Today’s summary highlights regulative tightening up and advancements in the crypto market throughout Asia and MENA. Dubai’s regulatory authority applies brand-new crypto advertising regulations, which will certainly work since October 1, 2024. At the same time, in South Korea, Worldcoin was fined $830,000 for breaching information personal privacy regulations, especially by accumulating delicate biometric information.

With regulative authorities tipping up oversight throughout the area, the crypto sector is experiencing a duration of improvement that is improving its future.

Since October 1, 2024, business advertising online properties in Dubai need to follow brand-new advertising guidelines presented by the Virtual Property Regulatory Authority (VARA). Under these guidelines, crypto promotions need to consist of a popular please note highlighting the dangers of crypto financial investments. The please note should plainly specify that online properties can decline completely or partially and go through substantial volatility.

Along with the brand-new please note needs, VARA has actually presented fines for non-compliance. Companies going against these advertising standards might encounter penalties of as much as AED 10 million (around $2.7 million).

Learn More: Just How Does Guideline Influence Crypto Advertising And Marketing? A Full Overview

The dimension of the penalty will certainly depend upon the extent of the violation. If the firm continuously breaks the guidelines, it might additionally encounter boosted penalties.

In addition, online property provider (VASPs) providing motivations connected to online properties need to currently acquire conformity authorization from VARA. This makes certain that marketing products do not cover the dangers financiers might encounter when getting in the very unpredictable crypto market.

This regulative upgrade belongs to Dubai’s continuous initiatives to stabilize crypto advancement with customer security. With the area placing itself as an international center for blockchain and electronic properties, the brand-new regulations intend to protect retail and institutional financiers from deceptive marketing material.

Worldcoin and TFH Strike with $800,000 Penalty for Information Breaches in South Korea

South Korea’s Personal Info Security Payment (PIPC) has fined Worldcoin and its growth firm, Devices for Humankind (TFH), 1.14 billion Oriental won ($ 830,000). This charge was for going against the nation’s information security regulations.

The great comes from Worldcoin’s unapproved collection of delicate biometric info, consisting of iris scans, from Oriental individuals without appropriate permission. Additionally, the information was moved abroad to Germany without informing individuals. This activity additionally breaches South Oriental information personal privacy regulations.

The PIPC got Worldcoin to carry out rehabilitative procedures, consisting of getting specific individual permission for delicate information collection. The firm additionally required enhancements in information storage space and usage openness. Additionally, the company should present a reliable information removal system for individuals that desire to pull out of the Worldcoin solution.

Hong Kong’s Job e-HKD+ Checks out Tokenized Possessions and Digital Cash

Hong Kong’s Monetary Authority (HKMA) lately introduced the 2nd stage of its electronic money job, currently rebranded as Job e-HKD+. This stage intends to check out advanced usage instances for electronic cash, consisting of tokenized down payments, along with more comprehensive applications in both retail and company setups.

Job e-HKD+ combines 11 companies that will certainly perform real-world tests on the negotiation of tokenized properties, programmable repayments, and offline deals. These pilot programs are vital for reviewing the usefulness and advantages of carrying out electronic money within the more comprehensive economic situation.

The result of Stage 2 will certainly assist form the future style and regulative structure for electronic money in Hong Kong. Authorities will certainly share vital understandings with the general public by the end of 2025.

Eddie Yue, President of the HKMA, highlighted that the effort is crucial for placing Hong Kong at the leading edge of monetary modern technology.

” The e-HKD Pilot Program has actually offered a useful possibility for the HKMA to check out with the sector just how brand-new types of electronic cash can include distinct worth to the public. The HKMA will certainly remain to embrace a use-case-driven technique in its expedition of electronic cash. We anticipate functioning carefully with sector individuals in Stage 2 to co-create numerous ingenious usage instances,” Yue stated.

The authority additionally prepares to develop the e-HKD Sector Online forum. This online forum will certainly be a collective system where sector leaders can talk about the more comprehensive fostering of electronic money.

Indonesia’s Largest Financial institution Launches Blockchain-Based Pilot Job

Indonesia’s biggest state-owned financial institution, Financial institution Rakyat Indonesia (BRI), is releasing a blockchain-based pilot job to boost openness and protection in monetary deals. Revealed throughout the Indonesia Blockchain Seminar (IBC), the job is developed to improve supply chains and protected service deals for BRI’s comprehensive consumer base of 82 million.

Nitia Rahmi, Head of BRI’s Digital Financial Advancement Division, highlighted that this effort belongs to the financial institution’s more comprehensive dedication to welcoming Web3 innovations. Rahmi described that the job would certainly boost BRI’s electronic facilities and place the financial institution as a leader in blockchain fostering within the Indonesian monetary market.

As blockchain modern technology obtains energy in Southeast Asia, BRI’s action straightens with an expanding local pattern of incorporating decentralized innovations right into typical financial systems. The financial institution’s fostering of blockchain is anticipated to establish a criterion for various other establishments aiming to introduce and boost monetary procedures.

WazirX Protects Court Postponement to Reorganize After $230 Million Hack

On September 26, Singapore’s High Court granted a four-month postponement to Zettai Pte Ltd, the moms and dad firm of the Indian crypto exchange WazirX. This choice adheres to the system’s $230 million make use of in July.

This postponement permits WazirX to reorganize its responsibilities and address individuals’ superior cryptocurrency equilibriums. Originally, the exchange asked for a six-month postponement. Nonetheless, the court chose a four-month postponement, considering the automated 30-day postponement that began with the preliminary declaring.

Nischal Shetty, Supervisor of Zettai and Creator of WazirX, shared thankfulness for the court’s choice. He explained it as a crucial action towards healing and resolution. Shetty additionally highlighted that this breathing room is required for creating a reasonable, creditor-approved restructuring strategy that optimizes healing capacity for impacted individuals.

As component of the court’s problems, WazirX has actually dedicated to complete openness. The exchange will certainly make its pocketbook addresses public, launch monetary information, and address individual issues elevated throughout the lawful procedures. In addition, future ballot on restructuring strategies will certainly be managed by independent celebrations to make sure impartiality.

Learn More: Crypto Job Safety: An Overview to Very Early Hazard Discovery

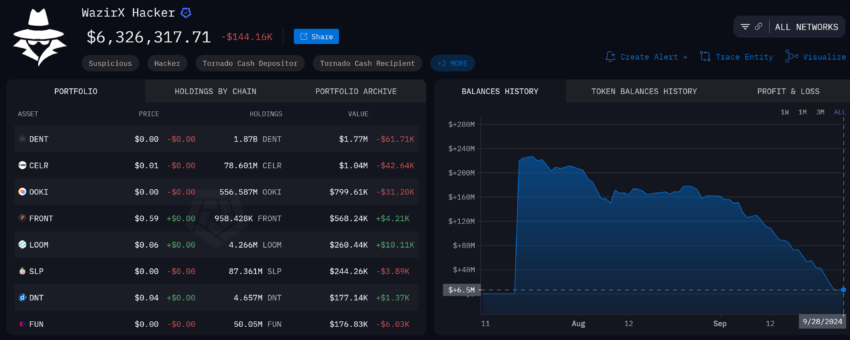

In parallel with these lawful procedures, blockchain information from Arkham Knowledge exposed that the cyberpunk in charge of the make use of has practically totally washed the taken properties. Of the $230 million, just $6 countless cryptocurrencies continues to be unlaundered. The cyberpunk channelled most of the funds via the crypto mixer Hurricane Cash money.

Please Note

In adherence to the Count on Job standards, BeInCrypto is dedicated to objective, clear coverage. This newspaper article intends to offer exact, prompt info. Nonetheless, visitors are suggested to confirm truths separately and seek advice from an expert prior to making any type of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.