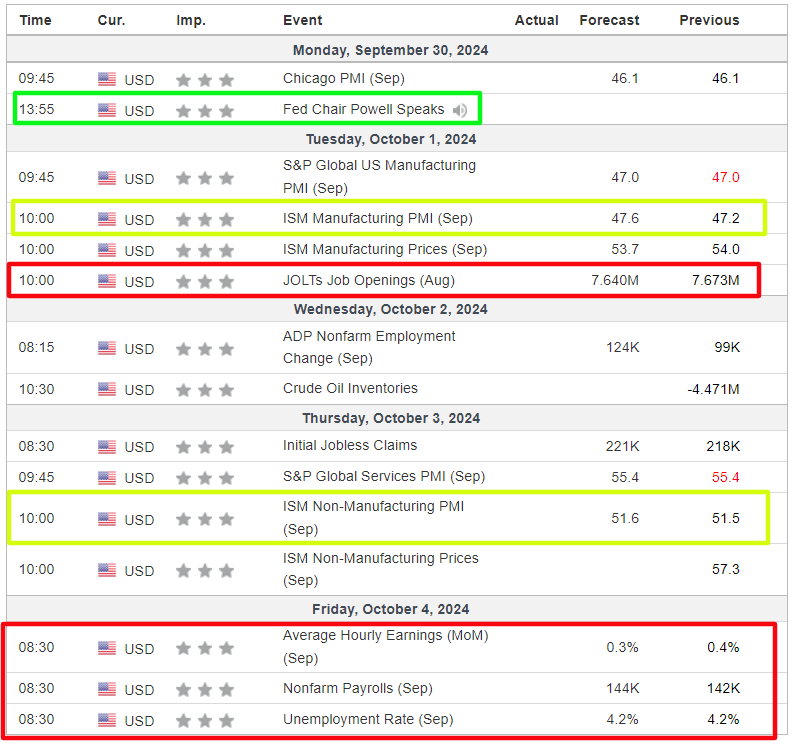

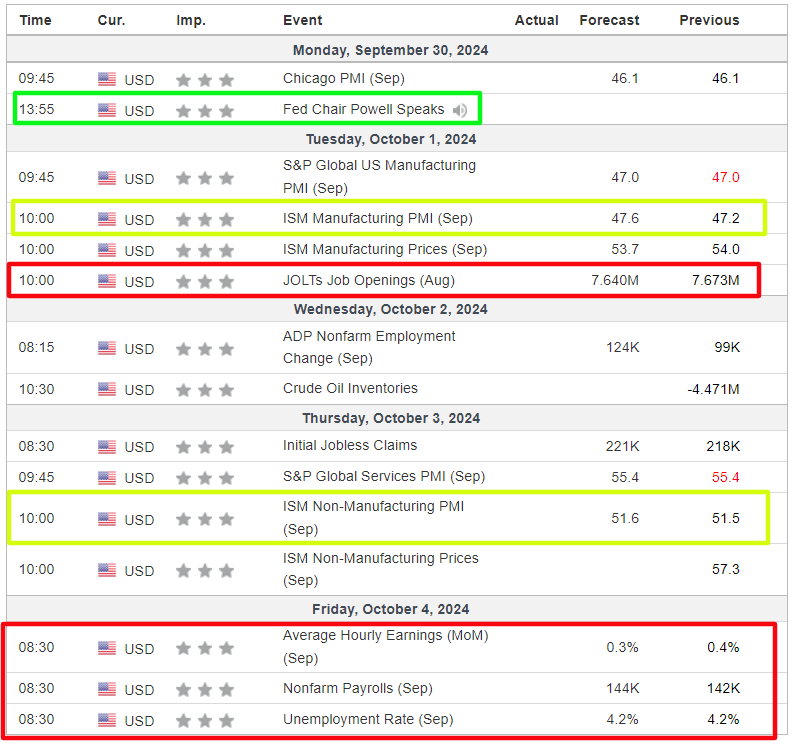

The week in advance is anticipated to be an active one as financiers remain to analyze the Fed’s overview for price cuts. Markets are totally valuing in a cut of at the very least 25 basis factors in November, with assumptions for a cut of 50bps provided a 48.1% possibility, according to Investing.com’s Fed Screen Device.

Crucial on the financial schedule will certainly be Friday’s united state work record for September, which is anticipated to reveal the economic situation included 144,000 placements, contrasted to tasks development of 142,000 in August. The joblessness price is seen holding consistent at 4.2%.

Ahead of the tasks record, the ISM production and solutions PMIs will certainly likewise be carefully viewed.

Resource: Investing.com

That will certainly be gone along with by a hefty slate of Fed audio speakers, consisting of Chairman Jerome Powell on Monday early morning.

Somewhere else, the incomes timetable for following week consists of records from simply a couple of notable firms. These consist of Nike (NYSE: NKE), Circus (NYSE: CCL), Levi Strauss (NYSE: LEVI), and Constellation Brands (NYSE: STZ).

No matter which instructions the marketplace goes, listed below I highlight one supply likely to be popular and one more which can see fresh drawback. Keep in mind however, my duration is simply for the week in advance, Monday, September 30 – Friday, October 4.

Supply to Acquire: Tesla

The primary stimulant driving Tesla (NASDAQ: TSLA)’s supply today is the very prepared for launch of its third-quarter distribution numbers, which are anticipated to be introduced on Wednesday early morning.

The EV business’s Q3 efficiency must come along after a rough initial fifty percent of the year, where need was influenced by slowing down development in vital worldwide markets.

Wall surface Road experts are anticipating 462,000 lorry shipments for the quarter, up 6% contrasted to Q3 2023. This would certainly note the EV manufacturer’s third-best quarterly total amount, complying with a record-setting 484,507 in Q4 2023 and 466,140 in Q2 2023.

Tesla’s solid distribution numbers are sustained by raising need, particularly in China, where federal government aids and inexpensive funding have actually sustained sales.

Tesla generates the Design 3, the Design Y, Design X and Design S, along with the Semi and Cybertruck. The Design Y crossover make up most of sales. The Austin, Texas-based business is extensively identified as the international leader in the electrical lorry market, holding a leading market share in the united state and China.

Financiers will certainly likewise be carefully viewing Tesla’s Robotaxi occasion on October 10, where updates on the business’s self-driving innovation and expert system will certainly be shared. This occasion is most likely to create buzz around Tesla’s AI abilities and future company possibilities, consisting of independent ride-hailing solutions.

Resource: Investing.com

TSLA supply rose 9.3% recently to finish Friday’s session at $260.46 per share, its highest possible closing rate given that July 10. Shares are up 4.8% in the year to day.

At existing degrees, Tesla has a market cap of $812 billion, making it the globe’s most important car manufacturer, larger than names such as Toyota (NYSE: TM), Volkswagen (ETR: VOWG_p), General Motors (NYSE: GM), and Ford (NYSE: F).

Resource: InvestingPro

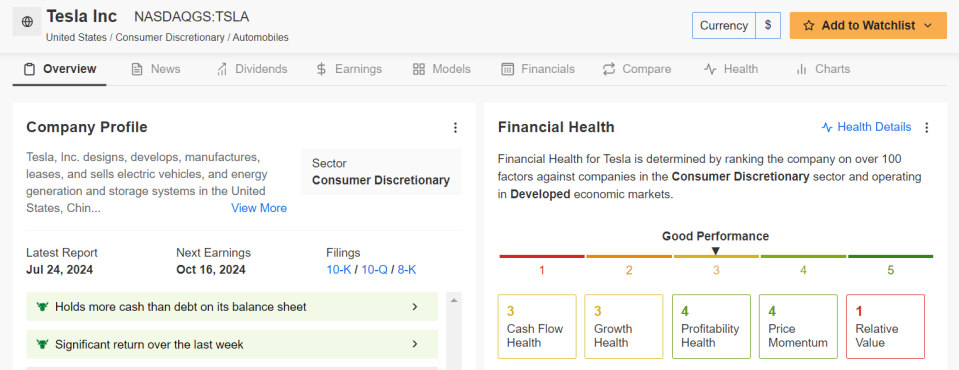

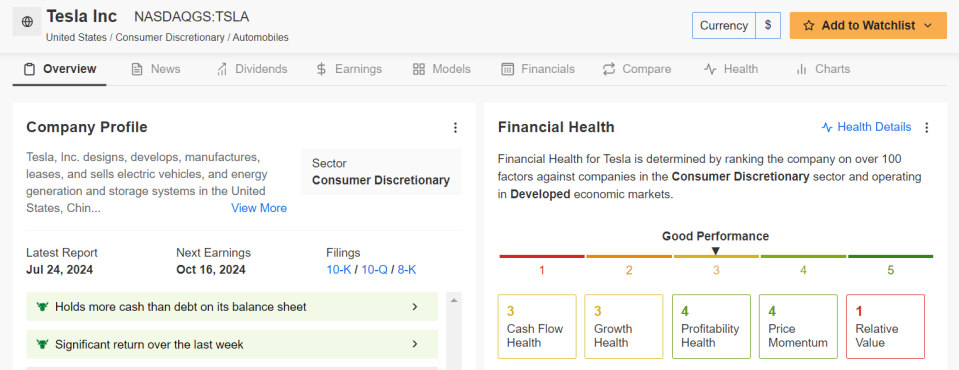

It deserves pointing out that Tesla has an above-average ‘Financial Health and wellness Rating’ of 3.0 out of 5.0, as analyzed by InvestingPro’s AI-backed designs, highlighting its durable principles, technological toughness, and market management in electrical lorries and AI-based automation.

Make certain to take a look at InvestingPro to remain in sync with the marketplace pattern and what it implies for your trading. Subscribe now to InvestingPro with an exclusive 10% discount and position your portfolio one step ahead of everyone else!

Supply to Offer: Levi Strauss

Unlike Tesla’s positive overview, Levi Strauss is fighting with compromising need in the middle of a difficult financial background.

The legendary denimwear business is anticipated to upload uninspired incomes for its 3rd quarter monetary record, which schedules after the marketplace close on Wednesday at 4:10 PM ET.

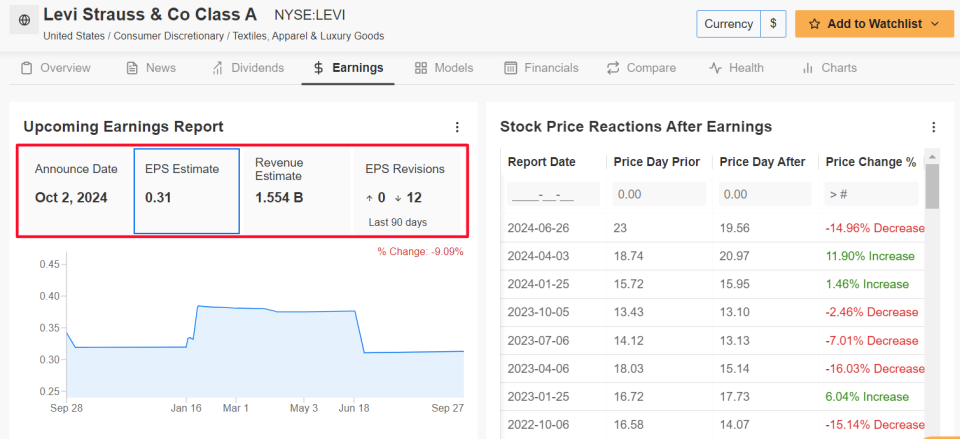

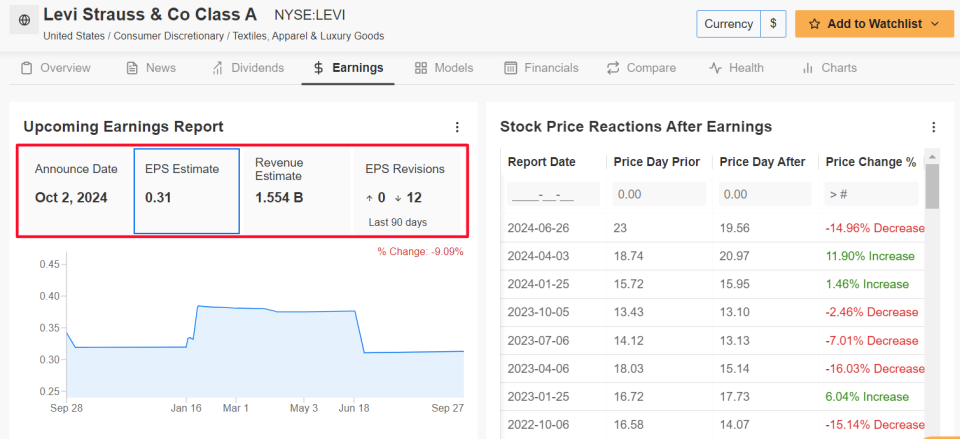

Financier view around Levi Strauss continues to be bearish, with experts lowering their earnings projections in the run-up to the incomes launch. Based on InvestingPro, all 12 experts covering LEVI have actually reduced their incomes price quotes in the last 90 days, showing expanding issues regarding the business’s overview.

Market individuals anticipate a large swing in LEVI supply after the upgrade decreases, according to the alternatives market, with a feasible indicated relocation of about 9.2% in either instructions. Incomes have actually been stimulants for outsized swings in shares this year, according to information from InvestingPro, with Levi Strauss supply toppling 15% when the business last reported quarterly numbers in late June.

Resource: InvestingPro

Experts forecast incomes per share of $0.31, a little up from $0.28 a year earlier, while income is anticipated to increase 3% to $1.55 billion.

In spite of these moderate development numbers, Levi Strauss has actually been struck hard by compromising customer need, as rising cost of living remains to press family spending plans worldwide. With greater expenses of living and rising cost of living lingering for longer than prepared for, lots of customers are drawing back on optional costs, consisting of garments acquisitions.

Taking that right into account, I think there is an expanding drawback threat that the business can decrease its full-year incomes and sales development overview in the middle of a wearing away retail atmosphere.

Resource: Investing.com

LEVI supply shut at $21.65 on Friday, the highest degree given that June 26. Shares have actually gotten 30.9% in 2024. At its existing evaluation, San Francisco-based Levi Strauss has a market cap of $8.5 billion.

It needs to be kept in mind that Levi Strauss’ near-term overview for earnings and cost-free capital shows up high-risk, according to InvestingPro, which flags its high incomes evaluation numerous as a reason for worry.

Whether you’re a newbie capitalist or a skilled investor, leveraging InvestingPro can open a globe of financial investment possibilities while lessening threats in the middle of the tough market background.

Subscribe now and unlock accessibility to a number of market-beating functions, consisting of:

-

Advanced Supply Screener: Look for the most effective supplies based upon numerous picked filters, and standards.

-

InvestingPro Fair Worth: Quickly learn if a supply is underpriced or misestimated.

-

AI ProPicks: AI-selected supply victors with tried and tested performance history.

-

Leading Concepts: See what supplies billionaire financiers such as Warren Buffett, Michael Burry, and George Soros are getting.

Disclosure: At the time of creating, I am long on the S&P 500, and the Nasdaq 100 through the SPDR ® S&P 500 ETF, and the Invesco QQQ Depend On ETF. I am likewise long on the Modern technology Select Industry SPDR ETF (NYSE: XLK).

I on a regular basis rebalance my profile of private supplies and ETFs based upon recurring threat analysis of both the macroeconomic atmosphere and firms’ financials.

The sights reviewed in this write-up are exclusively the point of view of the writer and must not be taken as financial investment guidance.

Comply With Jesse Cohen on X/Twitter @JesseCohenInv for even more securities market evaluation and understanding.

Associated Articles

1 Stock to Buy, 1 Stock to Sell This Week: Tesla, Levi Strauss

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.